Asian Market Value Stocks: 3 Companies Priced Below Estimated Worth

As Asian markets navigate a landscape marked by mixed performances across major indices, investors are increasingly focused on identifying opportunities within the region. In this context, undervalued stocks present a compelling prospect for those seeking to capitalize on discrepancies between market prices and estimated intrinsic values, especially in light of recent economic indicators and policy developments.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an International Medical Investment (SZSE:000516) | CN¥4.72 | CN¥9.38 | 49.7% |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥83.40 | CN¥162.39 | 48.6% |

| Takara Bio (TSE:4974) | ¥795.00 | ¥1579.24 | 49.7% |

| Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990) | HK$432.00 | HK$851.22 | 49.2% |

| Plus Alpha ConsultingLtd (TSE:4071) | ¥2332.00 | ¥4591.95 | 49.2% |

| Mobvista (SEHK:1860) | HK$15.43 | HK$30.64 | 49.6% |

| Meitu (SEHK:1357) | HK$7.59 | HK$14.75 | 48.5% |

| Kuraray (TSE:3405) | ¥1599.50 | ¥3167.05 | 49.5% |

| Great Giant Fibre Garment (TWSE:4441) | NT$234.50 | NT$457.28 | 48.7% |

| CURVES HOLDINGS (TSE:7085) | ¥794.00 | ¥1582.86 | 49.8% |

Here we highlight a subset of our preferred stocks from the screener.

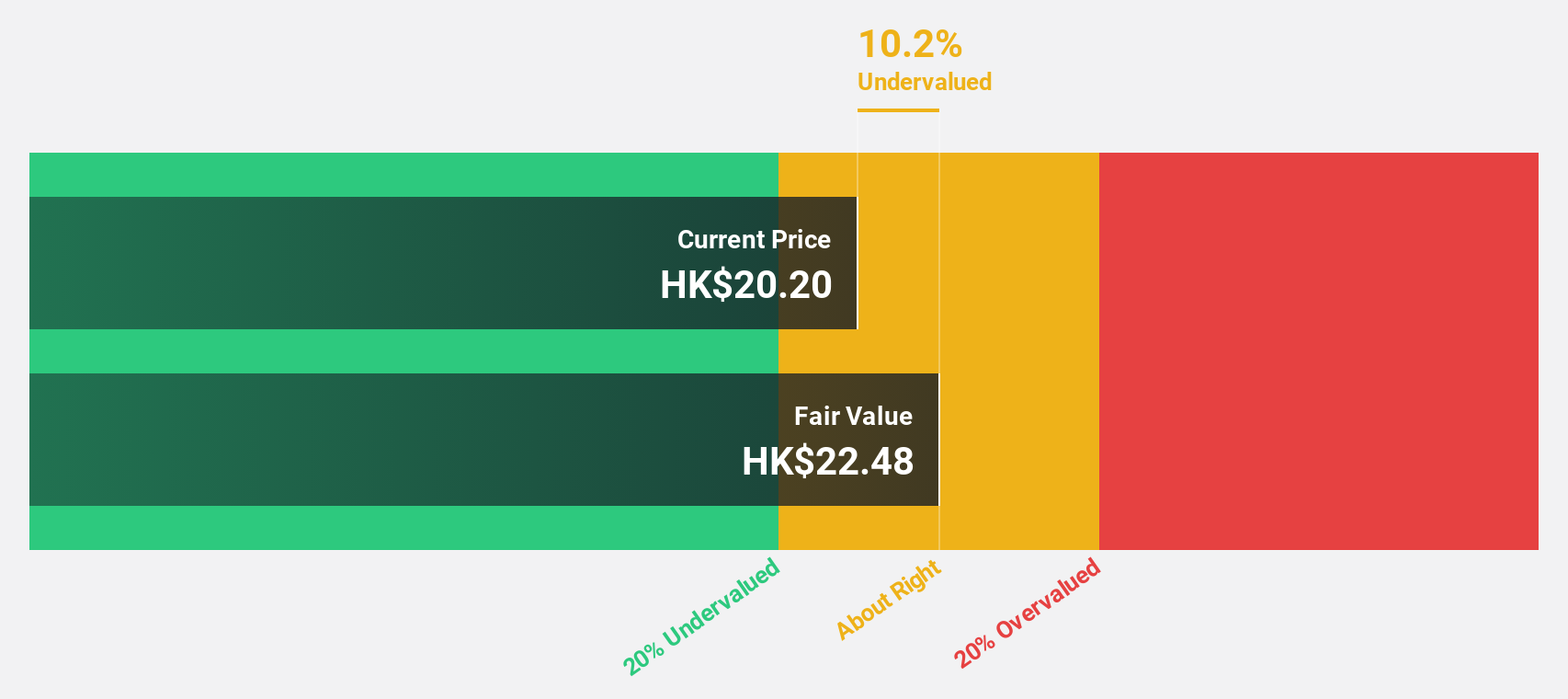

Innovent Biologics (SEHK:1801)

Overview: Innovent Biologics, Inc. is a biopharmaceutical company focused on the research and development of antibody and protein medicine products in China, the United States, and internationally, with a market cap of approximately HK$143.86 billion.

Operations: The company's revenue is primarily derived from its biotechnology segment, which generated CN¥11.42 billion.

Estimated Discount To Fair Value: 45%

Innovent Biologics appears undervalued, trading at HK$83.6, significantly below its estimated fair value of HK$152.01. Recent product approvals and strategic partnerships highlight its innovative pipeline, including the world's first approved CTLA-4 mAb for colon cancer and a dual receptor agonist for diabetes and obesity. Analysts forecast robust earnings growth of 27.2% annually, outpacing the Hong Kong market's 11.9%, suggesting potential upside in cash flow valuation despite existing revenue growth challenges.

- Our growth report here indicates Innovent Biologics may be poised for an improving outlook.

- Take a closer look at Innovent Biologics' balance sheet health here in our report.

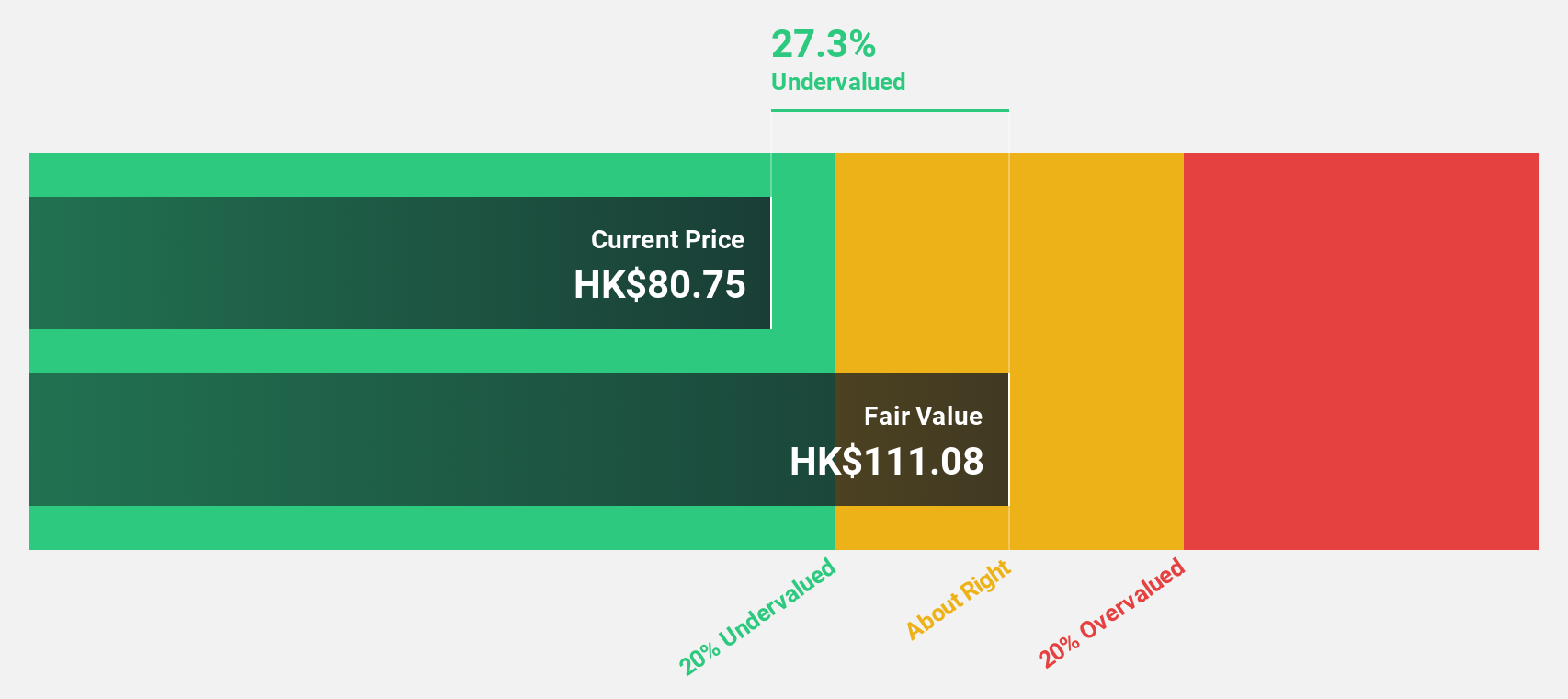

Zhaojin Mining Industry (SEHK:1818)

Overview: Zhaojin Mining Industry Company Limited is an investment holding company involved in the exploration, mining, processing, smelting, and sale of gold and other metallic products both in China and internationally, with a market cap of approximately HK$113.78 billion.

Operations: The company generates revenue primarily from the exploration, mining, processing, smelting, and sale of gold and other metallic products in China and international markets.

Estimated Discount To Fair Value: 48%

Zhaojin Mining Industry is trading at HK$32.12, well below its estimated fair value of HK$61.8, indicating it may be undervalued based on cash flows. Recent earnings reports show substantial growth, with net income rising to CNY 2.12 billion from CNY 880.64 million year-on-year. The company’s strategic alliance with Ant Digital Technologies aims to enhance digital capabilities in mining operations through AI and blockchain, potentially unlocking further value and growth opportunities in the sector.

- Insights from our recent growth report point to a promising forecast for Zhaojin Mining Industry's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Zhaojin Mining Industry.

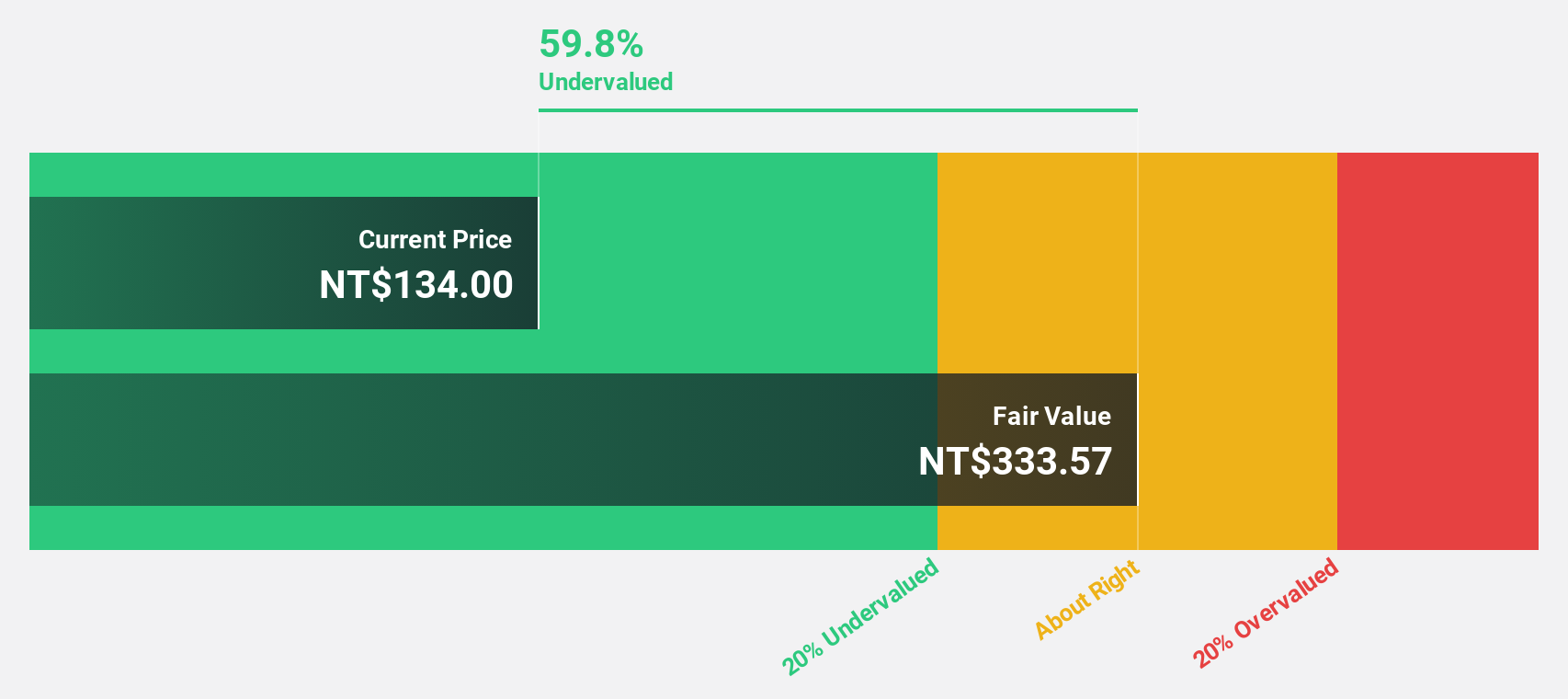

Unimicron Technology (TWSE:3037)

Overview: Unimicron Technology Corp. develops, manufactures, processes, and sells printed circuit boards and related electronic products globally, with a market cap of NT$351.59 billion.

Operations: The company's revenue segments include NT$88.64 billion from Taiwan and NT$52.63 billion from Mainland China.

Estimated Discount To Fair Value: 42.5%

Unimicron Technology, trading at NT$230, is significantly undervalued with a fair value estimate of NT$399.69. Despite volatile share prices recently, the company shows promising growth prospects. Earnings are expected to grow substantially over the next three years, outpacing market averages in Taiwan. Recent earnings reports highlight improved sales and net income year-on-year for Q3 2025. A private placement was announced to raise NT$700 million through issuing shares at TWD 116 each in December 2025.

- The growth report we've compiled suggests that Unimicron Technology's future prospects could be on the up.

- Click here to discover the nuances of Unimicron Technology with our detailed financial health report.

Make It Happen

- Embark on your investment journey to our 260 Undervalued Asian Stocks Based On Cash Flows selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报