Reassessing Viasat (VSAT) Valuation As Recent Momentum Meets Conflicting Fair Value Signals

Viasat (VSAT) has drawn fresh attention after recent share price moves, with the stock last closing at $37.63. Investors are weighing this performance against its communications business mix and current profitability profile.

See our latest analysis for Viasat.

That 9.2% 1 day share price return sits on top of a 20.3% 90 day share price return and a very large 1 year total shareholder return. Together these figures suggest momentum has been building as investors reassess Viasat’s risk and growth profile.

If Viasat’s recent move has caught your eye and you want to see what else is happening in communications and defense, take a look at aerospace and defense stocks.

With Viasat trading around $37.63, sitting close to the average analyst price target yet showing a very large 1 year total shareholder return, you have to ask yourself whether this is a genuine mispricing or whether the market is already pricing in future growth.

Most Popular Narrative: 3.8% Overvalued

With Viasat last closing at $37.63 against a narrative fair value of $36.25, the current price sits slightly above that long term estimate and puts more focus on what is driving that gap.

The analysts have a consensus price target of $24.286 for Viasat based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $52.0, and the most bearish reporting a price target of just $10.0.

Curious how a modest revenue growth outlook, a step change in profit margins and a lower future earnings multiple still land on this fair value? The earnings bridge, margin reset and discount rate work together in a way that is not obvious from the headline target. If you want to see how those pieces fit, the full narrative spells out the assumptions in detail.

Result: Fair Value of $36.25 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you also need to consider ongoing heavy ViaSat-3 and Inmarsat spending, as well as subscriber declines in U.S. fixed broadband, which could pressure cash flow and margins.

Find out about the key risks to this Viasat narrative.

Another View: Market Pricing Versus DCF

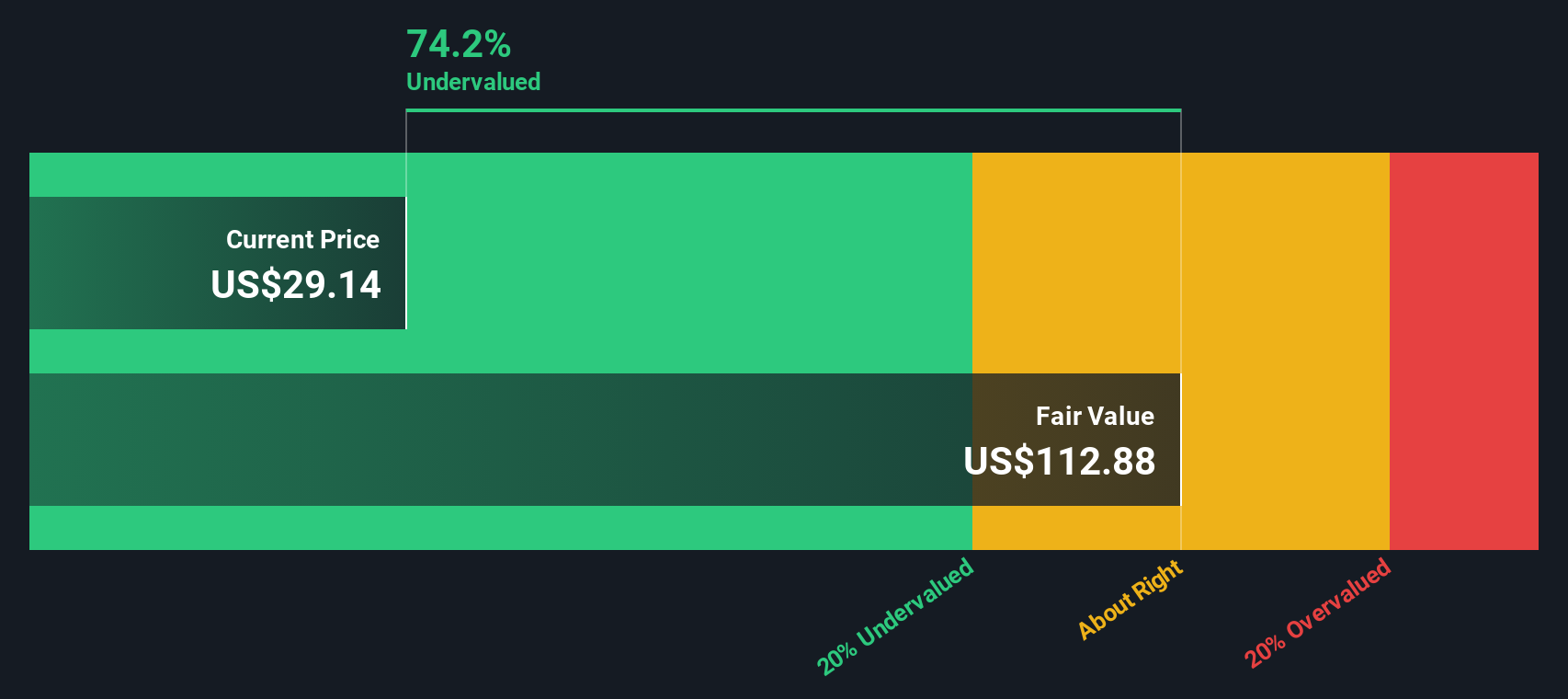

While the consensus narrative points to Viasat trading about 3.8% above its $36.25 fair value, our DCF model presents a very different picture. On that view, the current $37.63 price is around 64% below an estimated fair value of $104.87. This raises an obvious question: which lens do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Viasat Narrative

If you look at these numbers and come to a different conclusion, or simply prefer building your own view from the ground up, you can shape a fresh Viasat story in just a few minutes with Do it your way.

A great starting point for your Viasat research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Viasat has you thinking more broadly about your portfolio, it is worth widening the net and seeing what else the market has to offer right now.

- Spot potential value opportunities by scanning these 867 undervalued stocks based on cash flows, where cash flow focused metrics help you quickly filter for candidates that fit your criteria.

- Ride major tech shifts by checking out these 25 AI penny stocks, highlighting companies exposed to artificial intelligence themes across different parts of the market.

- Target higher income potential with these 14 dividend stocks with yields > 3%, focusing on businesses that currently offer dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报