Thomson Reuters (TSX:TRI) Valuation Check As AI Investments And Acquisitions Lift Subscription Appeal

Thomson Reuters (TSX:TRI) is back in focus as investors reassess its recurring subscription model and the growing use of artificial intelligence across legal and tax platforms, along with recently integrated legal tech and risk intelligence acquisitions.

See our latest analysis for Thomson Reuters.

Recent trading has been weaker, with a 90 day share price return of a 17.83% decline and a 1 year total shareholder return of a 23.65% decline, despite multi year total shareholder returns of 16.51% over three years and 83.90% over five years. This suggests long term momentum has been stronger than the recent pullback.

If Thomson Reuters’ AI push has caught your attention, it could be a good moment to broaden your watchlist with other high growth tech and AI stocks that are reshaping information and software markets.

So with CA$7,376 million in revenue, CA$1,753 million in net income and recent share price weakness, is Thomson Reuters now trading at a discount, or is the market already pricing in its AI ambitions and future growth?

Most Popular Narrative: 34% Undervalued

At a last close of CA$173.66 compared with a narrative fair value of about CA$263 per share, Thomson Reuters is framed as materially underpriced, with that view hinging on how its AI led subscription model supports earnings and margins over time.

Investments in innovation and digital transformation including significant GenAI spend are producing operating leverage and capital efficiency. These investments, alongside continued focus on cloud migration and workflow automation, are expected to incrementally lift operating margins and support long-term earnings growth.

Want to see how recurring software style revenue, margin expansion and a premium future earnings multiple fit together in this story? The narrative leans on steady growth assumptions, a richer profit profile and a valuation multiple more often associated with higher growth peers. Curious which earnings and margin paths are used to justify that fair value and how sensitive it is to small changes in those inputs?

Result: Fair Value of CA$263.01 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if AI adoption stays slow or new legal tech competitors and in house tools compress pricing, the earnings and margin story behind that 34% discount could weaken.

Find out about the key risks to this Thomson Reuters narrative.

Another Angle: Price Tag Looks Full

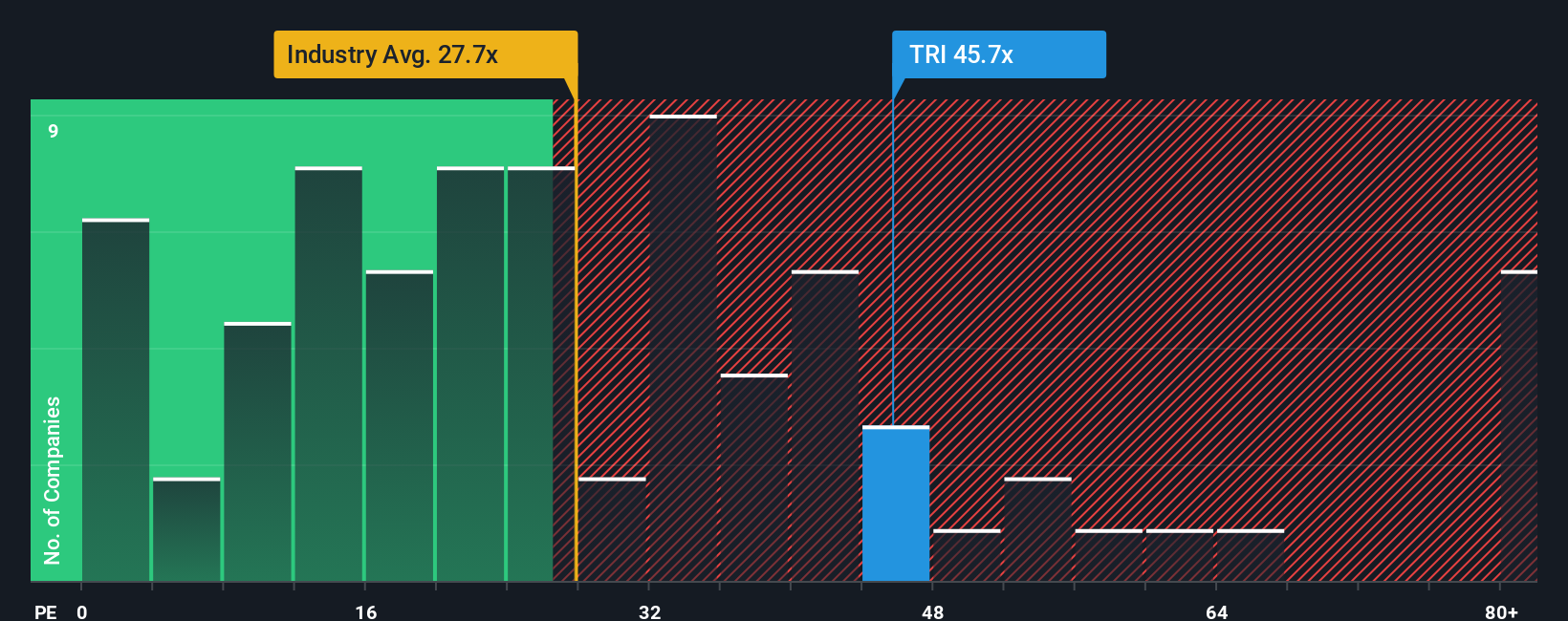

That 34% DCF style discount sits alongside a very different message from the P/E ratio. Thomson Reuters trades on about 32.2x earnings, compared with a peer average of 29x and a fair ratio of 29x, which points to an overvalued picture rather than a bargain. With earnings growth forecasts in single digits and return on equity at 14.9%, is the premium price a comfort or a risk for you?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Thomson Reuters Narrative

If you are not fully on board with this view or just prefer testing the assumptions yourself, you can build your own narrative in a few minutes: Do it your way.

A great starting point for your Thomson Reuters research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Thomson Reuters is already on your radar, do not stop there. Widen your opportunity set now so you are not relying on just one storyline.

- Target mispriced opportunities by scanning these 875 undervalued stocks based on cash flows that align with the kind of financial traits you want in your portfolio.

- Ride the AI momentum by focusing on these 25 AI penny stocks that are applying machine learning and automation to real revenue producing products.

- Secure potential income streams by filtering for these 14 dividend stocks with yields > 3% that suit your preferred yield and payout profile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报