Assessing Woolworths Group (ASX:WOW) Valuation As Margin Pressures Test Its Defensive Reputation

Recent commentary around Woolworths Group (ASX:WOW) has focused on margin pressures from wage inflation, heavy promotions and more price sensitive shoppers, raising questions about its traditional defensive role for investors.

See our latest analysis for Woolworths Group.

At a share price of A$29.30, Woolworths Group has delivered an 11.79% 90 day share price return, while its 1 year total shareholder return of 1.76% decline and 3 year total shareholder return of 4.08% decline suggest momentum has been fading, even as investors reassess the balance between margin pressures and its traditional defensive appeal.

If these shifts in sentiment have you reconsidering where defensiveness and growth might intersect, it could be a good time to broaden your search with fast growing stocks with high insider ownership.

With the shares sitting at A$29.30 and an intrinsic value estimate suggesting a sizeable discount, the key question is simple: is Woolworths quietly undervalued, or is the market already pricing in all of its future growth?

Most Popular Narrative: 4% Undervalued

With Woolworths Group last closing at A$29.30 against a narrative fair value of about A$30.51, the current pricing gap is relatively modest but still raises questions about what is being factored into the shares.

The ongoing investment and upgrades in Woolworths' supply chain automation and distribution centers are expected to drive significant operational efficiencies and margin improvement over the next few years, as dual running and commissioning costs roll off and new facilities like Moorebank and Auburn CFCs deliver returns, likely supporting higher future EBIT and ROIC.

Curious what kind of revenue path, margin lift and earnings power are baked into that view? The narrative leans on measured growth, fatter margins and a future earnings multiple that still assumes investors stay confident in Woolworths' core food engine. Want to see exactly how those moving parts get discounted at just over 7% to land on that fair value?

Result: Fair Value of A$30.51 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on BIG W not putting greater pressure on group profits and on heavy price competition from Coles, ALDI and others not squeezing margins further.

Find out about the key risks to this Woolworths Group narrative.

Another View: Rich P/E Puts The Brakes On

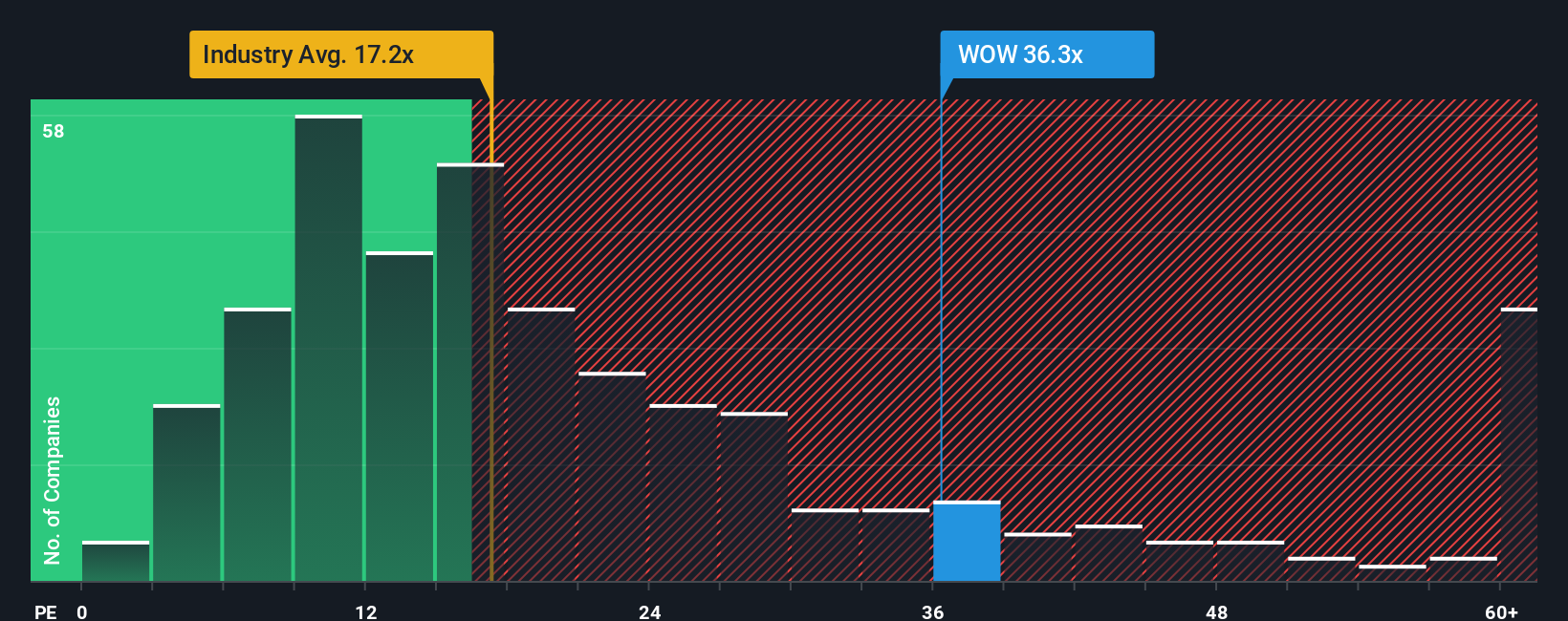

Our DCF work suggests Woolworths is trading well below an estimate of fair value, yet the current P/E of 37.1x is far richer than the global Consumer Retailing average of 17.7x, the peer average of 19.7x, and even its own fair ratio of 33x. Is the market already paying up for the good news that has not fully shown through in recent returns?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Woolworths Group Narrative

If you interpret the numbers differently or prefer to test your own assumptions, you can quickly build a personalised Woolworths view in under 3 minutes with Do it your way.

A great starting point for your Woolworths Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one supermarket stock. Broaden your watchlist and let fresh ideas challenge your assumptions before the market moves without you.

- Spot potential early movers by scanning these 3562 penny stocks with strong financials that already show stronger financial foundations than many expect at this size.

- Ride the AI tailwind by zeroing in on these 25 AI penny stocks that blend cutting edge tech themes with listed market access.

- Hunt for value by filtering for these 878 undervalued stocks based on cash flows where prices sit below what cash flows might suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报