A Look At Independence Realty Trust (IRT) Valuation As Investors Weigh Recent Price Momentum And Income Potential

With no single headline event driving attention to Independence Realty Trust (IRT) today, investors are instead focusing on its recent performance, income profile, and how the current price around US$17.60 lines up with fundamentals.

See our latest analysis for Independence Realty Trust.

The current share price around US$17.60 follows a recent pattern where the 30 day share price return of 6.47% and 90 day share price return of 8.44% sit against a 1 year total shareholder return decline of 4.90%. Meanwhile, the 3 year and 5 year total shareholder returns of 19.71% and 57.20% indicate that longer term holders have still seen gains, and that short term momentum has picked up after a softer year.

If you are weighing IRT against other ideas in real estate and beyond, it could be a good time to broaden your search with fast growing stocks with high insider ownership.

So with IRT trading near US$17.60, at some discount to analyst targets and with an implied gap to certain intrinsic value estimates, you have to ask: is this a mispriced income REIT, or is the market already factoring in future growth?

Most Popular Narrative Narrative: 14.1% Undervalued

With Independence Realty Trust closing at US$17.60 against a narrative fair value of US$20.50, the current setup hinges on how you view its future cash generation under a 7.48% discount rate.

Ongoing capital recycling, selling older, higher CapEx assets to acquire newer, lower CapEx communities with higher growth profiles in high-demand regions, allows IRT to enhance portfolio quality, capture operating synergies, and improve overall net margins and earnings growth potential.

Curious what it takes to justify that uplift? The narrative leans on faster earnings growth, wider margins, and a higher future P/E than many peers. The exact mix of assumptions might surprise you.

Result: Fair Value of $20.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on supply easing and asset recycling staying on track. Prolonged Sun Belt oversupply or weaker-than-expected rent growth could quickly undermine that underpriced story.

Find out about the key risks to this Independence Realty Trust narrative.

Another View: What The Ratios Say

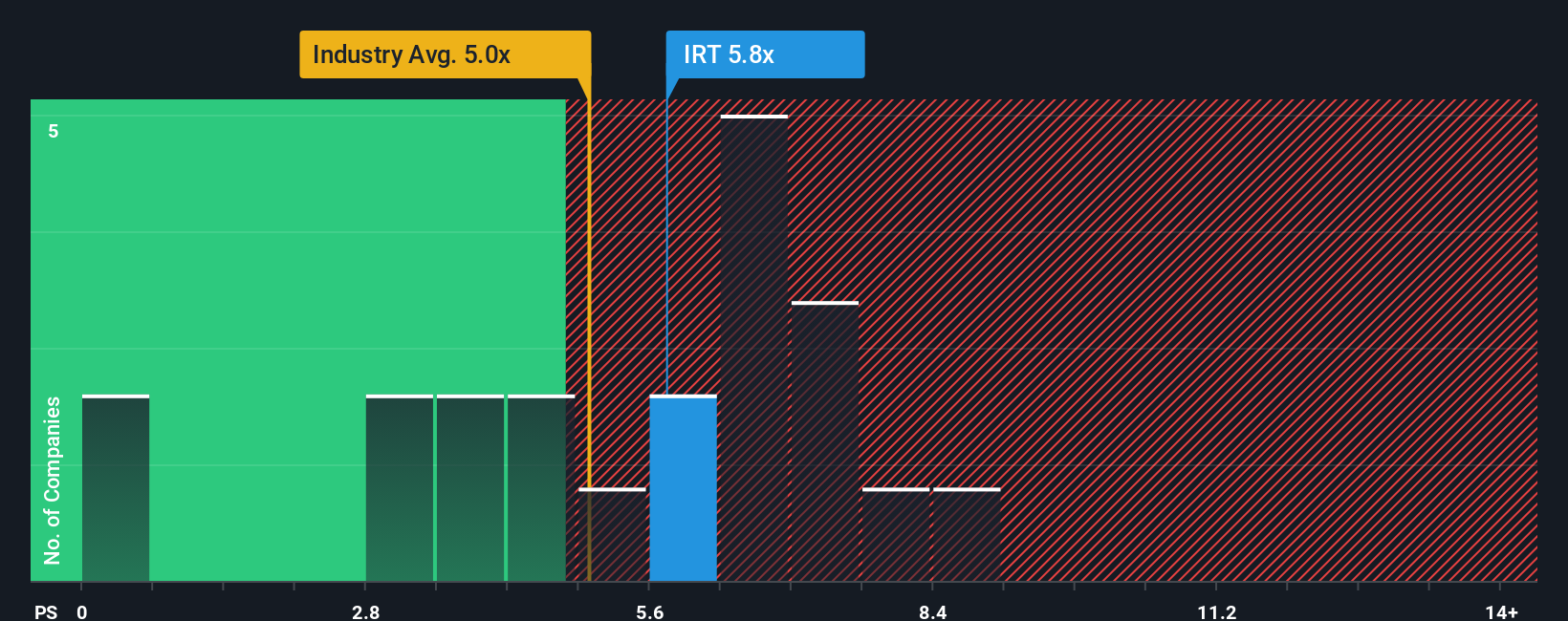

While the narrative and fair value estimate lean toward IRT being undervalued, the P/S ratio of 6.3x tells a tougher story. It sits above both the North American Residential REITs average of 5.1x and a fair ratio of 4.4x, which suggests less room for error if growth or margins disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Independence Realty Trust Narrative

If you would rather weigh the data yourself than rely on any single view, you can test your own assumptions in just a few minutes, starting with Do it your way.

A great starting point for your Independence Realty Trust research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready to hunt for more investment ideas?

If IRT is on your radar, do not stop there. Widen your watchlist now so you can compare fresh ideas before the next opportunity gets crowded.

- Target income-focused opportunities by scanning these 14 dividend stocks with yields > 3% and see which companies currently support higher yield profiles.

- Spot potential mispricings by filtering for these 870 undervalued stocks based on cash flows that may offer stronger cash flow support for their current prices.

- Get early exposure to emerging themes by reviewing these 79 cryptocurrency and blockchain stocks that tie listed companies to digital asset trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报