A Look At Ameren (AEE) Valuation As New Earnings Growth Outlook And Analyst Targets Emerge

Ameren (AEE) shares are back in focus after the utility set new long term earnings growth guidance of 6% to 8% a year from 2025 through 2029, alongside refreshed analyst views.

See our latest analysis for Ameren.

The refreshed guidance comes after a period where Ameren’s share price has been relatively steady near $100.86, with short term momentum mixed but a 1 year total shareholder return of 19.51% pointing to more supportive longer term sentiment.

If Ameren’s update has you thinking about where regulated utilities sit in your portfolio, it could be a good moment to broaden your search with fast growing stocks with high insider ownership.

With Ameren trading around $100.86, which represents a 10.66% discount to the average analyst price target of $111.62 and an intrinsic value estimate that sits above the current price, you have to ask whether this is a genuine opening or if the market is already incorporating that 6% to 8% earnings growth guidance.

Most Popular Narrative: 10% Undervalued

With Ameren closing at $100.86 and the most followed narrative pointing to fair value around $111.62, the gap comes down to how you see its long run earnings profile and regulatory backdrop.

Ongoing and future investments in grid modernization, resilience (e.g., smart substations, composite poles, automation), and clean energy resources (wind, solar, batteries) are expected to expand Ameren's regulated rate base at a forecasted 9.2% CAGR. This is cited as a factor that could enable higher allowed returns and improved net margins. Strong, constructive regulatory relationships and approval of new rate structures (such as the proposed large load rate for data centers) are described as providing cost recovery certainty, minimizing earnings volatility, and supporting predictable long term earnings and dividend growth.

Curious what sits behind that fair value call? Revenue climbing steadily, margins edging higher, and a future earnings multiple that leans richer than many integrated utilities. The real tension is how much growth from large load demand and electrification is assumed in those numbers, and what that means for the price you see today.

Result: Fair Value of $111.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, those assumptions rely heavily on data center demand materializing as planned, and on continued regulatory and tax credit support, which could shift and challenge this upbeat story.

Find out about the key risks to this Ameren narrative.

Another View on Valuation

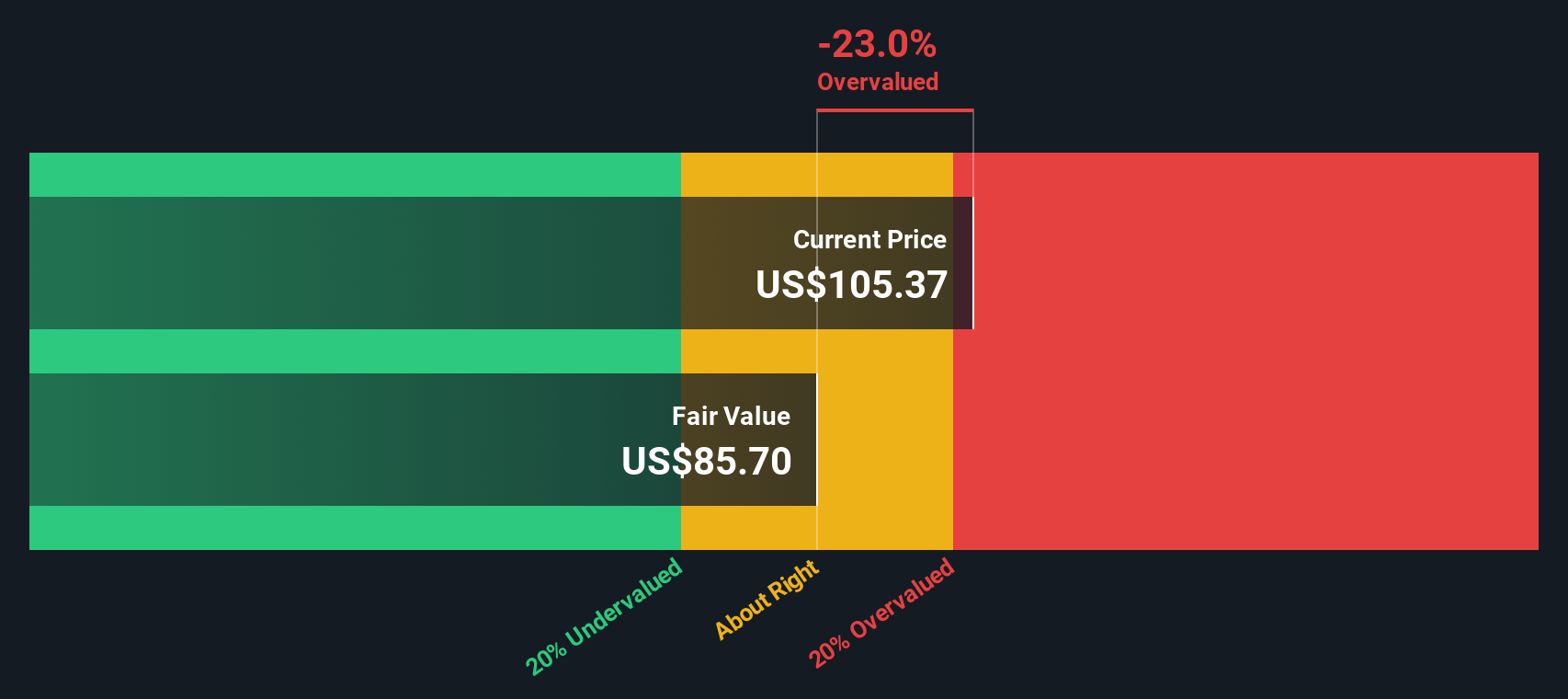

Our DCF model presents a different view from the narrative fair value of $111.62. Using this approach, Ameren at $100.86 appears overvalued relative to an estimated fair value of $88.10. This difference raises a straightforward question: which set of assumptions do you consider more reliable?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Ameren Narrative

If you see the numbers differently or prefer to dig into the data yourself, you can build a fresh view in minutes with Do it your way.

A great starting point for your Ameren research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Ameren has you thinking harder about where to put your next dollar, do not stop here. Broaden your watchlist with a few focused stock themes.

- Target income potential by reviewing these 14 dividend stocks with yields > 3% that might help you build a more reliable stream of payouts across sectors.

- Back future growth themes by checking out these 25 AI penny stocks that are tied to artificial intelligence demand across software, hardware, and infrastructure.

- Hunt for price gaps by scanning these 870 undervalued stocks based on cash flows that screens for companies trading below their estimated cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报