Sunrun’s Cash Flow And Storage Gains Might Change The Case For Investing In Sunrun (RUN)

- In Q3 2025, Sunrun Inc. reported a revenue increase of 35% year over year, a 10% rise in aggregate subscriber value, strong storage adoption, and six consecutive quarters of positive cash flow, supported by US$709 million in unrestricted cash and ongoing access to capital markets.

- This combination of improving cash generation and storage-led unit economics has strengthened the perception of Sunrun’s business model resilience and long-term value creation potential.

- Next, we’ll examine how Sunrun’s sustained positive cash flow reshapes its investment narrative around growth, risk, and long-term profitability.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Sunrun Investment Narrative Recap

To own Sunrun, you need to believe that residential solar and storage can support a durable, cash generative business even as incentives and financing conditions evolve. The Q3 2025 results, with six straight quarters of positive cash flow and strong storage-driven economics, help near term by easing worries about funding growth, but they do not remove the bigger risk tied to future tax credit expirations and potential market contraction.

Among recent announcements, the multi year alliance with NRG Energy’s Reliant in Texas stands out here, because it directly links Sunrun’s storage and grid services capabilities to a large power market and potential recurring capacity revenues. This type of agreement matters for today’s catalyst around storage led value creation and could help diversify against future demand pressures if the residential solar market shrinks once key tax incentives roll off.

Yet despite improving cash flow, investors should be aware that Sunrun’s exposure to expiring solar tax credits could still materially affect...

Read the full narrative on Sunrun (it's free!)

Sunrun's narrative projects $2.9 billion revenue and $465.4 million earnings by 2028.

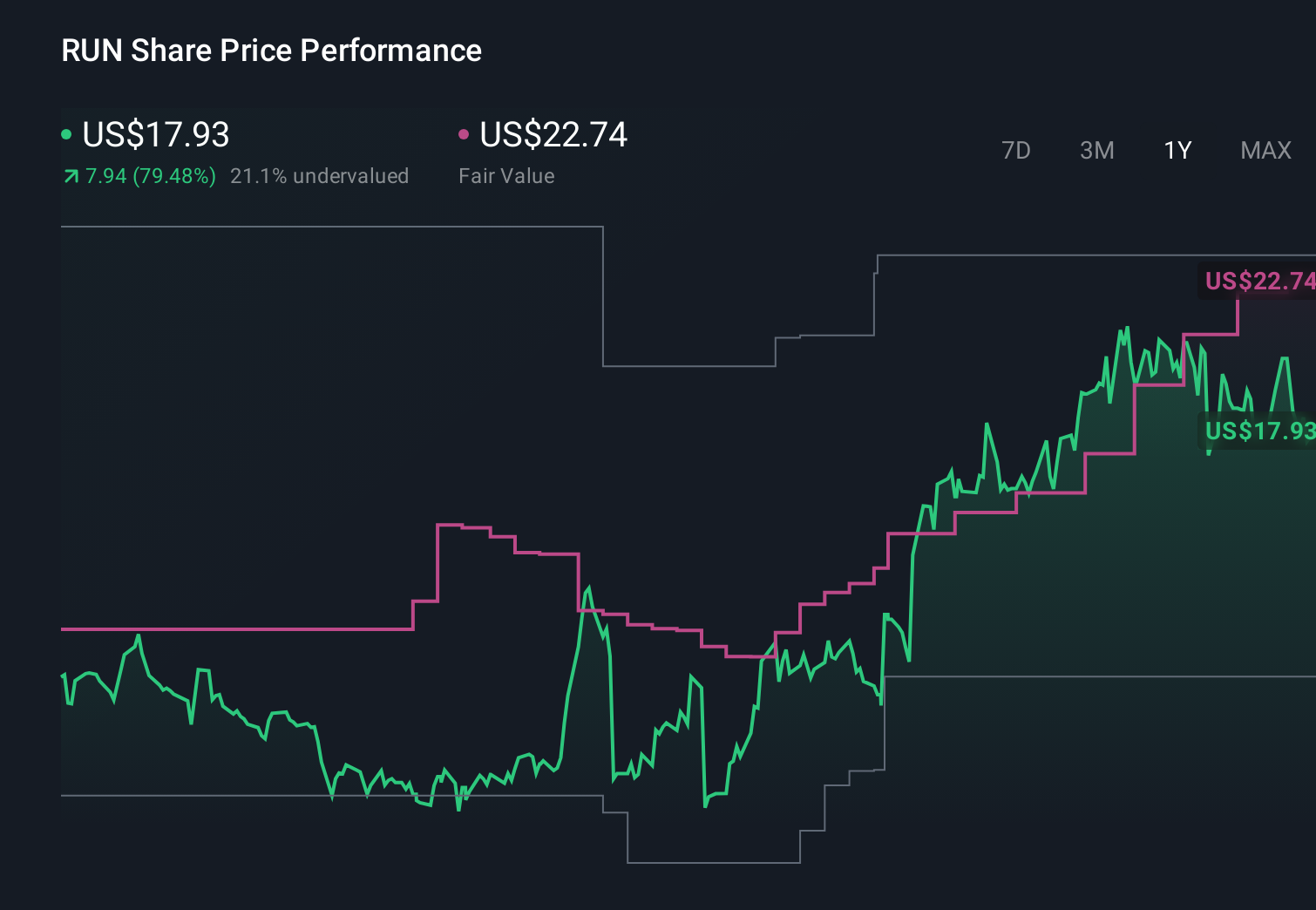

Uncover how Sunrun's forecasts yield a $22.74 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span roughly US$13 to US$24 per share, showing how far apart individual views can be. You can weigh those against the recent shift to sustained positive cash flow, which may influence how you think about Sunrun’s ability to handle tax credit risks and long term profitability.

Explore 6 other fair value estimates on Sunrun - why the stock might be worth 32% less than the current price!

Build Your Own Sunrun Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sunrun research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sunrun research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sunrun's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

- This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报