Veracyte (VCYT) Valuation Check As Share Price Momentum And Earnings Outlook Diverge

Why Veracyte Is On Investors’ Radar Today

Veracyte (VCYT) has been drawing fresh attention after recent share price moves, with the stock recording mixed short term returns and a stronger performance over the past 3 months compared with the recent month.

In this context, investors are revisiting the company’s diagnostics-focused business, its current valuation signals, and whether recent price action aligns with Veracyte’s underlying revenue and net income profile.

See our latest analysis for Veracyte.

Veracyte’s share price has cooled in the past month, with a 30 day share price return of a 4.98% decline. However, momentum over the last quarter remains positive with a 90 day share price return of 22.48%. The 3 year total shareholder return of 83.82% contrasts with a 1 year total shareholder return showing a 2.35% decline, suggesting longer term holders have seen stronger results than more recent investors.

If Veracyte’s diagnostics story has caught your attention, it can be helpful to see what else is moving in healthcare, including healthcare stocks as potential next ideas to research.

With Veracyte trading at $42.39, an indicated 31.22% intrinsic discount and revenue of $495.141m supporting net income of $30.317m, is the market underestimating its diagnostics business or is it already pricing in future growth?

Most Popular Narrative Narrative: 10.8% Undervalued

With Veracyte last closing at $42.39 against a narrative fair value of $47.50, the gap between price and assumptions is grabbing attention.

Pipeline momentum with five major product launches and a pivotal clinical study completing in the next 18 months positions Veracyte to further diversify revenue, drive cross-selling, penetrate new markets, and significantly expand addressable markets, supporting long-term topline acceleration. Continued market penetration and share gains for Decipher Prostate, including expansion into metastatic and high-risk segments, are associated with outsized growth, with robust clinical evidence and guideline inclusions cited as factors that could drive further physician adoption and payer coverage, potentially bolstering both revenues and earnings visibility.

Curious what has to happen for that valuation gap to close? The narrative focuses on faster earnings growth, richer margins, and a premium future earnings multiple. The exact hurdles might surprise you.

Result: Fair Value of $47.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story can change quickly if payer coverage for key tests like Decipher or Afirma falls short, or if rival genomic platforms gain share faster than expected.

Find out about the key risks to this Veracyte narrative.

Another View On Veracyte’s Valuation

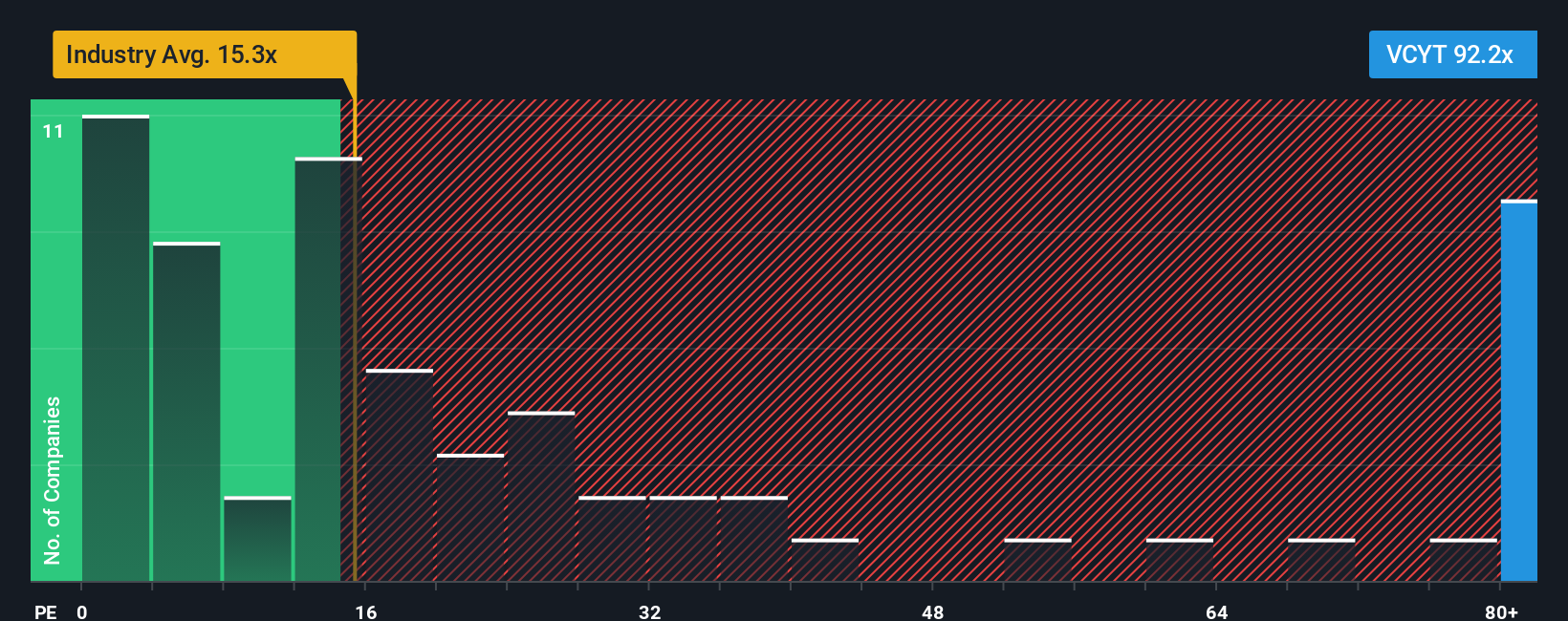

The earlier narrative leans on long term earnings power and a fair value of $47.50, with Veracyte also trading at a 31.2% discount to an intrinsic estimate of $61.63. Yet the current P/E of 110.5x is far higher than the US Biotechs average of 21.1x, the peer average of 33.1x, and a fair ratio of 23.9x. This points to a lot of optimism already in the price and raises the question of whether this is a genuine value gap or simply a richer story that requires multiple factors to work out positively.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Veracyte Narrative

If parts of this story do not quite fit your view, or you prefer to weigh the numbers yourself, you can pull the key data, stress test your own assumptions, and publish a custom view of Veracyte in just a few minutes, all by using Do it your way.

A great starting point for your Veracyte research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Veracyte is on your watchlist, do not stop there. Casting a wider net across high potential themes can help you spot opportunities others miss.

- Target dependable income by scanning these 14 dividend stocks with yields > 3% that may suit a portfolio focused on regular cash returns.

- Ride long term technology shifts by researching these 25 AI penny stocks shaping how artificial intelligence reaches everyday products and services.

- Hunt for mispriced opportunities by reviewing these 870 undervalued stocks based on cash flows where current prices differ from underlying cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报