Discover UK Penny Stocks: James Cropper And Two More Compelling Picks

The UK stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting the interconnectedness of global economies. In such a climate, investors often seek opportunities in lesser-known areas like penny stocks—companies that may offer unique value and growth potential despite their smaller size or newer presence in the market. While the term 'penny stocks' might seem outdated, these investments can still be relevant when backed by strong financials and strategic positioning.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.265 | £489.8M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.94 | £156.73M | ✅ 4 ⚠️ 2 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.75 | £133.18M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £1.135 | £17.14M | ✅ 2 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.71 | $412.74M | ✅ 4 ⚠️ 2 View Analysis > |

| Michelmersh Brick Holdings (AIM:MBH) | £0.865 | £78.43M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.53 | £185.3M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.525 | £73.63M | ✅ 3 ⚠️ 2 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.465 | £40.08M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.16 | £186.68M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 293 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

James Cropper (AIM:CRPR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: James Cropper PLC is a company that manufactures and sells paper products and advanced materials, with a market cap of £38.03 million.

Operations: James Cropper PLC has not reported any specific revenue segments.

Market Cap: £38.03M

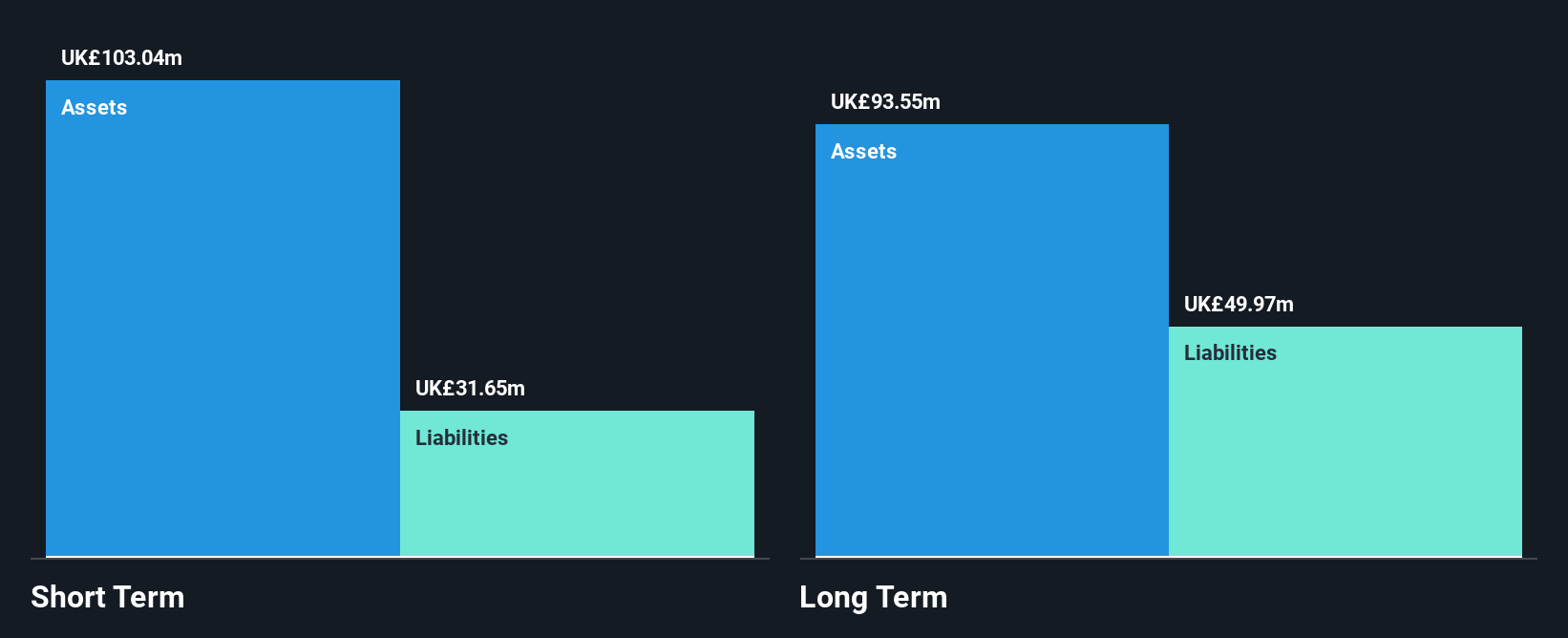

James Cropper PLC, with a market cap of £38.03 million, has shown some financial resilience despite being unprofitable. The company reported half-year sales of £51.76 million and a net income of £2.04 million, marking an improvement from a previous loss. Although it trades at a significant discount to its estimated fair value and maintains stable short-term asset coverage over liabilities, its debt levels have risen significantly over the past five years. The board and management are experienced, but the stock remains volatile compared to peers in the UK market.

- Navigate through the intricacies of James Cropper with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into James Cropper's future.

Serica Energy (AIM:SQZ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Serica Energy plc, with a market cap of £703.52 million, operates in the United Kingdom where it identifies, acquires, and exploits oil and gas reserves.

Operations: The company generates revenue of $570.52 million from its oil and gas exploration, development, production, and related activities.

Market Cap: £703.52M

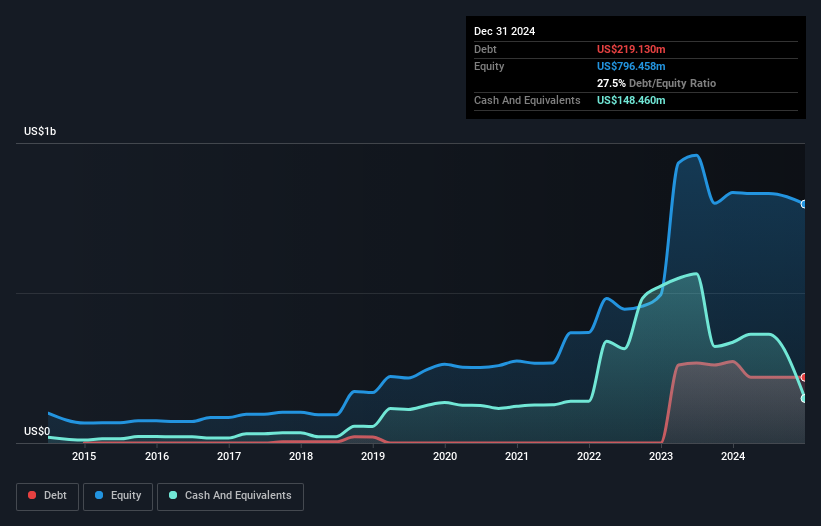

Serica Energy, with a market cap of £703.52 million, faces challenges despite its revenue generation of US$570.52 million from oil and gas activities. Recent production disruptions due to technical issues on the Triton FPSO have impacted output levels, though operations have resumed at reduced capacity. The acquisition of a 40% stake in the P2530 Licence enhances its growth prospects but awaits regulatory approval. Financially, Serica's short-term assets cover liabilities, yet it remains unprofitable with negative return on equity and unsustainable dividend coverage by earnings or cash flow. Its management team is relatively inexperienced but has not diluted shareholders recently.

- Dive into the specifics of Serica Energy here with our thorough balance sheet health report.

- Examine Serica Energy's earnings growth report to understand how analysts expect it to perform.

Focusrite (AIM:TUNE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Focusrite plc develops, manufactures, and markets professional audio and electronic music products globally, with a market cap of £140.82 million.

Operations: The company's revenue is primarily derived from its Focusrite Novation segment at £85.16 million, followed by Audio Reproduction at £45.88 million, ADAM Audio at £25.58 million, Sequential at £9.84 million, and Sonnox contributing £2.46 million.

Market Cap: £140.82M

Focusrite plc, with a market cap of £140.82 million, has shown promising financial performance with earnings growing by 105.8% over the past year and net profit margins improving to 3.2%. Despite trading at 26.1% below its estimated fair value, the company benefits from a seasoned management team and board of directors, averaging tenures of 7.6 and 8.3 years respectively. The company's debt is well covered by operating cash flow (73.8%), though its debt-to-equity ratio has risen slightly over five years to 25.7%. Recent dividend affirmations reflect stable financial health amidst improved earnings per share from continuing operations (£0.092).

- Take a closer look at Focusrite's potential here in our financial health report.

- Assess Focusrite's future earnings estimates with our detailed growth reports.

Key Takeaways

- Explore the 293 names from our UK Penny Stocks screener here.

- Ready To Venture Into Other Investment Styles? These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报