Artrya And 2 Other High Growth Tech Stocks With Potential In Australia

As the Australian market kicks off 2026, the ASX has been relatively flat with a brief pause in the Santa Rally, while IT stocks have led declines amidst broader market uncertainties. In this environment, identifying high-growth tech stocks like Artrya and others requires careful consideration of their potential to navigate current challenges and capitalize on emerging opportunities within Australia's dynamic economic landscape.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pureprofile | 10.51% | 37.56% | ★★★★★☆ |

| Pro Medicus | 19.70% | 21.17% | ★★★★★☆ |

| Kinatico | 13.27% | 42.29% | ★★★★☆☆ |

| BlinkLab | 104.90% | 101.40% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 22.02% | 23.88% | ★★★★★☆ |

| Xero | 18.02% | 24.83% | ★★★★☆☆ |

| Wrkr | 35.94% | 53.22% | ★★★★★★ |

| Nuix | 9.46% | 44.74% | ★★★★☆☆ |

| Artrya | 50.54% | 61.25% | ★★★★★☆ |

| RPMGlobal Holdings | 15.00% | 55.02% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our ASX High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Artrya (ASX:AYA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Artrya Limited is a medical technology company focused on developing and commercializing an artificial intelligence platform for detecting, diagnosing, and addressing coronary artery disease in Australia, with a market capitalization of A$792.00 million.

Operations: Artrya Limited generates revenue primarily from the development of its AI-driven CCTA image analysis technology, amounting to A$0.03 million.

Artrya, a burgeoning name in Australia's tech landscape, is navigating the high-growth trajectory with impressive revenue forecasts. With an annual revenue growth rate projected at 50.5%, Artrya outpaces the broader Australian market's 6.1% expansion rate significantly. Despite its current unprofitability, earnings are expected to surge by 61.25% annually, positioning it for profitability within three years. Recent engagements like presenting at influential conferences and conducting an Annual General Meeting underscore its active pursuit of growth and investor confidence. However, shareholder dilution over the past year raises concerns about equity value erosion amidst these advances. In terms of innovation investments, Artrya's commitment to R&D could be pivotal for sustaining its rapid growth pace although specific figures on R&D expenses were not disclosed in the provided data set; this area remains crucial as it directly correlates with product development and competitive edge in technology sectors.

- Take a closer look at Artrya's potential here in our health report.

Gain insights into Artrya's past trends and performance with our Past report.

Cogstate (ASX:CGS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cogstate Limited is a neuroscience solutions company focused on developing and commercializing digital brain health assessments globally, with a market capitalization of A$387.87 million.

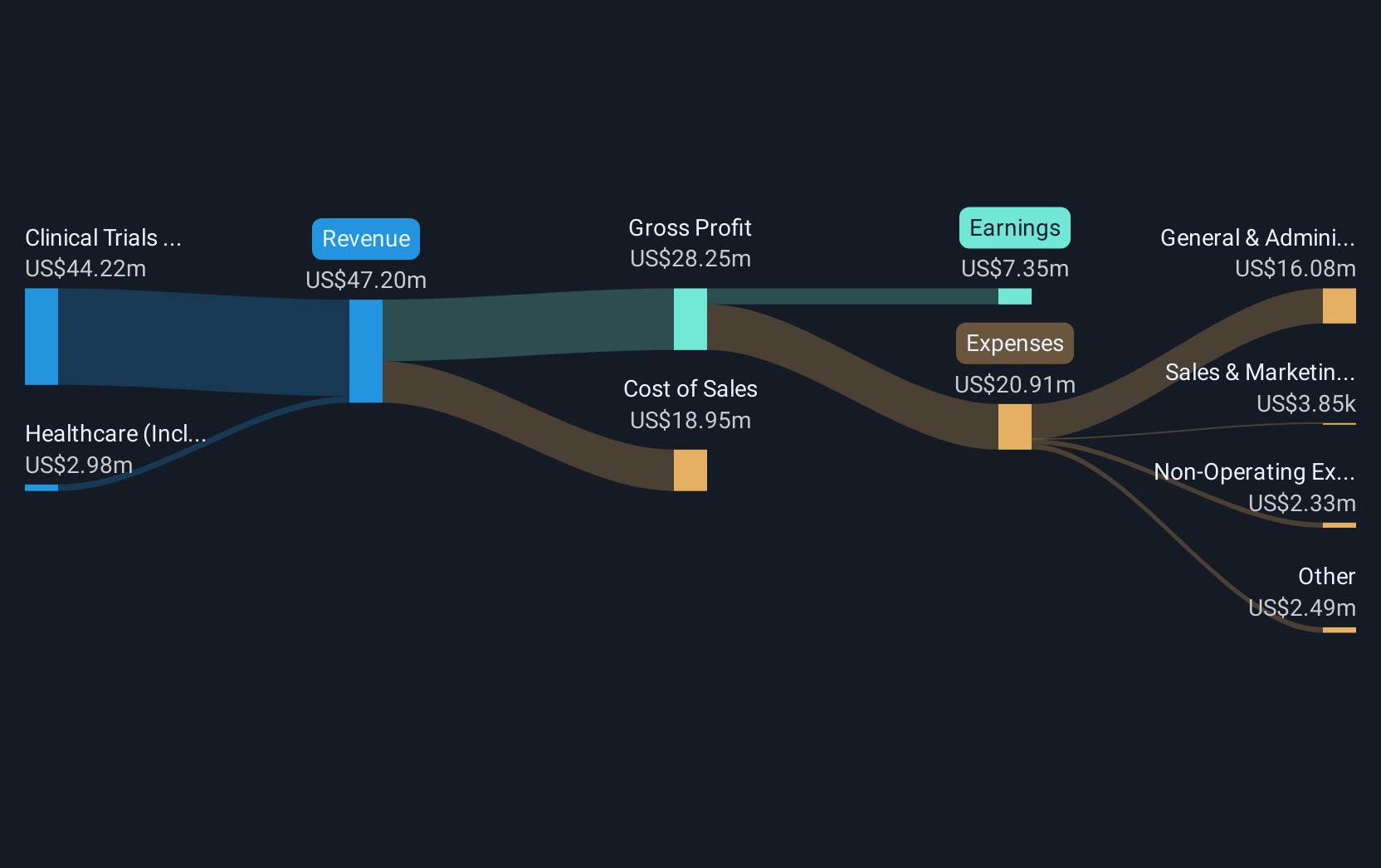

Operations: Cogstate generates revenue primarily from two segments: Clinical Trials, which includes precision recruitment tools and research, contributing $50.58 million, and Healthcare (including sports), contributing $2.51 million. The company is involved in the creation, validation, and commercialization of digital brain health assessments worldwide.

Cogstate, a player in Australia's tech sector, demonstrates a promising growth trajectory with an annual revenue increase of 13.6% and earnings growth of 18.8%. The company's strategic focus on R&D, which is essential for maintaining its competitive edge in cognitive assessment technology, is evident from its significant investment in this area; however, specific figures were not provided. Recently, Cogstate has actively repurchased shares, reinforcing shareholder value by buying back 3.41% of its issued capital for AUD 7.65 million. This move highlights management’s confidence in the company’s prospects and commitment to returning value to shareholders.

- Click here to discover the nuances of Cogstate with our detailed analytical health report.

Understand Cogstate's track record by examining our Past report.

Clinuvel Pharmaceuticals (ASX:CUV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Clinuvel Pharmaceuticals Limited is a biopharmaceutical company that develops and commercializes treatments for genetic, metabolic, systemic, and life-threatening disorders across Australia, Europe, the United States, Switzerland, and internationally with a market cap of A$623.99 million.

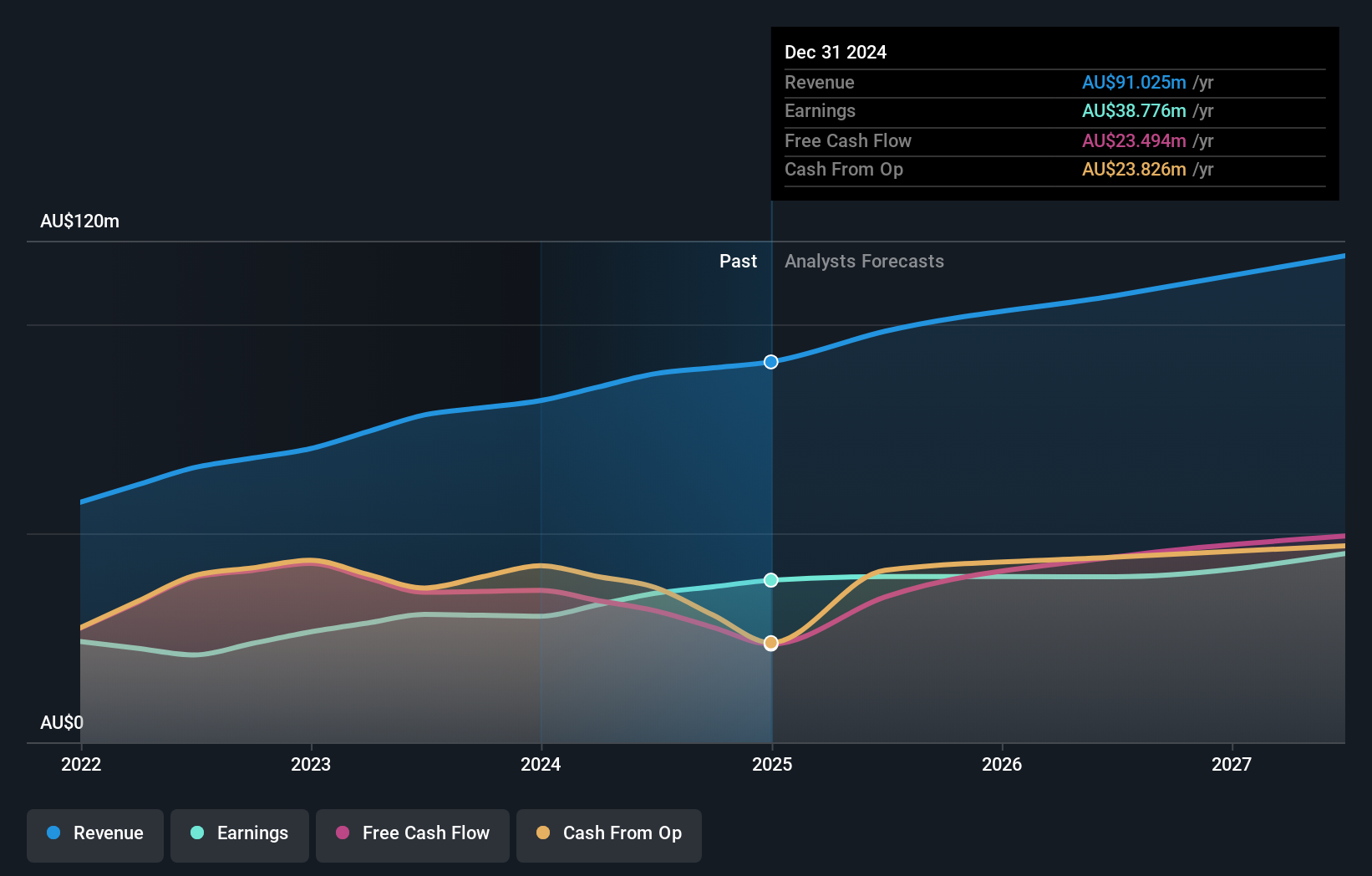

Operations: Clinuvel Pharmaceuticals generates revenue primarily from its biopharmaceutical sector, amounting to A$95.02 million. The company's focus is on developing and commercializing treatments for various disorders across multiple regions, including Australia, Europe, the United States, and Switzerland.

Clinuvel Pharmaceuticals stands out in the Australian tech landscape with a robust growth profile, evidenced by its annual revenue and earnings growth rates of 22.0% and 23.9%, respectively. These figures not only surpass the general market trends but also highlight the company's aggressive expansion strategy. In addition to financial growth, Clinuvel is deeply invested in research and development, dedicating substantial resources to innovate within the biotech sector—though exact R&D expenditure figures are not detailed here. The firm's recent activities include exploring acquisitions in North America, demonstrating a strategic approach to scaling operations while maintaining stringent investment criteria for high returns. This blend of financial performance and strategic R&D investment positions Clinuvel as a noteworthy entity within high-growth sectors, navigating through opportunities with precision and forward-thinking leadership.

Key Takeaways

- Dive into all 20 of the ASX High Growth Tech and AI Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报