A Look At Entegris (ENTG) Valuation As AI Infrastructure Demand Shows Early Signs Of An Upturn

Recent commentary around Entegris (ENTG) centers on its role in supplying materials and purity solutions for advanced semiconductor production, as investors watch for order stabilization tied to AI infrastructure projects and related chip manufacturing investments.

See our latest analysis for Entegris.

The recent commentary around AI related ordering has arrived alongside a 1 day share price return of 6.3% to US$89.56, while the 1 year total shareholder return of a 12.24% decline and 3 year total shareholder return of a 22.33% gain suggest building but still uneven momentum.

If you are tracking how AI demand ripples across the chip supply chain, it can be useful to scan other potential beneficiaries in high growth tech and AI stocks as a next step.

With Entegris posting revenue of US$3.22b and net income of US$288.49m, yet sitting 10% below the average analyst price target and showing a 1 year total return decline, is there mispricing here, or is future growth already fully reflected?

Most Popular Narrative Narrative: 10.9% Undervalued

The most followed narrative sees Entegris trading below an estimated fair value of about US$100.50 compared with the recent close at US$89.56, and ties that gap to a specific view on future earnings power and capital intensity.

Ongoing cost reduction initiatives and operational efficiencies, alongside higher expected facility utilization in the second half and beyond, are set to enhance free cash flow and expand margins once the current inventory and ramping inefficiencies abate.

Curious what underpins that valuation gap? The narrative leans heavily on steady revenue expansion, higher profit margins, and a premium future earnings multiple. Want the full blueprint?

Result: Fair Value of $100.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story can change quickly if trade tensions disrupt Entegris' Asia heavy revenue base, or if high debt and interest costs keep squeezing financial flexibility.

Find out about the key risks to this Entegris narrative.

Another View: Rich Multiples Versus Fair Ratio

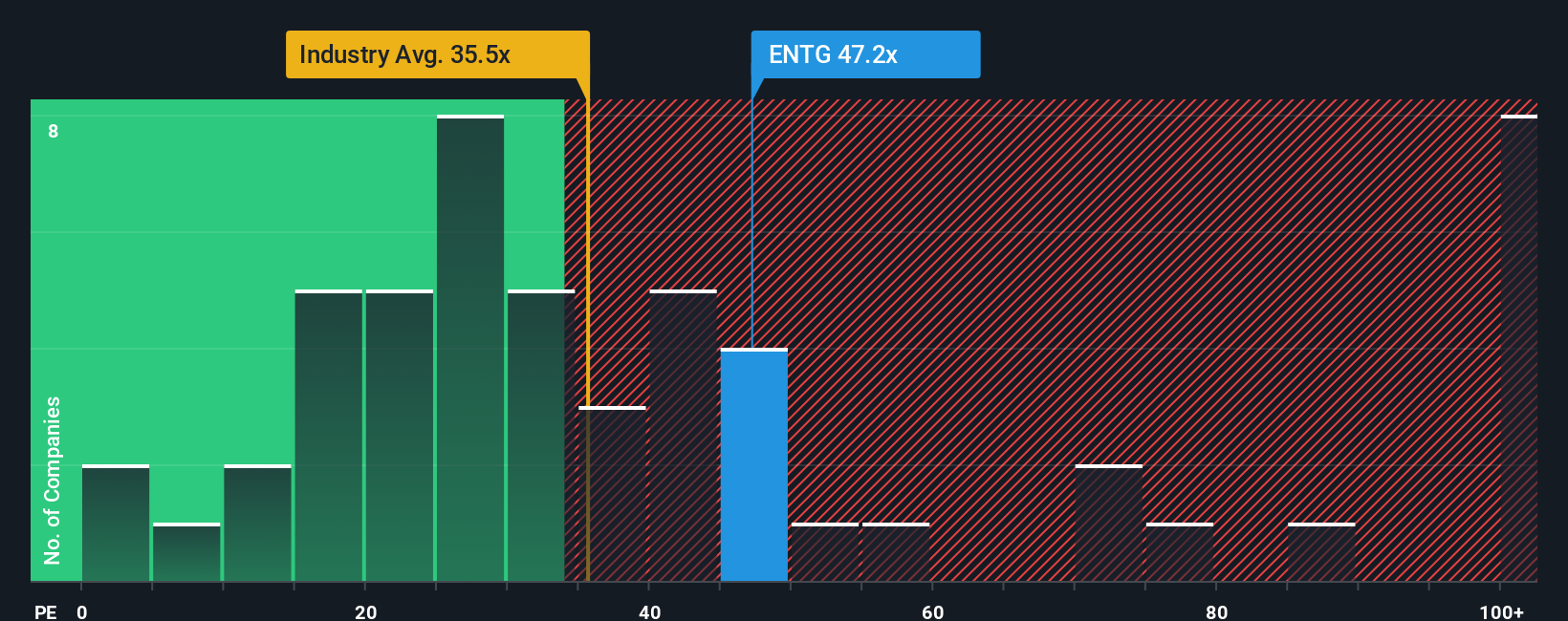

The narrative that Entegris trades below an estimated fair value of about US$100.50 sits alongside a very different message from its current P/E. At roughly 47.1x earnings, the share price is above the US Semiconductor industry average of 37.3x and above peers at 36x.

Simply Wall St's fair ratio for Entegris is also 36x, which is well under the current 47.1x. If the market shifted closer to that fair ratio, the share price would have less room for error, especially if earnings or sentiment softened. How comfortable are you paying a premium multiple when the fair ratio points lower?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Entegris Narrative

If you see the numbers differently, or just prefer to test your own assumptions against the data, you can shape a complete story in minutes: Do it your way.

A great starting point for your Entegris research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If Entegris is on your radar, do not stop there. Broaden your watchlist with a few focused stock sets that could sharpen how you allocate capital.

- Spot potential mispricing by scanning these 878 undervalued stocks based on cash flows that match your return expectations and risk comfort.

- Ride the AI build out more intentionally by filtering for these 25 AI penny stocks that align with your thesis on data centers and automation.

- Target dependable income streams by reviewing these 14 dividend stocks with yields > 3% that might fit a more yield focused approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报