Assessing Triple Flag Precious Metals (TSX:TFPM) Valuation After Recent Share Price Weakness

Why Triple Flag Precious Metals is on investors’ radar today

Triple Flag Precious Metals (TSX:TFPM) has drawn attention after recent share price moves, with a 1 day decline of 1.47% and a modest negative return over the past month, contrasting with gains over the past 3 months.

See our latest analysis for Triple Flag Precious Metals.

At a share price of CA$44.94, Triple Flag Precious Metals has recently given back some ground, with a 1 day share price return of a 1.47% decline and a 7 day share price return that is also slightly negative. Its 3 month share price return of 7.28% sits against a much stronger 1 year total shareholder return of 107.97% and a 3 year total shareholder return of 150.49%, which suggests earlier optimism has cooled a little in the very short term as investors reassess growth prospects and risk around the streaming and royalty portfolio.

If this kind of move has you looking beyond precious metals, it could be a good moment to broaden your watchlist with fast growing stocks with high insider ownership.

With Triple Flag Precious Metals trading at CA$44.94 alongside an indicated 11% intrinsic discount and analyst targets pointing higher, it raises the question of whether there is still value left or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 14.4% Undervalued

Against the last close of CA$44.94, the most followed narrative points to a higher fair value, built on a detailed view of Triple Flag Precious Metals' future cash generation and profitability.

Analysts expect earnings to reach $311.4 million (and earnings per share of $1.47) by about September 2028, up from $172.2 million today. The analysts are largely in agreement about this estimate.

Want to understand why a royalty company is being priced closer to growth stocks? The narrative leans heavily on rising margins, faster revenue expansion and a premium future earnings multiple. Curious which assumptions really drive that valuation gap?

Result: Fair Value of $52.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the upbeat story could unwind if production declines at key assets, or if acquisition driven growth compresses margins and weakens future earnings power.

Find out about the key risks to this Triple Flag Precious Metals narrative.

Another View on Triple Flag Precious Metals’ valuation

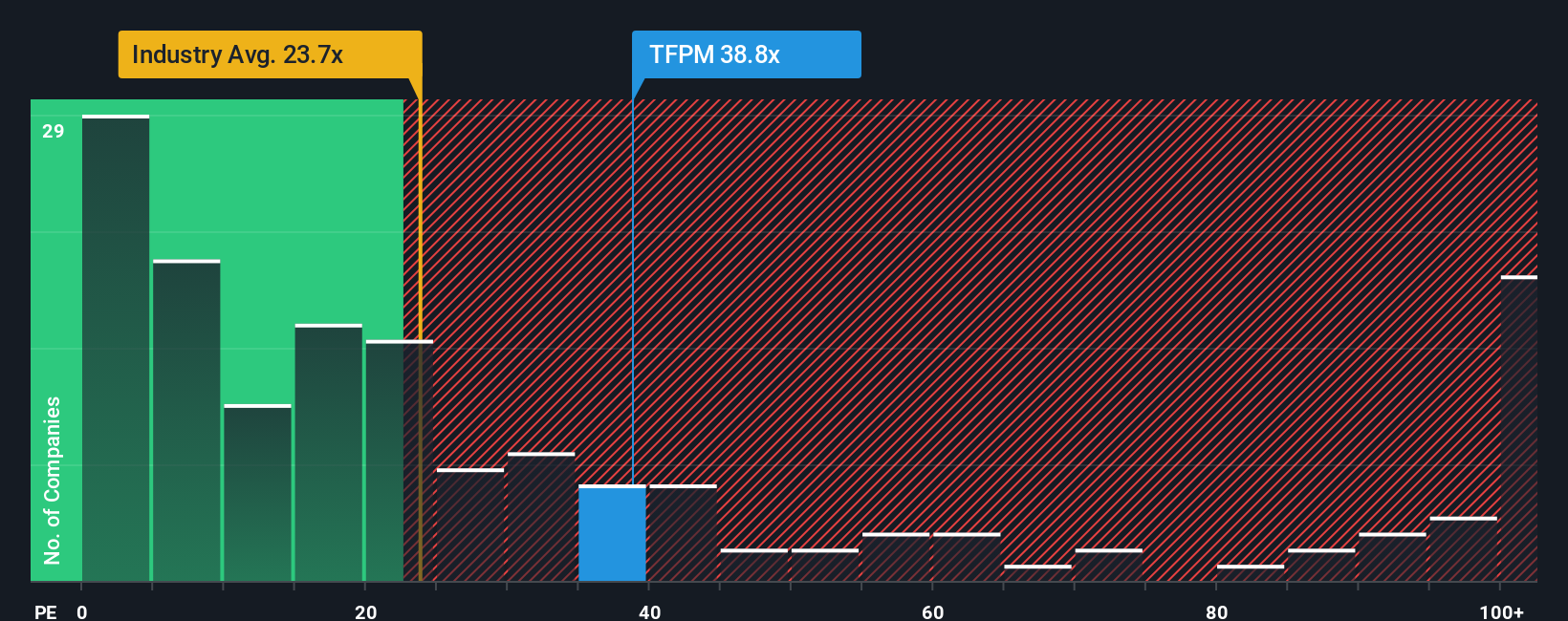

The narrative values Triple Flag Precious Metals at CA$52.52 using forward earnings and cash flow assumptions. Today the shares trade on a P/E of 33.1x versus a fair ratio of 20.5x, the Canadian Metals and Mining industry at 22.6x and peers at 21.2x. That rich gap suggests less room for error if growth or metal prices soften, so which signal do you trust more, the model or the market history?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Triple Flag Precious Metals Narrative

If you see the numbers differently, or prefer to test your own assumptions against the data, you can build a custom view in minutes: Do it your way.

A great starting point for your Triple Flag Precious Metals research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Triple Flag Precious Metals has caught your attention, do not stop here, broaden your watchlist so you are not missing other potential opportunities on your radar.

- Spot potential value plays early by checking out these 875 undervalued stocks based on cash flows that line up with your own expectations on cash flows and pricing.

- Ride the AI trend thoughtfully by scanning these 25 AI penny stocks that tie real businesses to this fast growing theme.

- Tap into high income ideas by reviewing these 14 dividend stocks with yields > 3% that could support a more reliable stream of portfolio returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报