Coca-Cola (KO) Valuation Check After Recent Share Price Softness

Why Coca-Cola stock is on investors’ radar today

Coca-Cola (KO) is back in focus after recent trading left the shares with a 1.1% one day decline and slightly lower performance over the past week and month, despite a positive past 3 months.

See our latest analysis for Coca-Cola.

Zooming out, Coca-Cola’s recent share price softness contrasts with a 1-year total shareholder return of 17.0% and a 5-year total shareholder return of 60.0%. This suggests longer term momentum remains positive even as short term sentiment cools.

If Coca-Cola’s steadier profile has you thinking about diversification, it could be a good moment to look across fast growing stocks with high insider ownership for other ideas that might complement a consumer staples holding.

With Coca-Cola shares easing recently but still carrying multi year total returns of 60.0%, the key question is whether today’s price reflects its future earnings power or if there is still a genuine buying opportunity the market has not fully priced in.

Most Popular Narrative Narrative: 2.4% Overvalued

According to AllTrades, the fair value estimate of US$67.50 sits slightly below Coca-Cola’s last close of US$69.12, which shapes the whole narrative.

“In discounted cash flow (DCF) analysis, the discount rate represents the cost of capital investors demand for future cash flows. A lower Fed Funds rate reduces borrowing costs and the weighted average cost of capital (WACC). Even a quarter-point cut can noticeably lift the present value of a durable cash generator like Coca-Cola.”

Curious how a small shift in the discount rate, steady revenue lift, and firm profit margins combine into that fair value? The math behind this story is very specific.

Result: Fair Value of $67.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story can change quickly if interest rates move higher again or if health regulations and sugar taxes weigh more heavily on beverage demand.

Find out about the key risks to this Coca-Cola narrative.

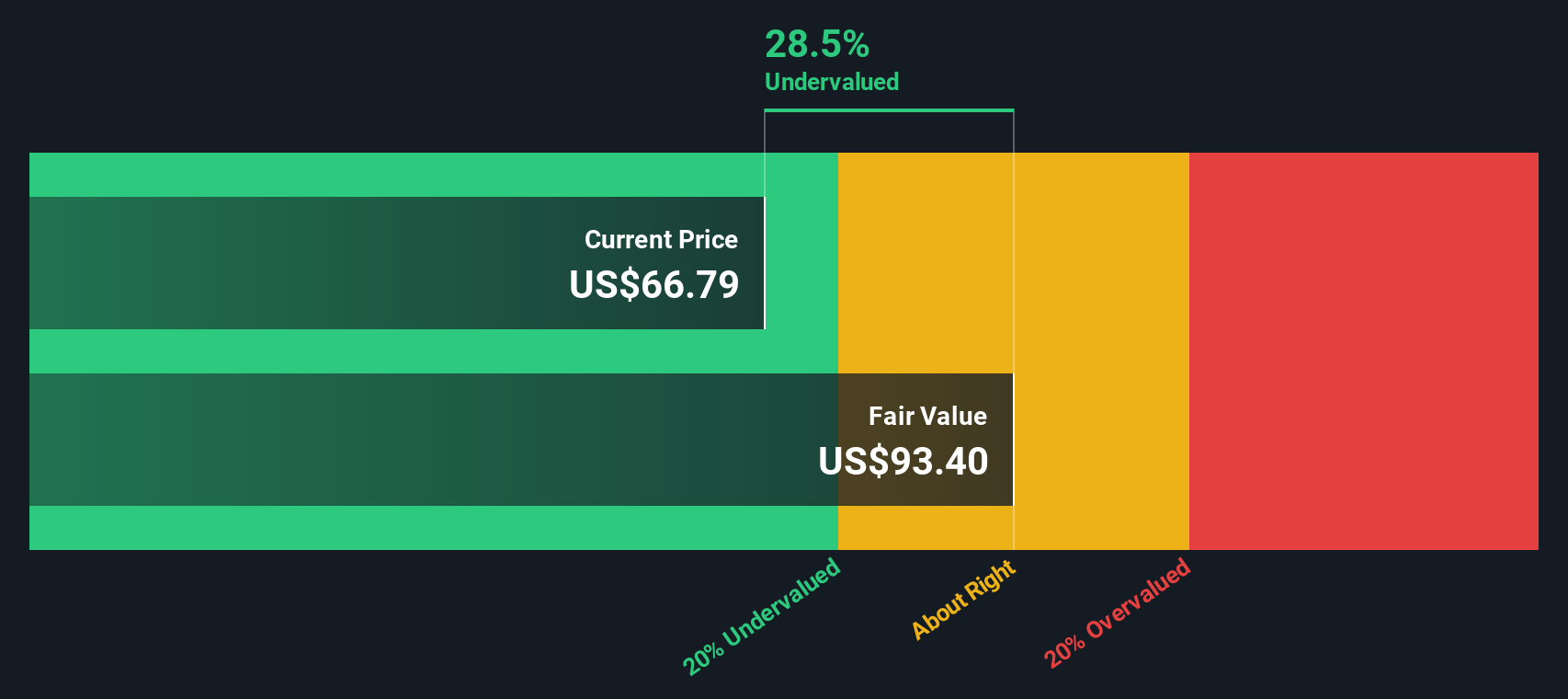

Another View: Our DCF Model Paints A Different Picture

AllTrades sees Coca-Cola as about 2.4% overvalued using its own DCF, but our SWS DCF model currently points the other way, with KO at US$69.12 trading around 22.4% below an estimated fair value of US$89.02. Which interpretation is more appropriate for the level of risk you are willing to take?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Coca-Cola for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Coca-Cola Narrative

If you look at the numbers and come to a different conclusion, or simply prefer to test your own assumptions, you can build a fresh view in minutes: Do it your way.

A great starting point for your Coca-Cola research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready to hunt for your next idea?

If Coca-Cola has sharpened your thinking, do not stop here. Your next move across high conviction stock ideas could be the one you wish you had made earlier.

- Explore potential sources of cash returns by checking out these 14 dividend stocks with yields > 3% that may suit an income focused portfolio.

- Look for potential mispricings by scanning these 878 undervalued stocks based on cash flows that might trade below their estimated cash flow value.

- Consider fast evolving trends by reviewing these 79 cryptocurrency and blockchain stocks linked to digital assets and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报