Assessing First Solar (FSLR) Valuation After Intersect Power And AI Data Center Momentum

Why the Intersect Power partnership matters for First Solar

First Solar (FSLR) is back in focus after a partnership involving Alphabet backed Intersect Power highlighted its thin film modules in large scale solar and storage projects serving power hungry AI data centers.

The collaboration has drawn fresh attention to how First Solar’s technology is being used in utility scale clean energy, alongside ongoing support from U.S. government incentives for domestic solar manufacturing.

See our latest analysis for First Solar.

The Intersect Power news lands on top of a strong run, with a 90 day share price return of 20.38% and a 1 year total shareholder return of 43.43%, suggesting momentum has been building rather than fading.

If the Intersect Power deal has you thinking more broadly about clean energy and digital infrastructure, it could be a good moment to look at high growth tech and AI stocks as potential next candidates for your watchlist.

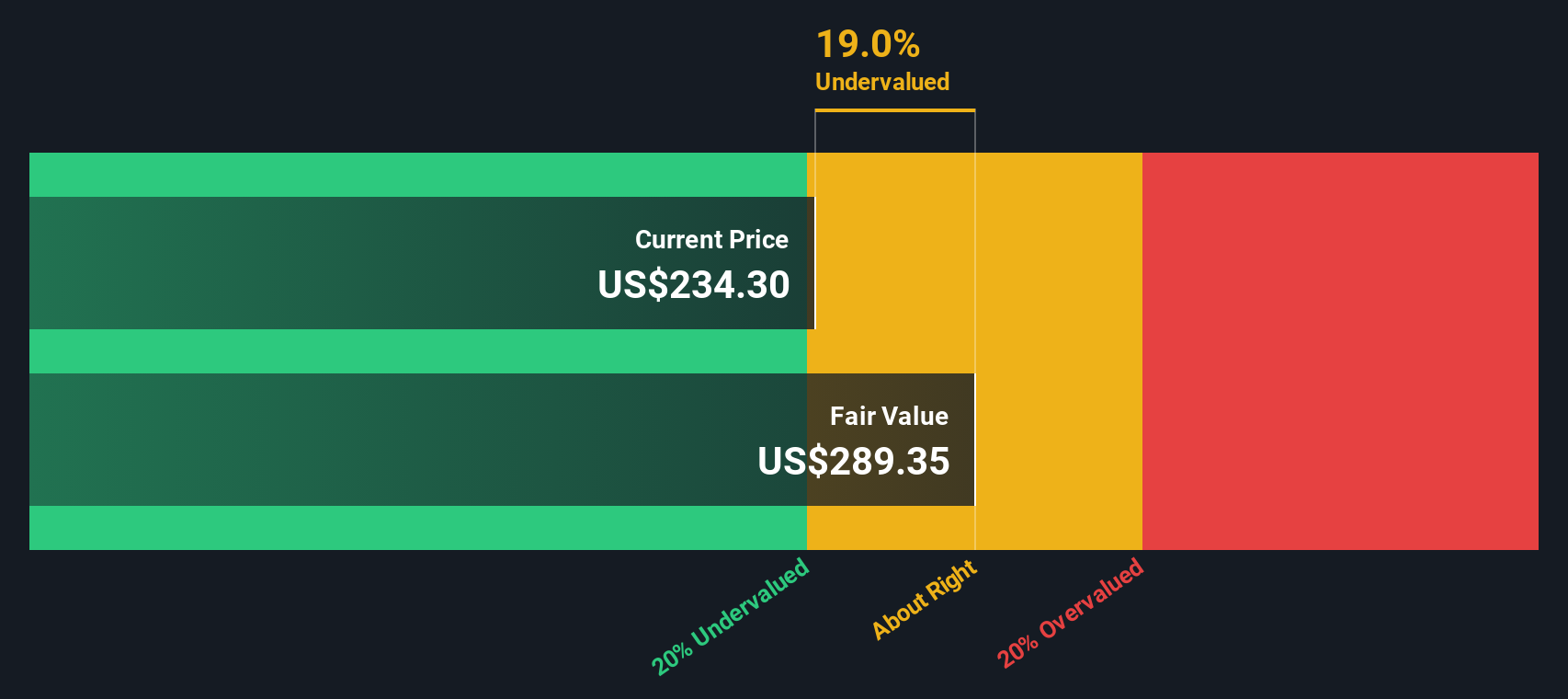

With First Solar trading near its analyst price target and showing solid recent returns, the key question now is whether its US$274.34 share price still reflects a discount to intrinsic value, or if the market is already pricing in future growth.

Most Popular Narrative: Fairly Valued

Compared with First Solar’s last close at US$274.34, the most followed narrative pegs fair value at about US$271.61, putting market price and model output very close together while still leaning on detailed long term cash flow assumptions.

The steadily growing, visibility rich contracted backlog (currently at $18.5 billion and 64 GW, with price adjusters for tech milestones and tariffs) provides stability against industry volatility. This allows consistent revenue recognition and helps mitigate net margin compression, even amid cyclical and policy driven swings in global solar markets.

Curious what kind of revenue path and margin profile could justify that fair value with only a small gap to today’s price? The narrative leans heavily on compounding earnings, richer profitability and a future earnings multiple that is very different from where many peers sit today. Want to see exactly how those moving parts are stitched together into one valuation story?

Result: Fair Value of $271.61 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there is still a real risk that policy support for clean energy is scaled back and that tariffs or contract disputes pressure margins and cash flow.

Find out about the key risks to this First Solar narrative.

Another View: Market Comparisons Paint A Different Picture

Our DCF model suggests First Solar shares are trading at about a 16% discount to an estimated fair value of roughly US$326.71, while the most followed narrative sits close to today’s market price. Two thoughtful models, two different answers, and a clear question for you: which one feels more realistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own First Solar Narrative

If you look at the numbers and reach a different conclusion, or just prefer to test your own assumptions directly, you can build a personalized view in minutes with Do it your way.

A great starting point for your First Solar research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas beyond First Solar?

If you are serious about building a stronger watchlist, do not stop at a single stock. Cast a wider net now so you are not reacting after the fact.

- Target potential mispricing by scanning these 875 undervalued stocks based on cash flows that align with your view on cash flows and margin strength.

- Zero in on income potential by reviewing these 14 dividend stocks with yields > 3% that may offer yields above 3% with different risk profiles.

- Get ahead of the next wave of AI driven demand by checking out these 25 AI penny stocks that link computing power, data, and real world cash generation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报