Datavault AI (DVLT): Reassessing Valuation After Special Warrant Dividend Sparks Investor Interest

Datavault AI (DVLT) jumped into the spotlight after announcing a special dividend in the form of warrants, with January 7 set as the record date. The news sent the stock up more than 20%.

See our latest analysis for Datavault AI.

The warrant dividend has arrived after a bruising stretch, with a 90 day share price return of minus 51.44 percent and a one year total shareholder return of minus 54.30 percent. This week’s sharp bounce hints at shifting sentiment rather than a confirmed turnaround.

If Datavault AI’s move has you rethinking where growth and risk intersect, it could be a good moment to explore other high potential names through high growth tech and AI stocks.

With Datavault AI still trading near penny stock territory despite rapid revenue growth and a hefty discount to analyst targets, is this a mispriced turnaround story, or evidence that the market already doubts its future growth?

Most Popular Narrative: 66.3% Undervalued

With Datavault AI last closing at $1.01 versus a narrative fair value of $3.00, the valuation story hinges on aggressive growth and margin expansion assumptions.

The announcement of multiple proprietary data exchange platforms (International Elements Exchange, NIL Exchange, Political Exchange) launching on compliant, AI-powered infrastructure positions Datavault AI to capitalize on accelerating digital transformation across sectors, suggesting significant future revenue growth as these exchanges monetize new verticals.

Want to see how ambitious growth targets, rising margins and a premium future earnings multiple all fit together? The full narrative reveals the bold projections behind this fair value call.

Result: Fair Value of $3 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained losses, complex acquisitions and heavy reliance on unrecognized licensing revenue could quickly challenge the bullish growth story and derail analyst expectations.

Find out about the key risks to this Datavault AI narrative.

Another Lens on Valuation

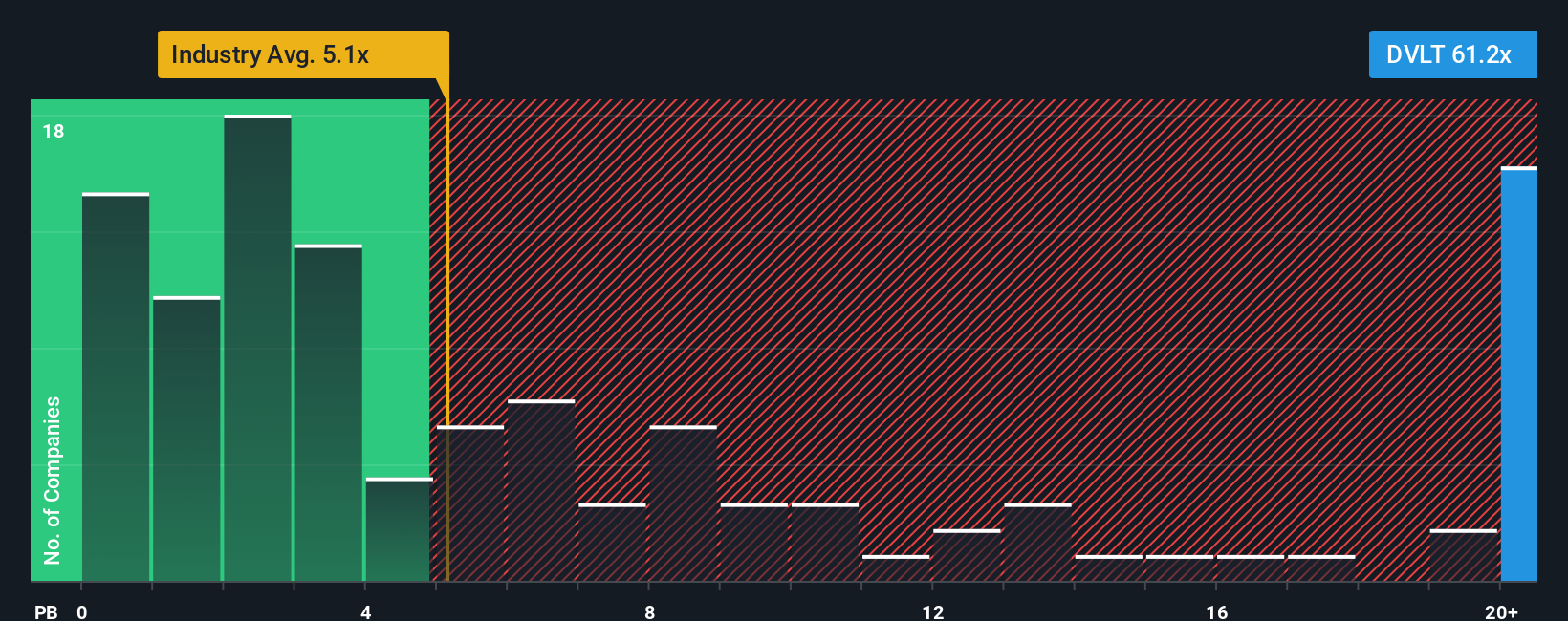

While the narrative fair value suggests Datavault AI looks cheap, its price to sales ratio of 46.7 times towers over the US Semiconductor industry at 5.6 times, peers at 5.5 times, and even a fair ratio of 39.7 times. This raises real questions about downside risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Datavault AI Narrative

If you see the story differently or want to dig into the numbers yourself, you can spin up a custom narrative in just minutes: Do it your way.

A great starting point for your Datavault AI research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before Datavault AI steals all your attention, consider planning your next moves with targeted opportunities from the Simply Wall St Screener so you are not chasing yesterday’s winners.

- Target potential mispricings by using these 875 undervalued stocks based on cash flows that align strong cash flows with attractive entry points.

- Position yourself early in transformative innovation through these 25 AI penny stocks capturing real revenue growth from artificial intelligence.

- Strengthen your income strategy with these 14 dividend stocks with yields > 3% that can help support steady returns even when markets turn volatile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报