Should Xcel’s Colorado Gas Hike and Craig Plant Extension Reshape Xcel Energy’s (XEL) Risk Equation?

- In late December 2025, Xcel Energy’s Colorado subsidiary filed for an 11.6% natural gas revenue increase of US$190 million, while the U.S. Department of Energy ordered continued operation of the Craig Power Plant’s Unit 1 beyond its planned retirement.

- Together, these moves highlight the tension between funding infrastructure and safety needs, managing aging fossil assets, and maintaining cost-effective, reliable service under regulatory scrutiny.

- Next, we’ll examine how the Colorado natural gas rate case could influence Xcel Energy’s previously outlined investment narrative and risk profile.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Xcel Energy Investment Narrative Recap

To own Xcel Energy, you have to be comfortable with a regulated utility that trades some growth potential for stability, dividends, and long-term infrastructure investment. The Colorado gas rate case and Craig plant extension both sit squarely in that regulated framework, but neither appears to materially alter the near term focus on rate outcomes and balance sheet pressure as the key catalyst and risk.

The most relevant development here is the December 29, 2025 Colorado natural gas rate filing, which requests an 11.6% revenue increase, or US$190 million, based on a 10.75% return on equity. For investors, the eventual Colorado commission decision will be an important signal for how constructively regulators allow Xcel to recover its growing capital spend and operating costs without unduly straining customers or compressing allowed returns.

Yet behind Xcel’s reputation for stability, investors should be aware of how its growing capital program and reliance on new debt and equity could...

Read the full narrative on Xcel Energy (it's free!)

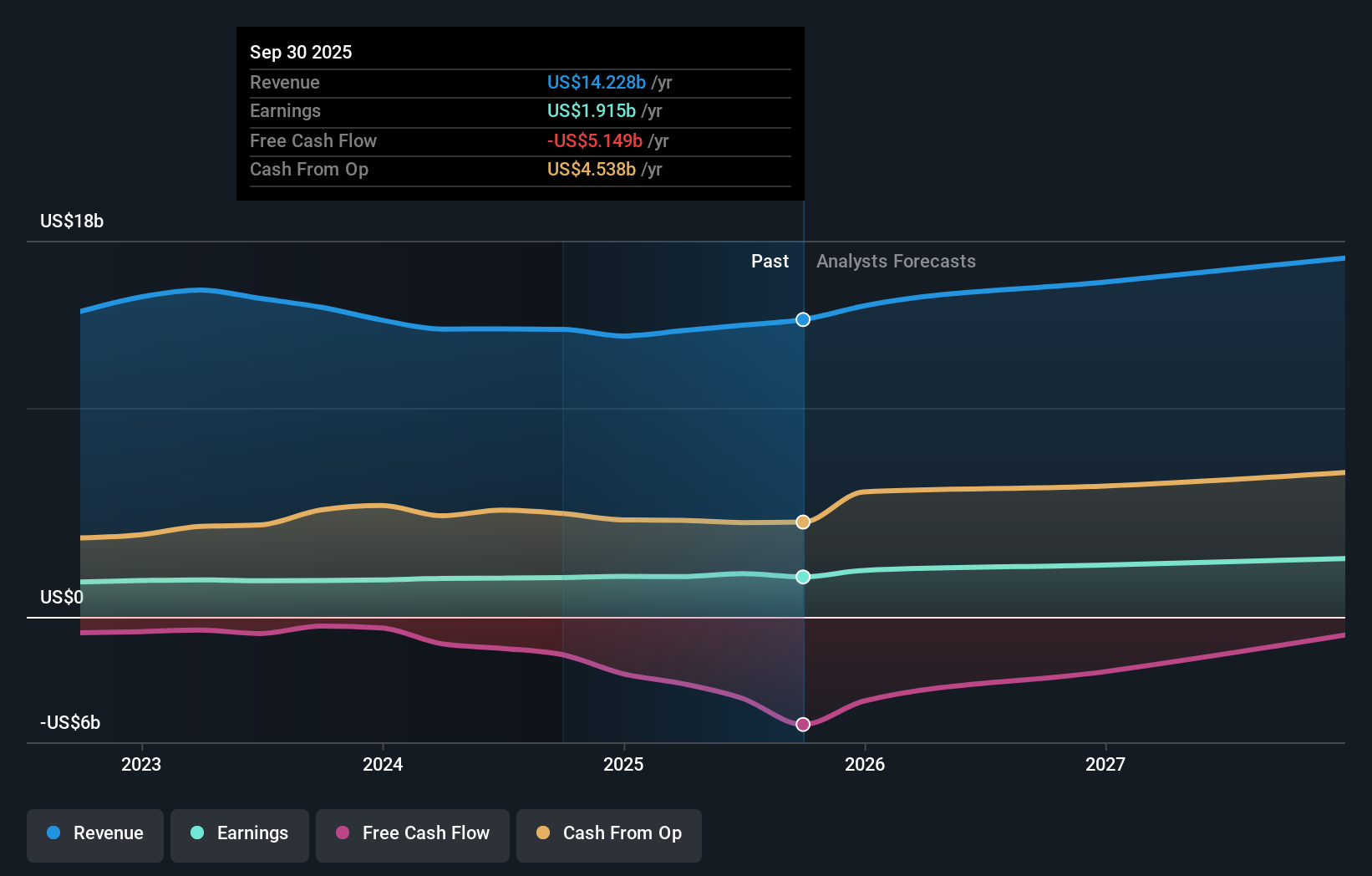

Xcel Energy's narrative projects $17.4 billion revenue and $2.9 billion earnings by 2028. This requires 7.6% yearly revenue growth and about an $0.8 billion earnings increase from $2.1 billion today.

Uncover how Xcel Energy's forecasts yield a $87.53 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community value Xcel Energy between US$67.45 and US$87.53, showing how far opinions can spread. Set against this, the pending Colorado gas rate decision may meaningfully shape views on its future earnings resilience, so it is worth comparing several of these perspectives side by side.

Explore 3 other fair value estimates on Xcel Energy - why the stock might be worth as much as 17% more than the current price!

Build Your Own Xcel Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Xcel Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Xcel Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Xcel Energy's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报