Assessing Ingredion (INGR) Valuation After Recent Share Weakness And Mixed Return Profile

Event context and recent price performance

Ingredion (INGR) shares recently closed at $109.79, with the stock showing mixed short term performance, including a roughly 1% move over the past month and a negative return over the past 3 months.

See our latest analysis for Ingredion.

Looking beyond the past few months, Ingredion’s recent 1 year total shareholder return decline of 15.95% contrasts with a 21.60% gain over 3 years and 58.89% over 5 years, suggesting momentum has faded after a stronger multiyear run.

If Ingredion has you rethinking where opportunities might sit in the market, this could be a good moment to check out fast growing stocks with high insider ownership.

With Ingredion trading at $109.79, modest annual revenue and net income growth, and a value score of 3, investors are left wondering if the recent share weakness signals an undervalued staple or if the market already reflects future growth.

Most Popular Narrative: 11.7% Undervalued

With Ingredion closing at $109.79 and the most followed narrative pointing to fair value near $124, the gap between price and modeled worth stands out.

Enhanced operational efficiencies, supply chain digitalization, and cost optimization initiatives have resulted in a structural step-change in segment margins (notably in Texture & Healthful Solutions), with management expecting these higher levels of profitability and operating leverage to persist, improving overall net margins and earnings.

Curious what underpins that margin story? The narrative leans heavily on measured revenue growth, steady earnings progress, and a future earnings multiple below current industry levels.

Result: Fair Value of $124.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case can quickly lose traction if softness in Latin America volume persists or if price mix pressure from lower corn costs continues to weigh on net sales.

Find out about the key risks to this Ingredion narrative.

Another View on Ingredion's Value

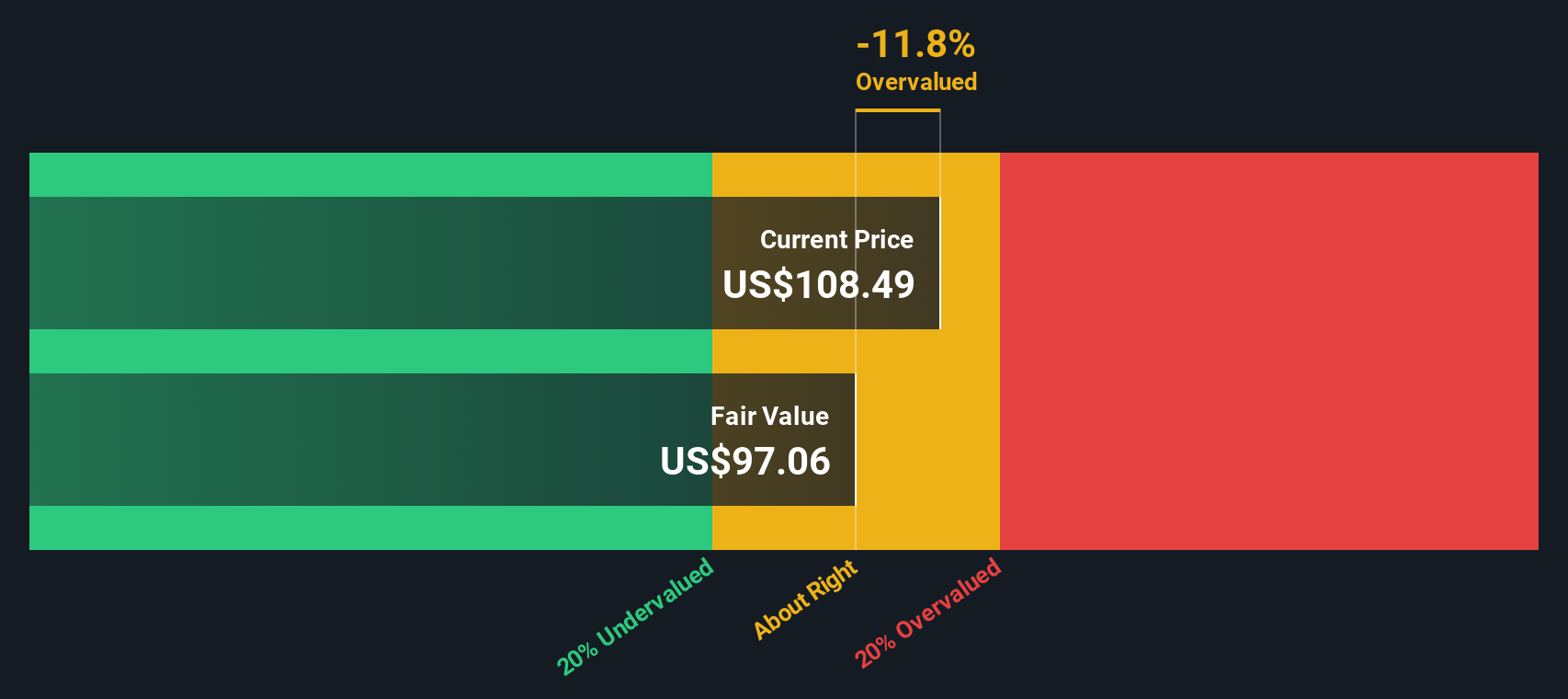

While the most followed narrative points to fair value around $124 and an 11.7% discount to the current $109.79 price, our DCF model comes out more cautious. On that framework, fair value sits nearer $97.06, which would make the shares look overvalued instead of cheap.

Look into how the SWS DCF model arrives at its fair value.

The gap between a $124 narrative fair value and a $97.06 DCF outcome leaves you with a simple but important question: which set of assumptions feels closer to how you expect Ingredion’s earnings and risks to play out over time?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ingredion for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ingredion Narrative

If you look at these numbers and reach a different conclusion, or simply prefer to test your own assumptions, you can build a custom view in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Ingredion.

Looking for more investment ideas?

If Ingredion has sharpened your thinking, do not stop here. Use this momentum to size up fresh ideas where the numbers and quality filters are already done for you.

- Spot potential value in quieter corners of the market by reviewing these 870 undervalued stocks based on cash flows that may not be on everyone’s radar yet.

- Capture the growth story in artificial intelligence by scanning these 25 AI penny stocks already filtered for this powerful theme.

- Tap into income focused opportunities by comparing these 14 dividend stocks with yields > 3% that offer yields above 3% and may suit a steadier return profile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报