How Tourmaline’s Share Pullback Amid Firm Gas Fundamentals Will Impact Tourmaline Oil (TSX:TOU) Investors

- In recent days, Tourmaline Oil has seen its shares weaken even as natural gas fundamentals remain firm and major banks reiterate positive views on the company’s operations and outlook.

- This contrast between softer market sentiment and Tourmaline’s continued emphasis on disciplined growth, stable production guidance, and shareholder returns has sharpened the debate over how investors should interpret the pullback.

- We’ll now examine how this recent investor hesitation, despite firm natural gas fundamentals, may influence Tourmaline Oil’s broader investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Tourmaline Oil Investment Narrative Recap

To own Tourmaline Oil, you need to believe in the long term case for Canadian natural gas, Tourmaline’s low cost position, and its ability to convert that into resilient cash generation and shareholder returns. The recent share pullback, despite firm gas fundamentals and steady guidance, does not materially change the near term catalyst of improving export access, but it does refocus attention on the key risk of ongoing exposure to volatile North American gas pricing.

Against this backdrop, the company’s ongoing pattern of maintaining a quarterly base dividend of C$0.50 per share is particularly relevant, because it ties the current weakness directly to a visible capital return stream that many investors watch closely. With revenue and earnings moving around quarter to quarter, the consistency of that dividend policy sits at the intersection of Tourmaline’s main catalyst of future export growth and the risk that commodity price pressure could eventually constrain free cash flow.

Yet behind the steady dividend, one risk that investors should be aware of is the company’s heavy long term capital commitments and potential exposure if...

Read the full narrative on Tourmaline Oil (it's free!)

Tourmaline Oil's narrative projects CA$10.6 billion revenue and CA$2.7 billion earnings by 2028. This requires 34.3% yearly revenue growth and about CA$1.2 billion earnings increase from CA$1.5 billion today.

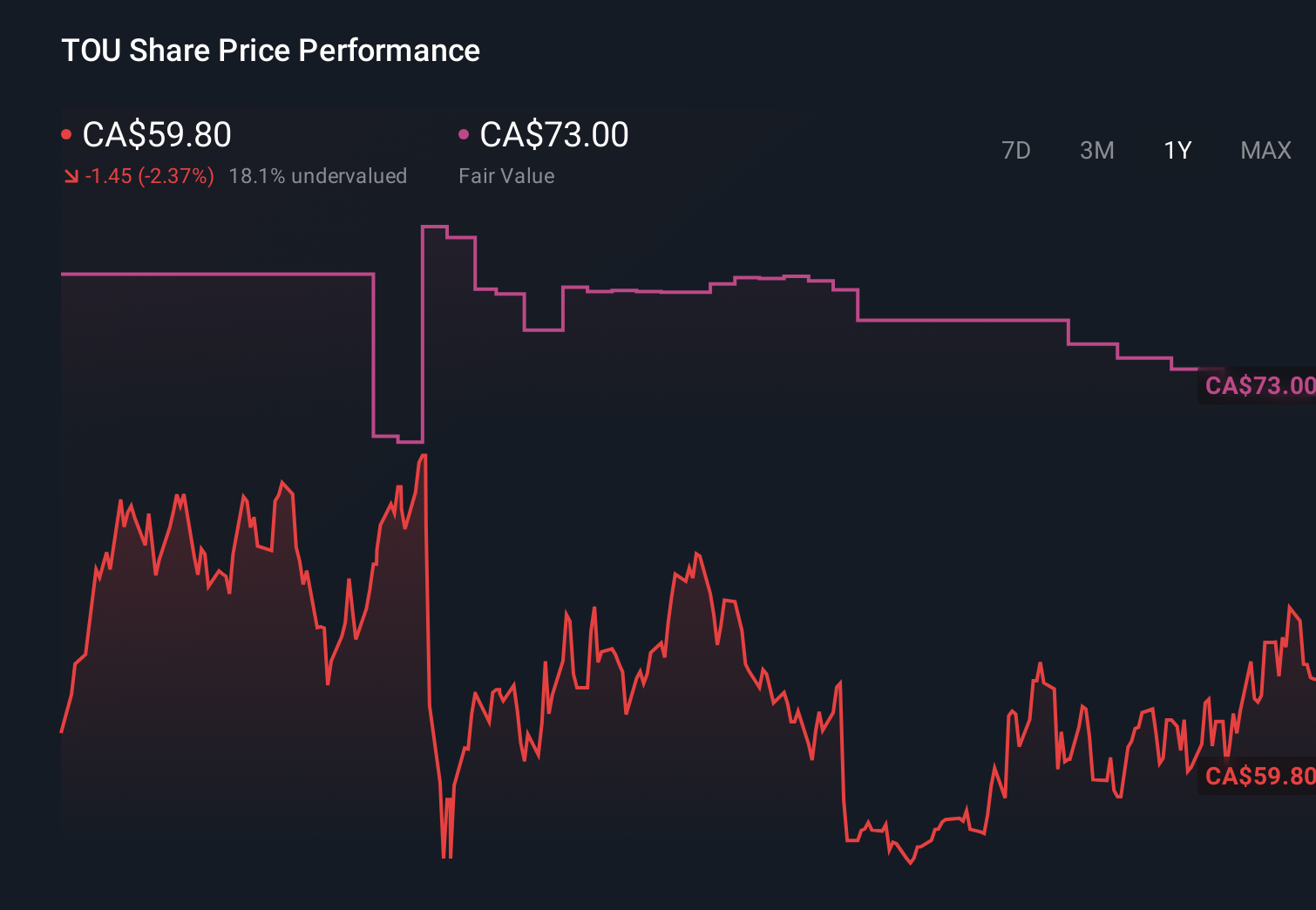

Uncover how Tourmaline Oil's forecasts yield a CA$73.00 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span from C$71.65 to C$148.30 per share, underscoring how far apart individual views can be. Set against Tourmaline’s reliance on natural gas prices and export access, this spread invites you to compare several perspectives on how those factors could shape future performance.

Explore 6 other fair value estimates on Tourmaline Oil - why the stock might be worth just CA$71.65!

Build Your Own Tourmaline Oil Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tourmaline Oil research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tourmaline Oil research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tourmaline Oil's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报