A Look At Target’s (TGT) Valuation As TOMS Capital’s Stake Raises Activist Pressure

TOMS Capital’s disclosed investment in Target (TGT) has turned fresh attention to the retailer’s sales slump, leadership transition and operational reset, and has raised questions about how activist pressure could influence the company’s next moves.

See our latest analysis for Target.

At around $100.51, Target’s recent 1 month share price return of 9.02% and 3 month share price return of 12.59% suggest momentum has picked up again. However, the 1 year total shareholder return of 24.66% and 3 year total shareholder return of 28.65% remain weak as investors reassess risks and potential change under activist scrutiny and new leadership.

If this kind of reset story has your attention, it can be useful to compare it with other retailers facing different pressures and opportunities using our fast growing stocks with high insider ownership.

With Target trading around $100.51 and an indicated 28.75% intrinsic discount, plus a 3.28% premium to the average analyst target, investors may question whether there is genuine value available or whether the market is already pricing in a turnaround.

Most Popular Narrative Narrative: 4.1% Overvalued

At a last close of $100.51 versus a narrative fair value of $96.52, the valuation gap is narrow and hinges on specific earnings and margin assumptions.

• The analysts have a consensus price target of $103.688 for Target based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $135.0, and the most bearish reporting a price target of just $82.0.

Curious what kind of revenue path and margin profile justify this fair value and price target range, especially with a higher discount rate and lower future P/E baked in?

Result: Fair Value of $96.52 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if investments in AI, owned brands, and higher margin digital businesses like Roundel and Target Plus gain traction, earnings pressure in this narrative could look too harsh.

Find out about the key risks to this Target narrative.

Another Way To Look At Value

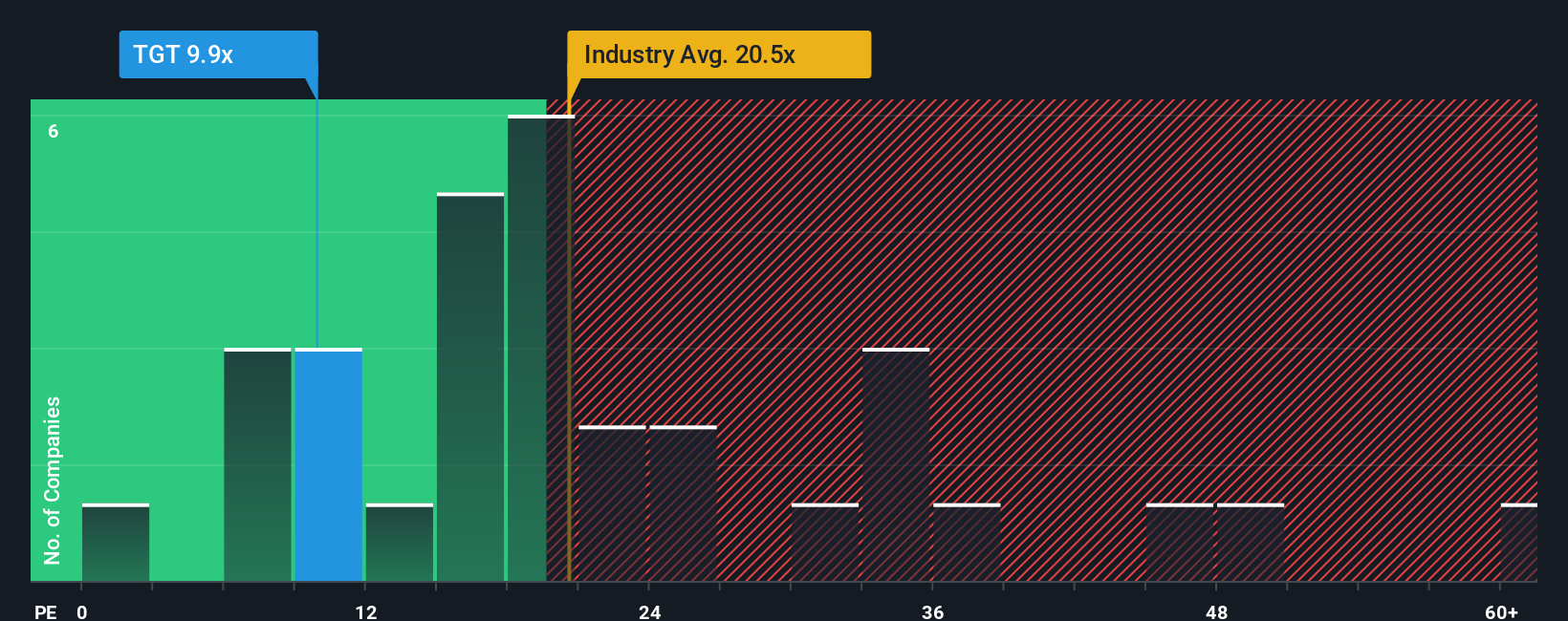

While the narrative fair value of US$96.52 points to Target looking 4.1% overvalued, the earnings multiple tells a different story. Target trades on a P/E of 12.1x versus 28.2x for peers and 22.8x for the US Consumer Retailing industry, and below an estimated fair ratio of 20.5x, which suggests the market could be assigning a heavy risk discount. The key question is whether that discount reflects real long term concerns or a potential opening for patient investors.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Target Narrative

If you are not sold on this view, or simply prefer to test the assumptions yourself, you can build a data driven story in minutes: Do it your way.

A great starting point for your Target research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you want to stress test your thinking beyond Target, you’ll find plenty of fresh ideas by scanning different themes and business models side by side.

- Spot potential mispricings by searching for companies trading on appealing cash flow metrics using these 875 undervalued stocks based on cash flows.

- Explore companies connected to artificial intelligence by screening for businesses exposed to this theme through these 25 AI penny stocks.

- Focus on income generation by filtering for companies with relatively higher yields using these 14 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报