A Look At Bank Of New York Mellon Corporation (BK) Valuation After Recent Share Price Momentum

Without a clear single event driving headlines, Bank of New York Mellon Corporation (BK) is drawing attention mainly for its recent share performance and fundamentals, prompting investors to reassess how its current valuation aligns with its business profile.

See our latest analysis for Bank of New York Mellon.

At a latest share price of US$117.04, BNY’s recent 90 day share price return of 9.45% and 1 year total shareholder return of 53.53% point to momentum that has been building rather than fading over time.

If BNY’s move has you thinking more broadly about financials, it could be a useful moment to scan fast growing stocks with high insider ownership as another way to spot what is gaining traction.

With BNY now trading near its recent price target and carrying an intrinsic value estimate that is slightly above the market price, the key question is whether there is still potential upside or if markets are already pricing in future growth.

Most Popular Narrative Narrative: 2% Undervalued

With BNY last closing at US$117.04 against a fair value estimate of roughly US$119.03, the most followed narrative sees the share price sitting slightly below its calculated worth. This sets up a valuation story built on measured growth, steady margins and an updated discount rate.

The fair value estimate has risen slightly to 119.03 dollars from 118.03 dollars, reflecting modestly higher long term expectations.

The discount rate has fallen slightly to approximately 10.51 percent from 10.61 percent, implying a modestly lower required return.

Curious what justifies that higher fair value with only modest tweaks to revenue growth, margins and the required return, plus a slightly richer future earnings multiple? The full narrative explains how these moving parts fit together and what kind of earnings power they imply a few years from now, without relying on aggressive assumptions.

Result: Fair Value of $119.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to keep an eye on fee pressure from passive products and the risk that recent net interest income strength proves harder to repeat.

Find out about the key risks to this Bank of New York Mellon narrative.

Another View: SWS DCF Model Flags Caution

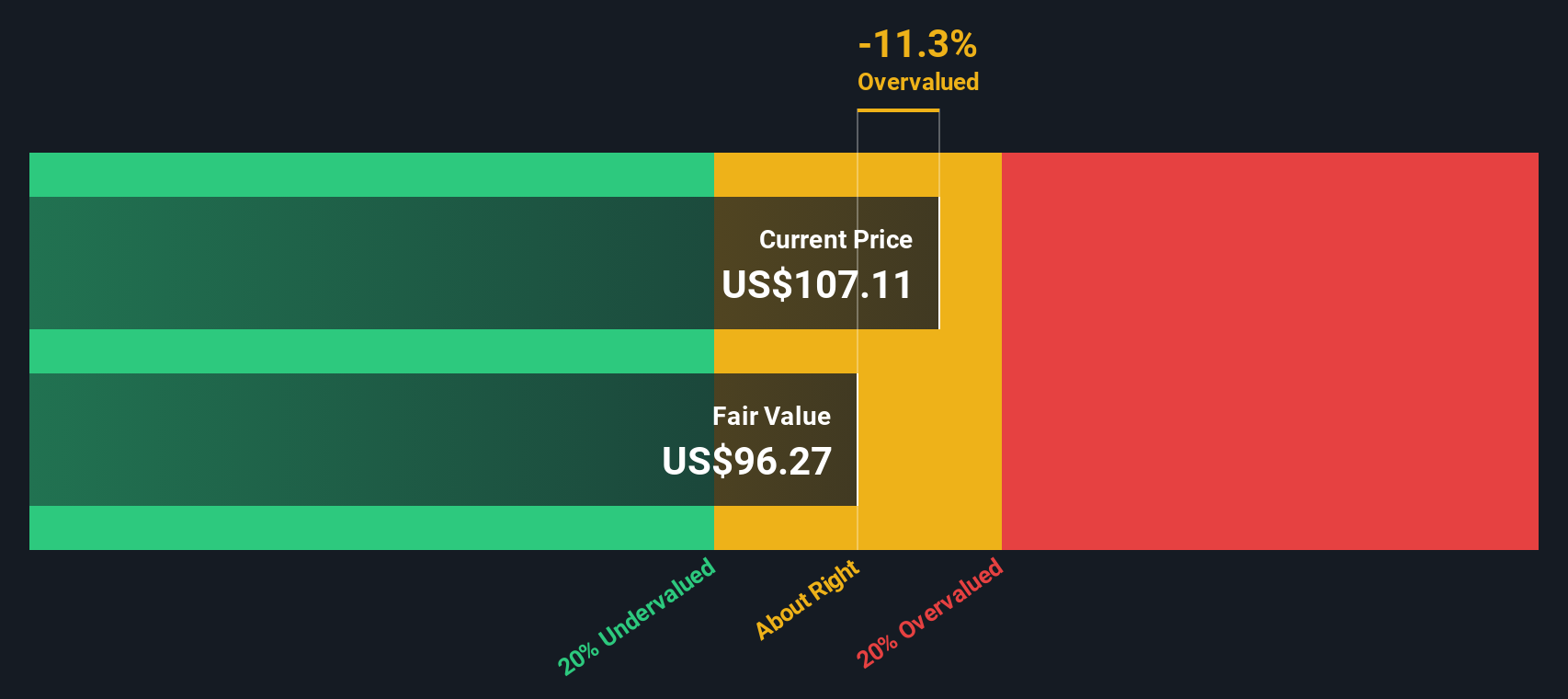

While the popular narrative points to a fair value of about US$119.03 and labels BNY as slightly undervalued, our DCF model tells a different story. On that basis, Bank of New York Mellon Corporation at US$117.04 sits above an estimated fair value of US$108.15, so screens as overvalued.

This gap is not huge, but it does flip the conversation from upside to valuation risk. It raises a simple question for you as an investor: which set of assumptions about future cash flows and required returns feels more realistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bank of New York Mellon for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 100+ undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bank of New York Mellon Narrative

If you look at the numbers and reach a different conclusion, or just want to test your own assumptions, you can build a custom view of Bank of New York Mellon Corporation’s valuation and key drivers in just a few minutes. You can then stress test it against different scenarios and see what stands out to you most, all by starting with Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Bank of New York Mellon.

Looking for more investment ideas?

If Bank of New York Mellon Corporation has sharpened your focus, do not stop there, use the screener to see what other opportunities might fit your style.

- Spot potential value candidates early by scanning these 100+ undervalued stocks based on cash flows that line up with your return and risk preferences.

- Capture income ideas by checking out these 14 dividend stocks with yields > 3% that may suit a portfolio built around regular cash payouts.

- Get ahead of emerging themes through these 100+ cryptocurrency and blockchain stocks that are tied to blockchain, digital payments and new financial infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报