Assessing Northrop Grumman (NOC) Valuation As Key Defense Programs Draw Renewed Attention

Why Northrop Grumman is back in focus

Northrop Grumman (NOC) is drawing renewed attention as investors weigh its role in high profile Pentagon programs like the B-21 Raider stealth bomber and strategic missile modernization, both central to its long cycle defense revenue base.

See our latest analysis for Northrop Grumman.

At a share price of $585.66, Northrop Grumman has seen a 6.68% 1 month share price return but a 5.79% decline over 3 months. Its 1 year total shareholder return of 30.91% suggests that longer term momentum has been stronger than the recent pullback.

If the renewed focus on defense spending has your attention, it could be a good moment to scan other aerospace and defense stocks that might fit your portfolio ideas.

With Northrop Grumman trading at $585.66 and sitting at a discount to the average analyst price target, yet above some intrinsic estimates, the key question is whether this pullback represents a potential opportunity or if future growth expectations are already reflected in the share price.

Most Popular Narrative Narrative: 11.6% Undervalued

With Northrop Grumman last closing at $585.66 against a most popular narrative fair value of about $662.68, the story centers on durable defense cash flows and how longer term program ramps might support that valuation.

The ramp-up of advanced autonomous and integrated systems such as Beacon and IBCS, combined with ongoing investments in solid rocket motor capacity (targeting a near-doubling by 2029), positions the company to capitalize on high-growth, higher-margin market segments, thereby enhancing future operating margins and underlying cash flow.

Curious what revenue path and margin profile sit behind that higher fair value, and what future earnings multiple ties it all together? The full narrative spells out how steady growth, modest margin shifts and a specific profit multiple work in combination, and why buybacks play a supporting role in the long term earnings picture.

Result: Fair Value of $662.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story can change quickly if big U.S. programs like B 21 or Sentinel face delays, or if allies push harder to build their own competing systems.

Find out about the key risks to this Northrop Grumman narrative.

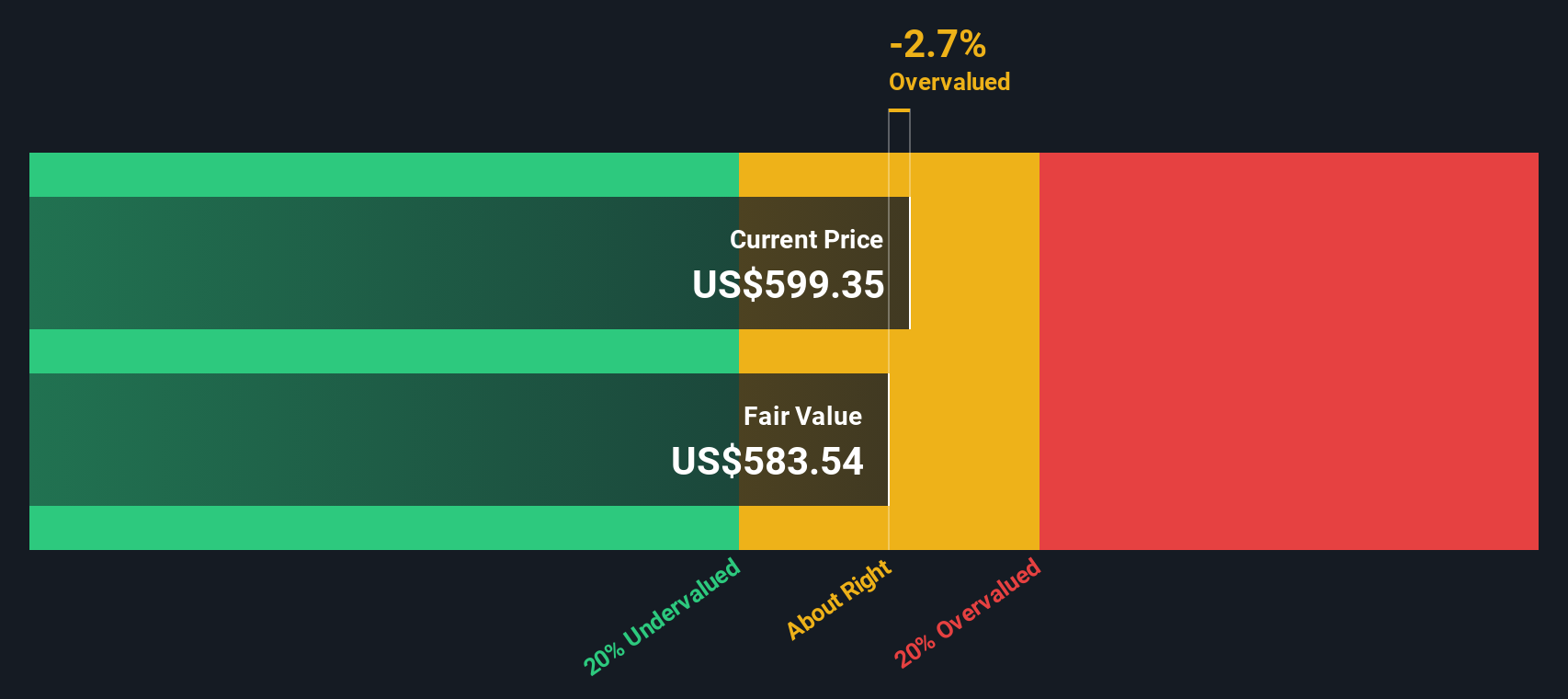

Another View: DCF Sends a Different Signal

While the popular narrative points to an 11.6% undervaluation around $662.68, our DCF model paints a different picture. With a fair value estimate of $512.83 versus the current $585.66 share price, the DCF view leans toward overvaluation. This raises a simple question: which story do you trust more, cash flows or multiples?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Northrop Grumman for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Northrop Grumman Narrative

If you are not fully aligned with these views or prefer to rely on your own work, you can quickly test the numbers yourself and Do it your way in under 3 minutes.

A great starting point for your Northrop Grumman research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you have come this far with Northrop Grumman, do not stop now. Broaden your watchlist and keep fresh ideas on your radar while others sit still.

- Spot potential mispricing by scanning these 870 undervalued stocks based on cash flows that align with your return goals and risk comfort.

- Ride long term tech shifts by filtering these 25 AI penny stocks that tie real business models to artificial intelligence themes.

- Boost your income focus by reviewing these 14 dividend stocks with yields > 3% that may offer more consistent cash returns than single stock ideas alone.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报