European Penny Stocks To Consider In January 2026

As we enter 2026, the European market is experiencing a notable upswing, with the pan-European STOXX Europe 600 Index reaching new highs and closing 2025 with its strongest yearly performance since 2021. Amidst this positive economic backdrop, investors are increasingly exploring diverse opportunities within the stock market. Penny stocks, though often seen as remnants of past trading eras, continue to offer intriguing possibilities for those seeking affordable investments with growth potential. Today, we'll explore three European penny stocks that stand out for their financial robustness and potential in today's market landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.484 | €1.55B | ✅ 4 ⚠️ 3 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.73 | €84M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.31 | €226.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.16 | €67.03M | ✅ 3 ⚠️ 3 View Analysis > |

| Hultstrom Group (OM:HULT B) | SEK3.20 | SEK194.68M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.485 | €396.41M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.265 | €313.07M | ✅ 4 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0726 | €7.89M | ✅ 2 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.846 | €28.33M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 286 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Voltatron (DB:VOTR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Voltatron AG specializes in providing electronics and electromobility solutions for industrial applications both in Germany and internationally, with a market capitalization of approximately €97.94 million.

Operations: Voltatron AG has not reported any specific revenue segments.

Market Cap: €97.94M

Voltatron AG, with a market cap of €97.94 million, has shown improved financial performance recently, reporting a net income of €1.2 million for the nine months ended September 2025 compared to a loss the previous year. Despite being unprofitable overall, it maintains a positive cash flow and sufficient cash runway for over three years. However, its high volatility and short-term asset coverage issues pose risks. The company's board is relatively inexperienced with an average tenure under one year, and while its debt levels have increased over five years, it holds more cash than total debt.

- Dive into the specifics of Voltatron here with our thorough balance sheet health report.

- Gain insights into Voltatron's past trends and performance with our report on the company's historical track record.

MotorK (ENXTAM:MTRK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: MotorK plc offers software-as-a-service solutions for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union, with a market cap of €203.93 million.

Operations: The company generates €40.62 million in revenue from its Software & Programming segment.

Market Cap: €203.93M

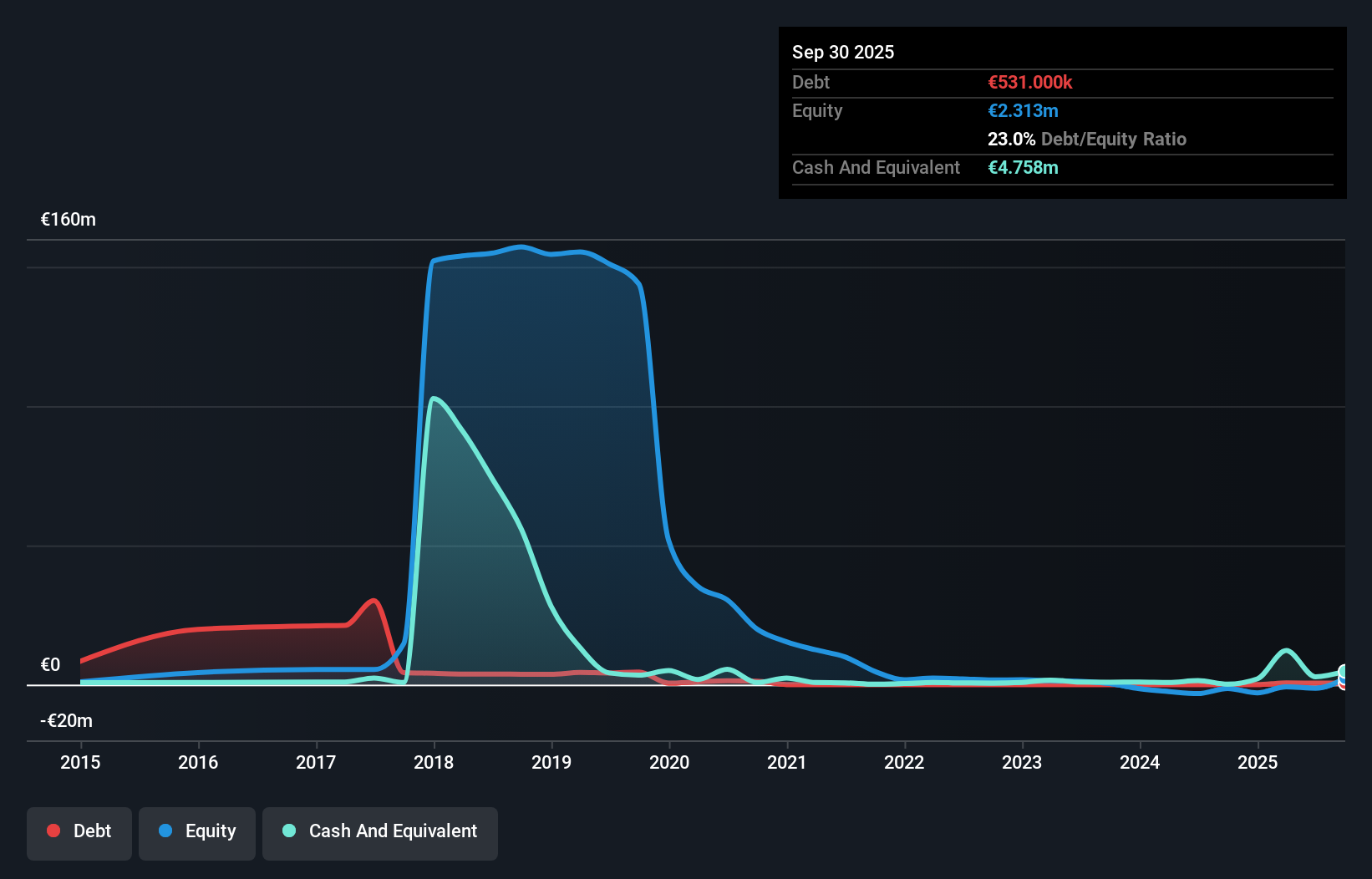

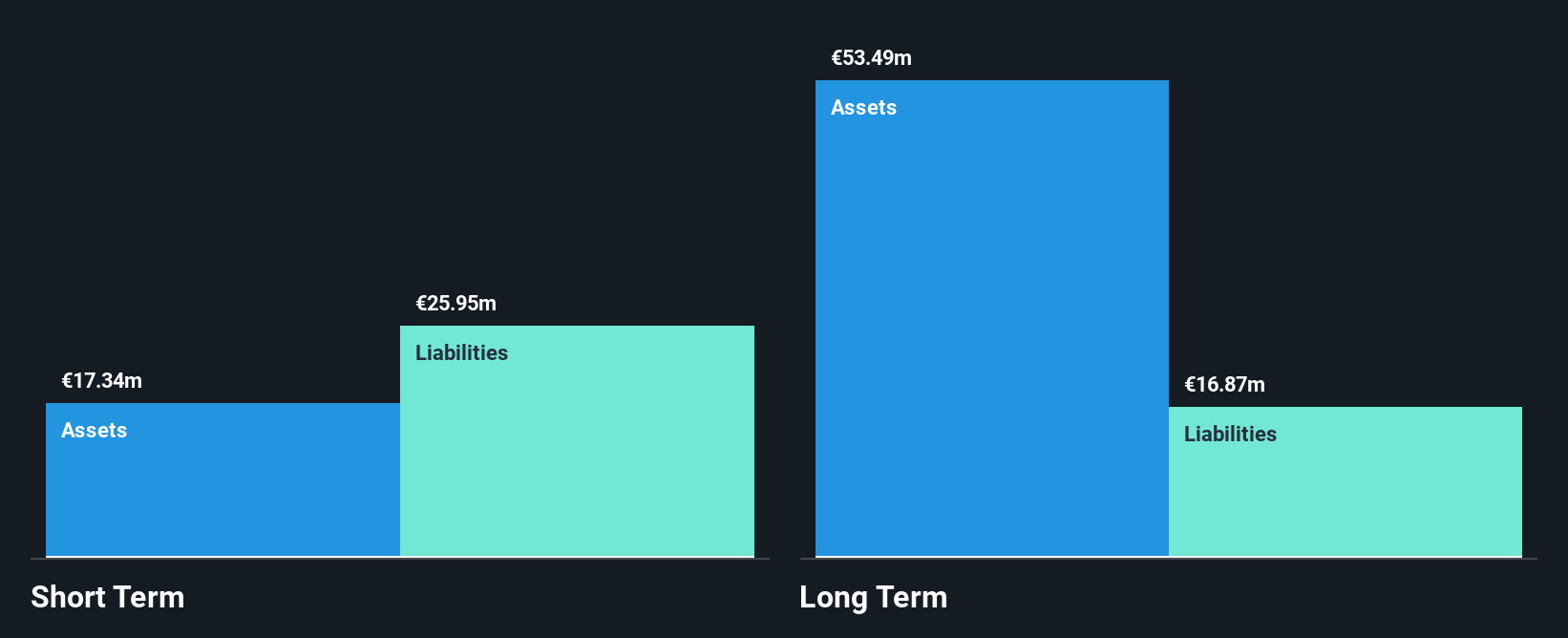

MotorK plc, with a market cap of €203.93 million, operates in the automotive retail software sector across several European countries. Despite being unprofitable and experiencing increased losses over the past five years, it has managed to significantly reduce its debt to equity ratio from very high levels. Recent funding of €3 million through private placements bolsters its cash position, although short-term assets still fall short of covering liabilities. The management team is relatively new with an average tenure under one year, while the board is more seasoned. Share price volatility remains higher than most Dutch stocks.

- Click to explore a detailed breakdown of our findings in MotorK's financial health report.

- Evaluate MotorK's prospects by accessing our earnings growth report.

KebNi (OM:KEBNI B)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: KebNi AB (publ) specializes in developing, producing, and selling stabilization, navigation, and satellite communication products globally with a market cap of SEK446.55 million.

Operations: The company's revenue primarily comes from its Unclassified Services segment, totaling SEK147.92 million.

Market Cap: SEK446.55M

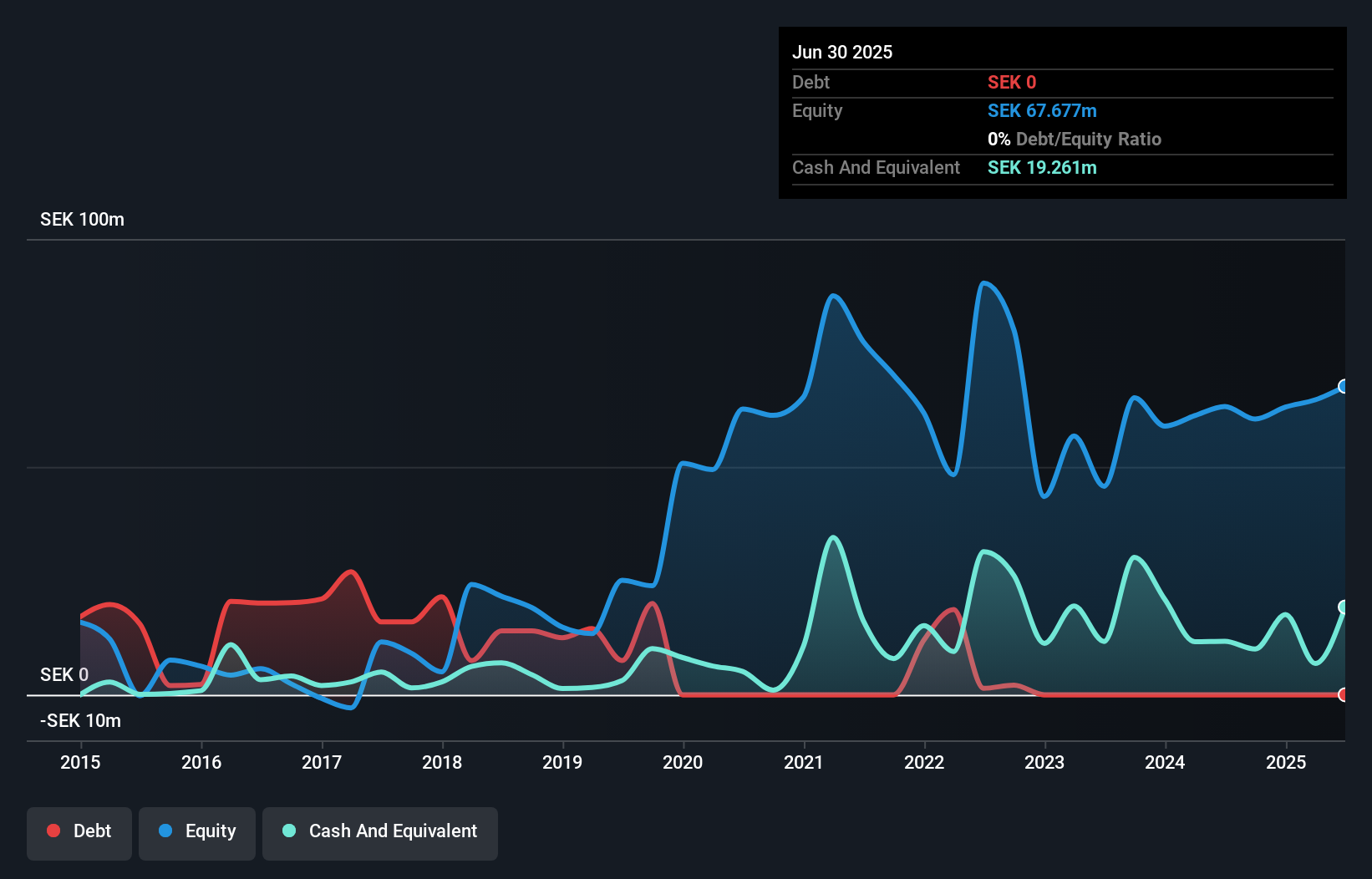

KebNi AB, with a market cap of SEK446.55 million, has shown significant financial improvement by becoming profitable over the past year. The company reported third-quarter revenue of SEK33.48 million, marking an increase from the previous year and achieving a net income of SEK0.938 million compared to a prior loss. Despite its low return on equity at 7.9%, KebNi's debt-free status and strong asset position provide financial stability, covering both short- and long-term liabilities comfortably. However, high share price volatility persists alongside an inexperienced board with an average tenure of 1.7 years despite experienced management at 3.9 years tenure.

- Click here and access our complete financial health analysis report to understand the dynamics of KebNi.

- Assess KebNi's future earnings estimates with our detailed growth reports.

Key Takeaways

- Navigate through the entire inventory of 286 European Penny Stocks here.

- Searching for a Fresh Perspective? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报