Assessing Vertex Pharmaceuticals (VRTX) Valuation As Recent Share Price Momentum Cools

Vertex Pharmaceuticals (VRTX) has been drawing attention after recent trading, with the stock around $452.13 and mixed short term returns. This has prompted investors to reassess how its current price lines up with fundamentals.

See our latest analysis for Vertex Pharmaceuticals.

Vertex’s recent pullback, including a 1-day share price return of 0.27% decline and a 7-day share price return of 1.66% decline, sits alongside a 90-day share price return of 10.20% and a 1-year total shareholder return of 12.33%. This suggests that recent momentum has cooled while longer term holders have still seen gains.

If you are assessing Vertex alongside other opportunities in the sector, it can be useful to scan comparable healthcare stocks and see how their recent returns and fundamentals line up.

With Vertex trading near $452 and an estimated intrinsic value implying a 33% discount, the key question is straightforward: are you looking at an undervalued growth story, or has the market already priced in what comes next?

Most Popular Narrative: 6.8% Undervalued

With Vertex shares at about $452 against a narrative fair value near $485, the current setup hinges on how you view its earnings and pipeline mix.

Commercial success and broad payer coverage for recent launches, particularly JOURNAVX and CASGEVY, are setting the stage for larger market uptake and eventual margin improvement as early launch support programs unwind and operational leverage is realized, positively impacting net margins and earnings.

Curious how steady revenue growth, rising margins and a premium future P/E all fit together? The most followed narrative connects these assumptions into one tight valuation case.

Result: Fair Value of $485.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on continued success beyond cystic fibrosis and on smooth regulatory progress, as setbacks in key kidney or gene editing programs could quickly challenge that story.

Find out about the key risks to this Vertex Pharmaceuticals narrative.

Another Angle: P/E Tells a Different Story

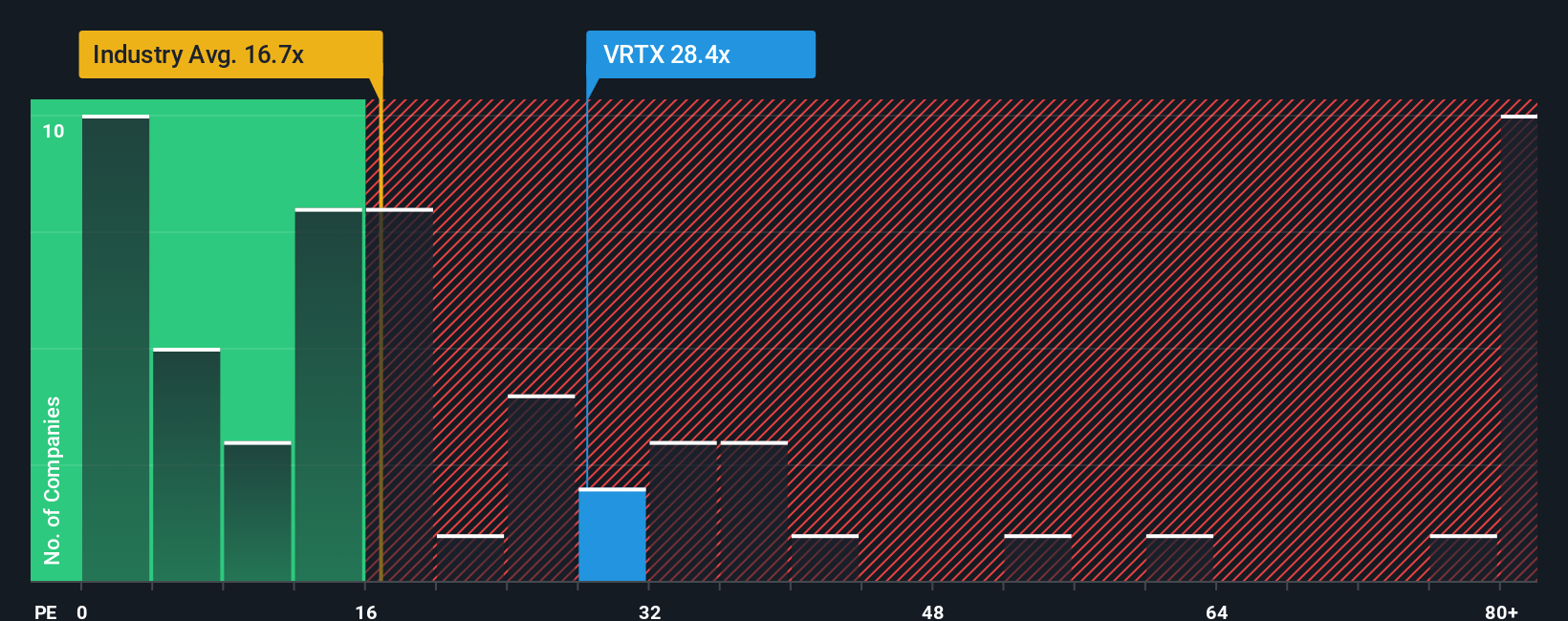

Our estimate suggests Vertex trades at a discount to fair value, yet the P/E ratio of 31.2x is higher than the US Biotechs industry at 21.1x and above the 28.6x fair ratio. That mix of apparent discount and richer multiple raises a simple question: which signal do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vertex Pharmaceuticals Narrative

If you see the numbers differently, or prefer to test your own assumptions against the data, you can build a complete view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vertex Pharmaceuticals.

Looking for more investment ideas?

If you only stop at one company, you risk missing other opportunities that fit your style and goals, so broaden your view before making your next move.

- Target potential bargains by scanning these 870 undervalued stocks based on cash flows that align with your expectations on cash flows and quality.

- Spot fast movers early by checking out these 3564 penny stocks with strong financials that already meet basic financial strength checks.

- Tap into powerful tech trends through these 25 AI penny stocks that link artificial intelligence themes with listed companies you can research in detail.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报