The Bull Case For BHP Group (ASX:BHP) Could Change Following Its Nickel Pause And Potash Pivot

- BHP Group recently saw unusual options trading activity as it integrated its Oz Minerals copper acquisition, advanced its Jansen potash project in Canada, and placed its nickel business on care and maintenance in 2024 in response to weak nickel prices.

- This combination of portfolio reshaping across copper, potash, and nickel is reshuffling how investors assess BHP’s long-term commodity mix and risk profile.

- We’ll now examine how the nickel suspension and push into potash could reshape BHP’s existing investment narrative for long-term investors.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

BHP Group Investment Narrative Recap

BHP’s investment case rests on its ability to convert a diversified mix of iron ore, copper and future-facing commodities into resilient cash flows and disciplined project delivery. The nickel suspension and Jansen potash ramp up do not materially change the near term focus on execution risk at Jansen, while iron ore price and Chinese steel demand remain the biggest swing factors for the business right now.

Among recent announcements, BHP’s update on higher inflation and productivity challenges at the Jansen potash project stands out alongside this latest push into potash. Together, they sharpen attention on cost control, schedule reliability and the risk that any further delays or overruns could weigh on returns from new growth projects at the same time the company is reshaping its commodity mix.

But against the appeal of diversification, investors should also be aware of the execution risk at Jansen and...

Read the full narrative on BHP Group (it's free!)

BHP Group’s narrative projects $49.6 billion revenue and $10.0 billion earnings by 2028. This implies revenue decreasing by 1.1% per year and an earnings increase of about $1.0 billion from $9.0 billion today.

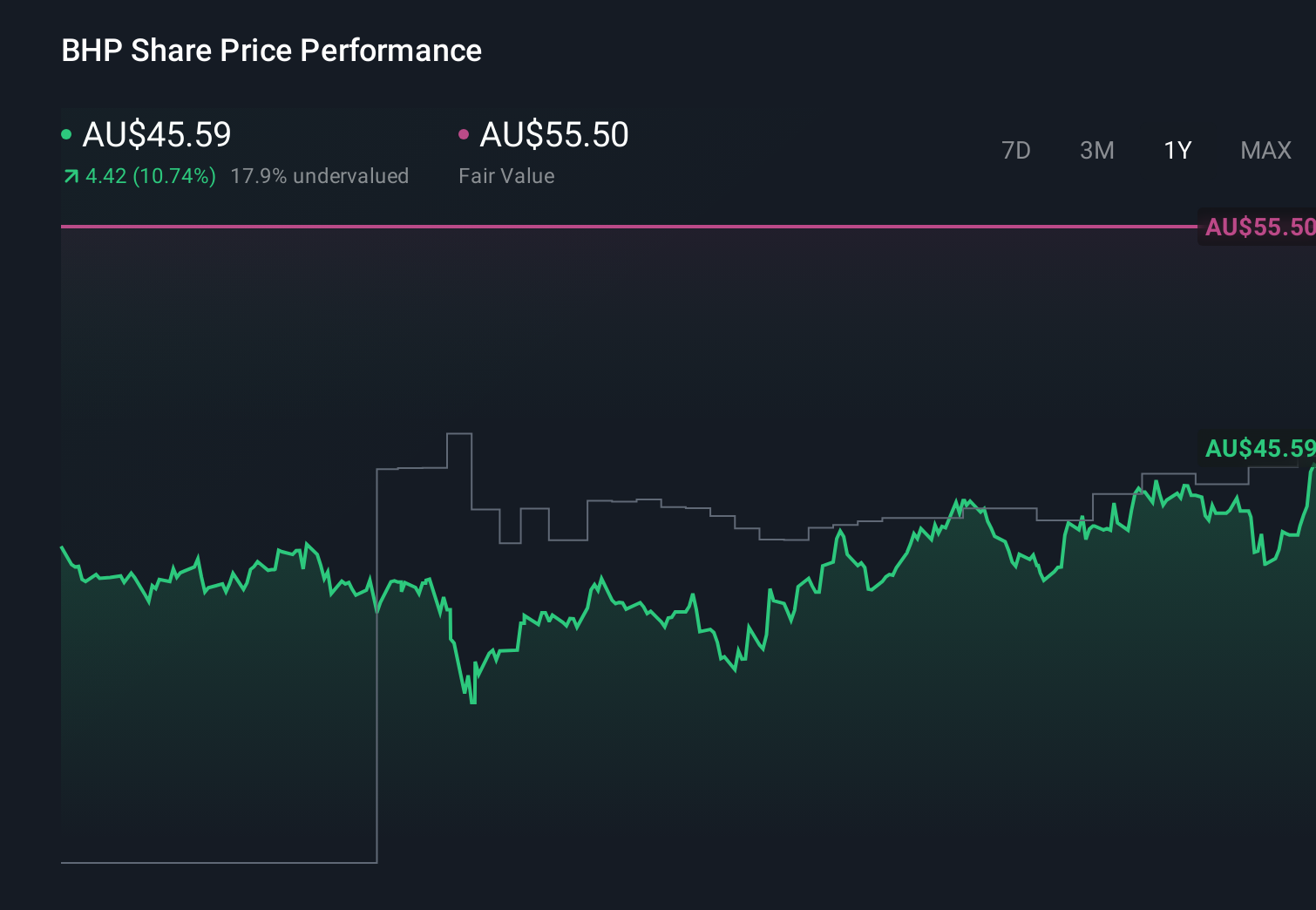

Uncover how BHP Group's forecasts yield a A$44.94 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Twenty one Simply Wall St Community fair value estimates for BHP span a wide range, from US$30.47 to US$55.50 per share, showing how far opinions can stretch. You can weigh these views against the highlighted risk that further cost overruns or delays at Jansen could affect how BHP’s project pipeline supports future performance.

Explore 21 other fair value estimates on BHP Group - why the stock might be worth 34% less than the current price!

Build Your Own BHP Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BHP Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BHP Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BHP Group's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报