A Look At Ares Management’s Valuation As Fundraising And Private Credit Pipeline Gain Momentum

Ares Management (ARES) is back in the spotlight after reports of fresh fundraising milestones across its flagship credit and private equity platforms, as well as continued deployment into private credit deals as traditional lenders step back.

See our latest analysis for Ares Management.

The latest fundraising headlines come against a backdrop of a US$166.33 share price, with a 1-day share price return of 2.91% and a 90-day share price return of 11.90%. At the same time, the 1-year total shareholder return shows a 5.20% decline, which contrasts with a very large 5-year total shareholder return of more than 3x. This suggests that long term momentum has been strong, even as shorter term sentiment has cooled at times.

If Ares’ fundraising story has caught your attention, this could be a good moment to broaden your search and check out fast growing stocks with high insider ownership.

With Ares shares around US$166 and analysts setting targets near US$189, plus a 5-year return of more than 3x, you have to ask: is there still value here, or is future growth already priced in?

Most Popular Narrative: 9.4% Undervalued

With Ares Management’s fair value pegged at US$183.60 against a US$166.33 last close, the widely followed narrative sees room above today’s price.

The significant ramp in perpetual capital (now nearly 50% of fee-paying AUM), combined with consistent investment performance and low client redemptions, is expected to drive higher recurring fee revenues, greater profitability, and improved earnings visibility.

Curious what kind of growth profile justifies that outcome, and how fee margins, earnings and valuation multiples are expected to line up over time? The narrative leans heavily on compounding earnings, rising profitability and a richer earnings multiple to bridge the gap between today’s price and its fair value.

Result: Fair Value of $183.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on private credit remaining attractive despite fee pressure from competitors and on retail-focused perpetual capital avoiding heavy redemptions or regulatory setbacks.

Find out about the key risks to this Ares Management narrative.

Another Angle On Valuation

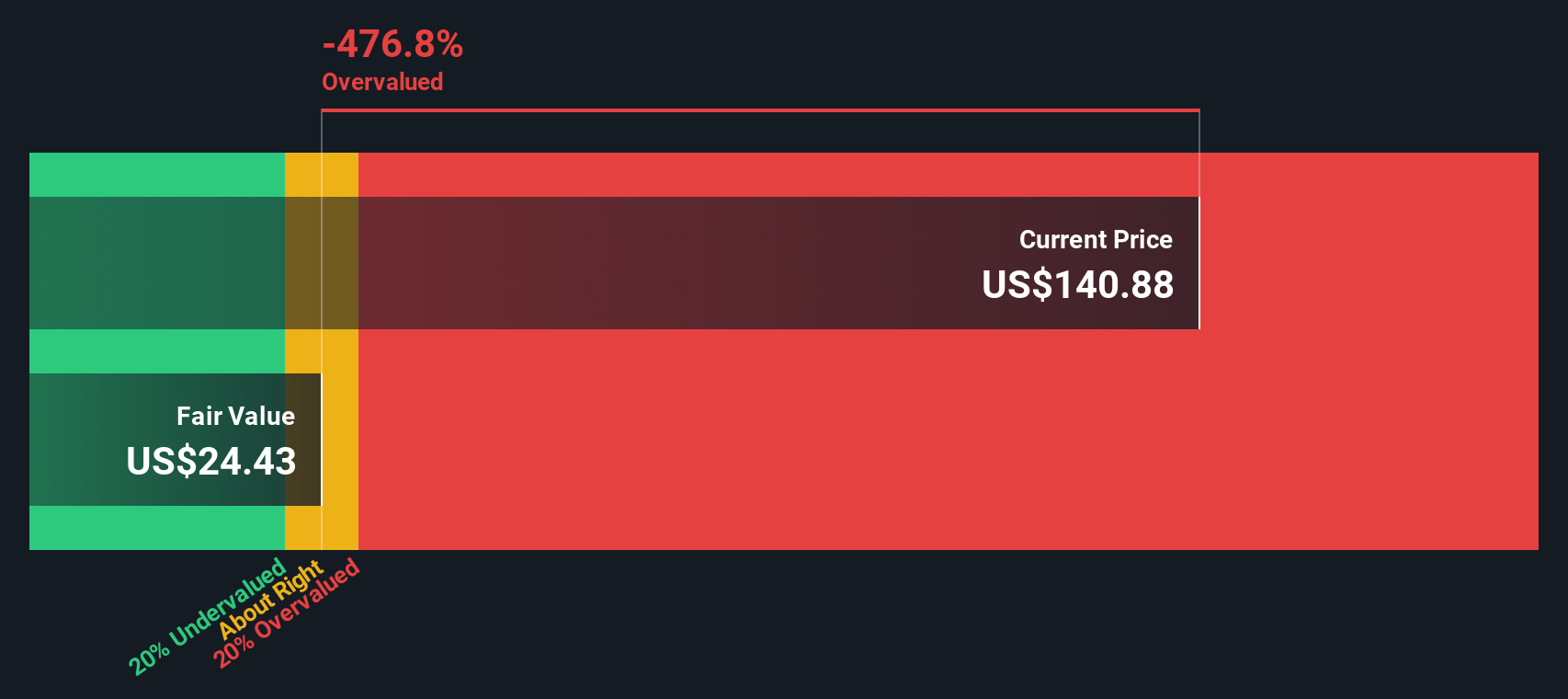

While the narrative points to a fair value of US$183.60 and describes Ares as undervalued, our DCF model presents a different perspective. According to this model, Ares at US$166.33 is trading above an estimated fair value of US$90.61, which indicates valuation risk rather than upside. Which interpretation aligns more closely with your expectations?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Ares Management Narrative

If you look at the numbers and reach a different conclusion, or just prefer to test your own view, you can build a personal narrative in just a few minutes. Start with Do it your way.

A great starting point for your Ares Management research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready to hunt for more ideas?

Do not stop at one stock when you can quickly scan the market for other opportunities that might suit your style and help round out your watchlist.

- Target dependable income by checking out these 14 dividend stocks with yields > 3% that could help you build a steadier cash flow profile.

- Spot potential mispricings by running through these 870 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Get ahead of the next big tech shift by reviewing these 29 quantum computing stocks that are working on cutting edge computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报