A Look At Fifth Third (FITB) Valuation As Investor Interest Builds On Recent Share Performance

Why Fifth Third Bancorp is on investors’ radar today

Fifth Third Bancorp (FITB) has attracted fresh attention after recent share price moves, with the stock closing at $47.71. Investors are weighing that level against its recent returns and fundamentals.

See our latest analysis for Fifth Third Bancorp.

The 1 day share price return of 1.92% and 30 day share price return of 5.04% sit alongside a 1 year total shareholder return of 15.16%. The 3 and 5 year total shareholder returns of 57.49% and 83.01% suggest momentum has been building over time rather than fading.

If Fifth Third’s recent move has you thinking about what else is out there, it could be a useful moment to widen your search with fast growing stocks with high insider ownership.

With Fifth Third trading at $47.71 against a consensus price target of $52.31 and an indicated intrinsic discount of about 49%, investors may question whether this represents genuine value or if the market is already pricing in stronger growth.

Most Popular Narrative Narrative: 7.3% Undervalued

At a last close of $47.71 versus a narrative fair value of $51.46, the widely followed view sees modest upside and builds a detailed earnings path behind it.

Expansion and densification in fast-growing Southeast markets, supported by accelerated branch openings and direct marketing initiatives, are expected to drive sustained loan and deposit growth in regions benefiting from robust economic and population increases. This is expected to contribute to higher revenue and market share over time.

For readers interested in what underpins that growth story, and how it is translated into higher earnings and a richer P/E multiple over time, the full narrative lays out the revenue build, margin pressures, share count assumptions and the discount rate that together support that fair value line.

Result: Fair Value of $51.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you also need to weigh that story against risks such as slower commercial loan demand and integration challenges related to the planned Comerica deal.

Find out about the key risks to this Fifth Third Bancorp narrative.

Another View: What the P/E Ratio Is Saying

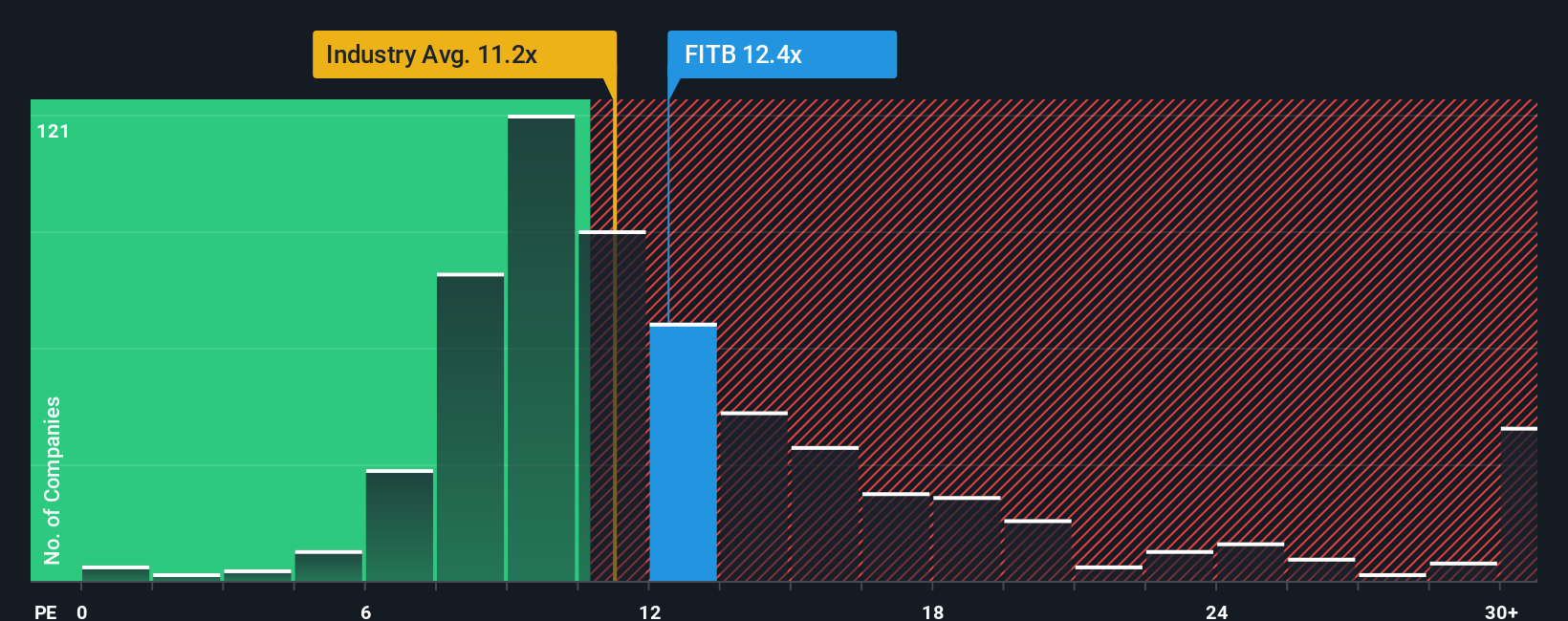

So far the story leans on fair value estimates and analyst narratives. If you just look at the P/E, though, Fifth Third trades at about 14x earnings, higher than the US Banks industry at 11.8x but below its peer average of 15.4x and the fair ratio of 19.9x.

That mix of slightly richer pricing than the broader industry, but cheaper than peers and the fair ratio, hints at both some valuation risk and some potential opportunity. The key question is whether earnings will justify the market moving closer to that 19.9x fair ratio or staying anchored near today’s 14x.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fifth Third Bancorp Narrative

If you see the numbers differently or prefer to lean on your own work, you can build a fresh view in just a few minutes using Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Fifth Third Bancorp.

Looking for more investment ideas?

If Fifth Third has sharpened your thinking, do not stop here. Broaden your watchlist with focused stock ideas that match the kind of opportunities you care about most.

- Target potential deep value opportunities by zeroing in on these 874 undervalued stocks based on cash flows that the market may be pricing conservatively.

- Ride major tech shifts early by scanning these 25 AI penny stocks pushing artificial intelligence into real products and services.

- Build a reliable income stream by filtering for these 14 dividend stocks with yields > 3% that can add meaningful yield to your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报