Take Care Before Jumping Onto Inscobee., Inc. (KRX:006490) Even Though It's 26% Cheaper

Inscobee., Inc. (KRX:006490) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 65% loss during that time.

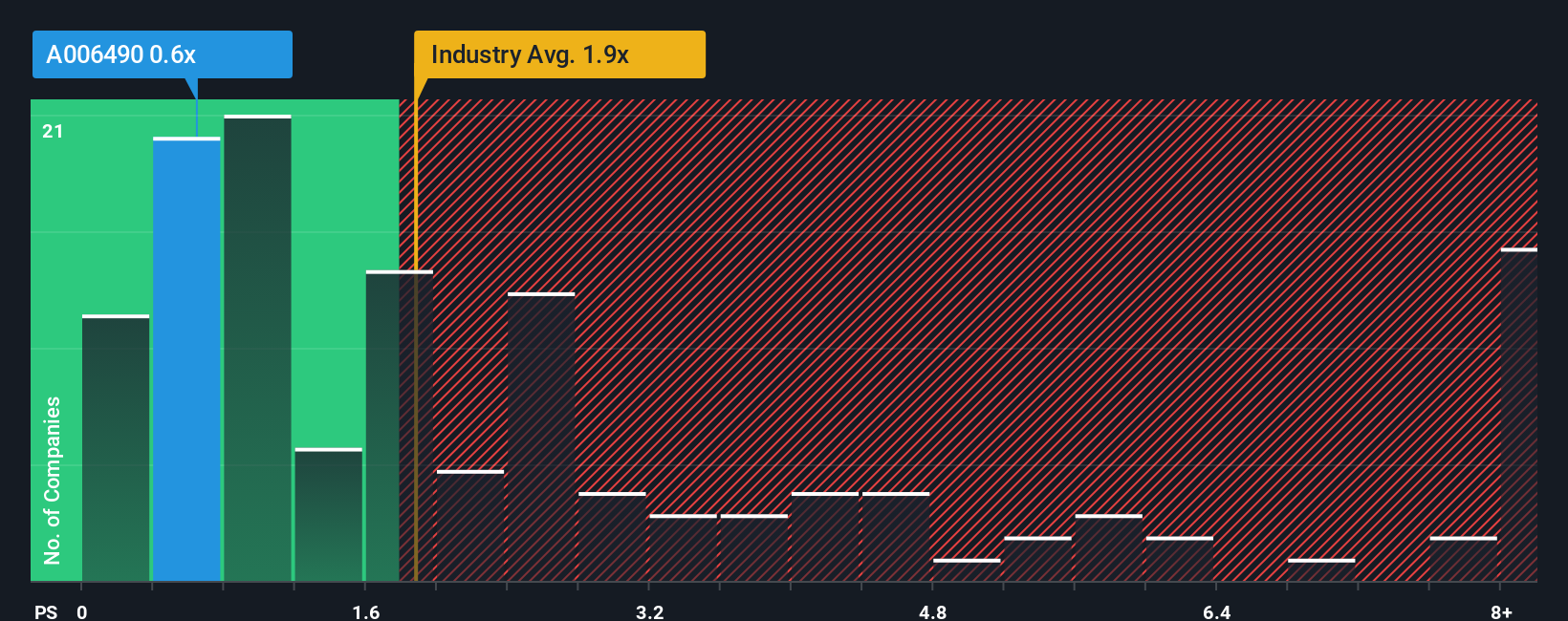

Even after such a large drop in price, it's still not a stretch to say that Inscobee's price-to-sales (or "P/S") ratio of 0.6x right now seems quite "middle-of-the-road" compared to the Telecom industry in Korea, where the median P/S ratio is around 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Inscobee

How Has Inscobee Performed Recently?

For example, consider that Inscobee's financial performance has been poor lately as its revenue has been in decline. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Inscobee will help you shine a light on its historical performance.How Is Inscobee's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Inscobee's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 3.1% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 36% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 4.4% shows it's noticeably more attractive.

With this information, we find it interesting that Inscobee is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Following Inscobee's share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We didn't quite envision Inscobee's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Inscobee (1 is significant!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报