What Perseus Mining (ASX:PRU)'s Upsized, Lower-Cost Loan Facility Means For Shareholders

- Perseus Mining Limited has amended and upsized its syndicated loan facility from US$300 million maturing in March 2026 to a US$400 million three-year facility with a two-year extension option, alongside a US$100 million accordion, reduced pricing, and more flexible covenants.

- This refinancing, combined with Perseus’s US$837 million net cash as of September 30, 2025, lifts total available liquidity to over US$1.24 billion, underscoring lender confidence in the company’s credit profile and funding capacity.

- We’ll now examine how this expanded, lower-cost credit facility could influence Perseus Mining’s investment narrative and financial flexibility.

Find companies with promising cash flow potential yet trading below their fair value.

Perseus Mining Investment Narrative Recap

To own Perseus Mining, you need to be comfortable with a gold producer whose fortunes are tightly linked to gold prices, West African operating conditions and disciplined capital deployment across its project pipeline. The enlarged, cheaper US$400 million loan facility, on top of US$837 million net cash, strengthens short term funding flexibility but does not change the core risk that weaker gold prices or rising all in site costs could quickly pressure margins.

The announcement that ties most directly into this new facility is Perseus’s ongoing work on Nyanzaga and CMA Underground, where sizeable future capital needs are expected. The expanded liquidity pool gives the company more room to fund these projects while continuing dividends and buybacks, which have already seen more than A$80 million deployed, but investors still need to weigh that against cost inflation and geopolitical exposure.

Yet behind this stronger balance sheet, investors should be aware of the company’s continued reliance on gold prices and cost trends in West Africa...

Read the full narrative on Perseus Mining (it's free!)

Perseus Mining's narrative projects $1.9 billion revenue and $580.6 million earnings by 2028.

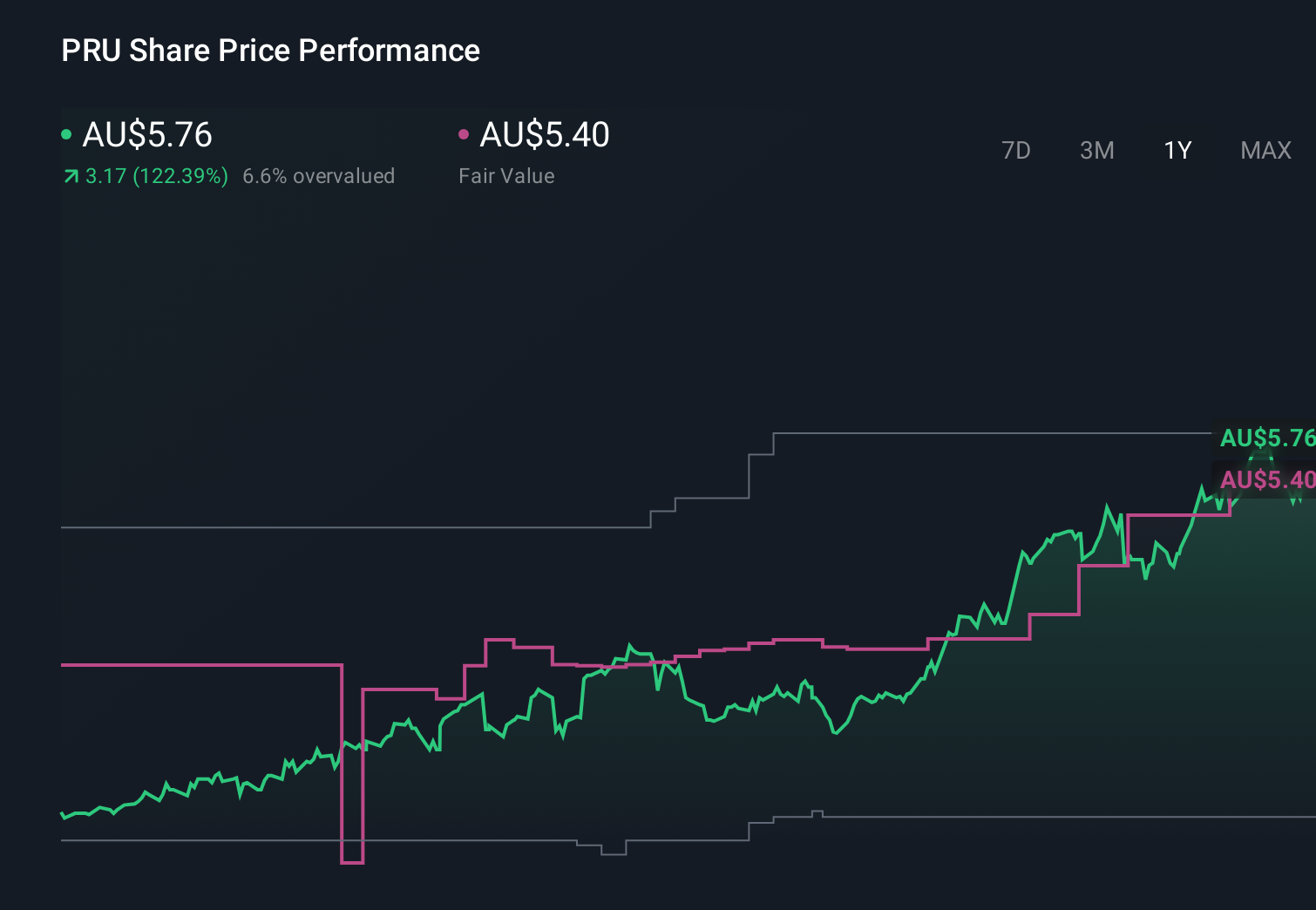

Uncover how Perseus Mining's forecasts yield a A$5.72 fair value, in line with its current price.

Exploring Other Perspectives

Nine members of the Simply Wall St Community place Perseus’s fair value anywhere between about A$3.25 and A$18.56 per share, highlighting very different expectations. Against that wide range, the recent upsized, lower cost US$400 million facility raises fresh questions about how Perseus balances growth spending with the risk that all in site costs in West Africa keep rising faster than production, so it is worth comparing several of these perspectives before forming a view.

Explore 9 other fair value estimates on Perseus Mining - why the stock might be worth over 3x more than the current price!

Build Your Own Perseus Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Perseus Mining research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Perseus Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Perseus Mining's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报