Global Undervalued Small Caps With Insider Action For January 2026

As we enter 2026, global markets are navigating a complex landscape characterized by mixed performances across major indices and shifting economic indicators. The U.S. saw a decline in stock indexes during the holiday-shortened week, while Europe experienced gains buoyed by an improving economic backdrop, highlighting the diverse challenges and opportunities facing small-cap stocks worldwide. In this environment, identifying promising small-cap stocks involves looking for those with strong fundamentals that can capitalize on current market dynamics and insider actions that may signal confidence in their future potential.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Tokmanni Group Oyj | 12.5x | 0.3x | 44.69% | ★★★★★☆ |

| Norcros | 14.5x | 0.8x | 38.14% | ★★★★☆☆ |

| Eurocell | 16.4x | 0.3x | 39.75% | ★★★★☆☆ |

| Eastnine | 12.1x | 7.6x | 49.13% | ★★★★☆☆ |

| Chinasoft International | 21.4x | 0.7x | -1191.47% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.02% | ★★★★☆☆ |

| Senior | 26.4x | 0.8x | 21.89% | ★★★★☆☆ |

| PSC | 10.1x | 0.4x | 17.62% | ★★★☆☆☆ |

| SmartCraft | 41.5x | 7.5x | 33.90% | ★★★☆☆☆ |

| CVS Group | 47.7x | 1.3x | 23.69% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Yubico (OM:YUBICO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Yubico is a company that specializes in security software and services, with a market capitalization of SEK 11.52 billion.

Operations: The company's primary revenue stream is from Security Software & Services, with a notable gross profit margin reaching 81.57% by the end of 2024. Operating expenses have shown fluctuations, with significant allocations towards Sales & Marketing and R&D. Net income margins varied over the periods, peaking at 17.75% in mid-2023 before experiencing a decline to around 10.36% by late 2025.

PE: 26.6x

Yubico, a company known for its cybersecurity solutions like YubiKeys, is capturing attention as an undervalued stock. Despite recent earnings showing a dip with Q3 sales at SEK 547.5 million and net income at SEK 64.2 million, insider confidence is evident with Mattias Danielsson purchasing 260,000 shares worth approximately SEK 35.37 million in the past year. The company's strategic partnerships and expanded retail presence bolster its growth potential amid volatile share prices and reliance on external funding sources.

- Delve into the full analysis valuation report here for a deeper understanding of Yubico.

Evaluate Yubico's historical performance by accessing our past performance report.

Bukit Sembawang Estates (SGX:B61)

Simply Wall St Value Rating: ★★★☆☆☆

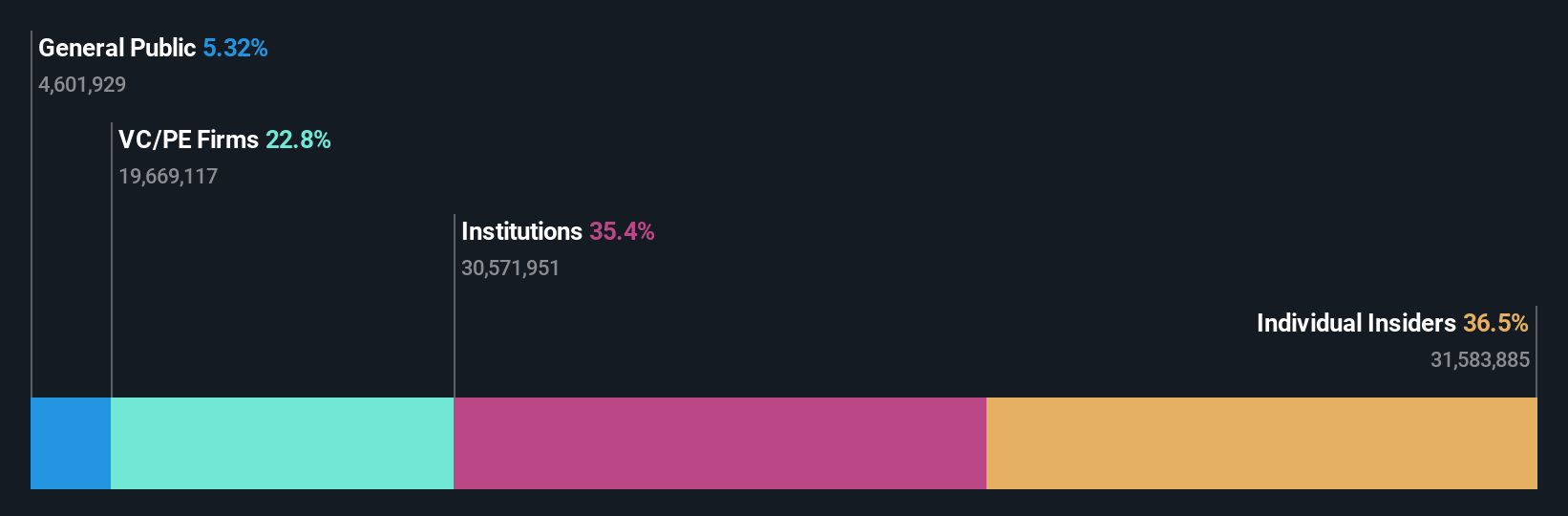

Overview: Bukit Sembawang Estates is a Singapore-based company primarily engaged in property development, with a market capitalization of approximately SGD 1.33 billion.

Operations: The primary revenue stream is property development, contributing significantly to its total revenue. The company has experienced fluctuations in gross profit margin, with recent figures showing a decrease to 13.39% as of September 2023 and a slight increase to 21.30% by December 2024. Operating expenses have generally remained stable over time, with general and administrative expenses being a consistent component.

PE: 12.6x

Bukit Sembawang Estates, a smaller company in the real estate sector, recently reported a drop in sales to S$130.24 million for the half-year ending September 2025, down from S$324.02 million the previous year. Despite this decline, insider confidence is evident with significant share purchases over recent months. The company's reliance on external borrowing poses risks; however, revenue growth is projected at 12.64% annually despite an anticipated earnings decline of 2.1% per year over the next three years.

- Get an in-depth perspective on Bukit Sembawang Estates' performance by reading our valuation report here.

Explore historical data to track Bukit Sembawang Estates' performance over time in our Past section.

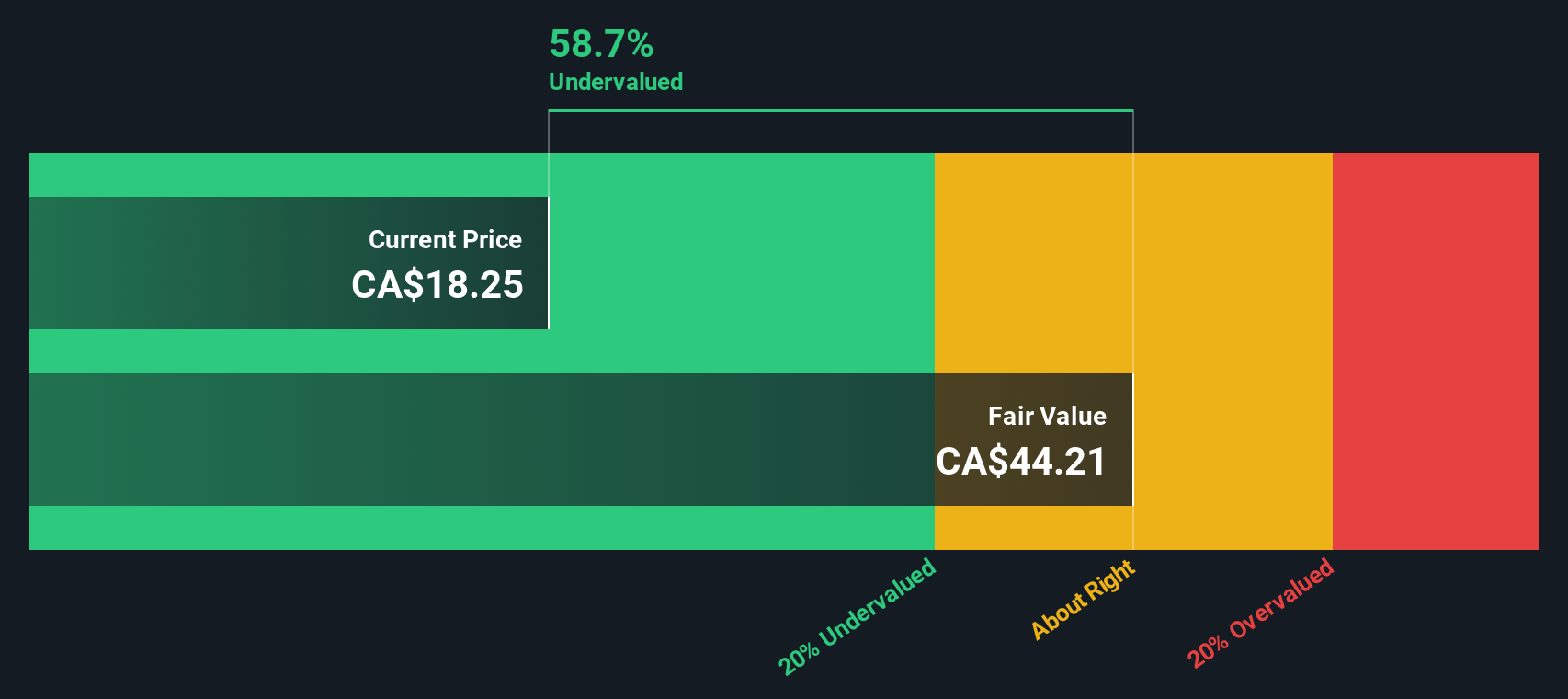

Flagship Communities Real Estate Investment Trust (TSX:MHC.UN)

Simply Wall St Value Rating: ★★★★★☆

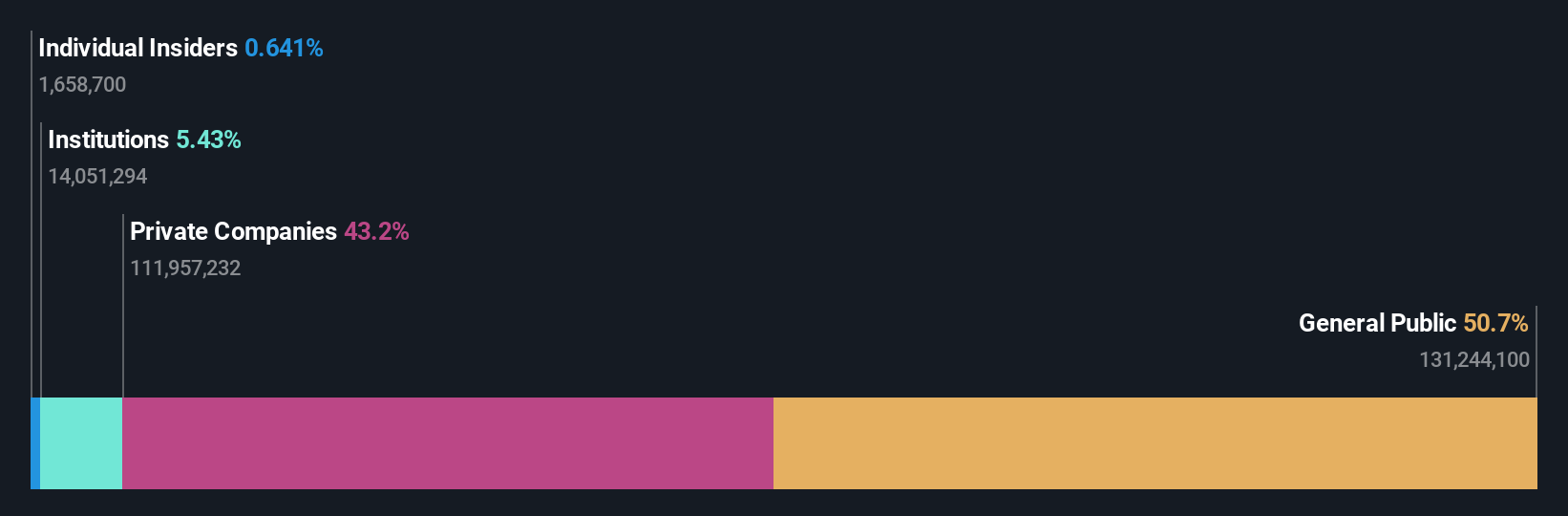

Overview: Flagship Communities Real Estate Investment Trust operates in the residential real estate sector, focusing on manufactured housing communities, with a market cap of C$0.54 billion.

Operations: The company's primary revenue stream is from residential real estate, with the latest reported revenue at $99.69 million. The gross profit margin has shown variability, reaching up to 66.92% in recent periods. Operating expenses have increased over time, impacting overall profitability, while non-operating expenses have fluctuated significantly across different periods.

PE: 4.1x

Flagship Communities Real Estate Investment Trust, a smaller player in the real estate sector, has shown insider confidence with share purchases over recent months. Despite anticipated earnings decline of 47.3% annually over three years, revenue is projected to grow by 9.17% per year. Recent acquisitions worth US$79 million in Indiana and Ohio aim to boost occupancy and expansion potential, aligning with their strategy of enhancing under-performing properties. However, reliance on external borrowing poses funding risks.

Taking Advantage

- Unlock our comprehensive list of 145 Undervalued Global Small Caps With Insider Buying by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报