3 ASX Penny Stocks With Market Caps Under A$200M

As the Australian stock market approaches the year's end, it experiences a slight dip, likely due to profit-taking as major indices in the U.S. near record highs. Despite being an older term, "penny stocks" continue to capture investor interest by offering potential growth at a lower entry cost. These stocks often represent smaller or newer companies and can provide intriguing opportunities when they demonstrate financial strength and resilience.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.395 | A$120.37M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.41 | A$68.28M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.77 | A$51.68M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.01 | A$453.39M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.10 | A$231.93M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.073 | A$39.45M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.00 | A$3.51B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.24 | A$1.37B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.805 | A$118.02M | ✅ 4 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.24 | A$122.75M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 417 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Adore Beauty Group (ASX:ABY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Adore Beauty Group Limited operates an integrated content, marketing, and e-commerce retail platform in Australia and New Zealand with a market cap of A$121.21 million.

Operations: The company generates revenue of A$198.82 million from the sale of beauty and personal care products through its online platform.

Market Cap: A$121.21M

Adore Beauty Group Limited, with a market cap of A$121.21 million, operates debt-free and has shown resilience despite recent challenges. The company experienced negative earnings growth of -65% over the past year, influenced by a significant one-off loss of A$2.5 million. However, it maintains a solid balance sheet with short-term assets exceeding both short and long-term liabilities. Trading at 67.4% below estimated fair value suggests potential for appreciation if profitability improves as forecasted earnings growth is strong at 60.09% per year. Recent executive changes include appointing Marcus Crowe as CFO to enhance financial strategy and governance.

- Unlock comprehensive insights into our analysis of Adore Beauty Group stock in this financial health report.

- Evaluate Adore Beauty Group's prospects by accessing our earnings growth report.

AML3D (ASX:AL3)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AML3D Limited provides 3D printing systems and contract manufacturing services to various sectors including aerospace, marine, defence, oil and gas, mining, and general manufacturing across Australia, Singapore, and the United States with a market cap of A$102.22 million.

Operations: The company generates revenue of A$7.39 million from its 3D printing services and machinery sales.

Market Cap: A$102.22M

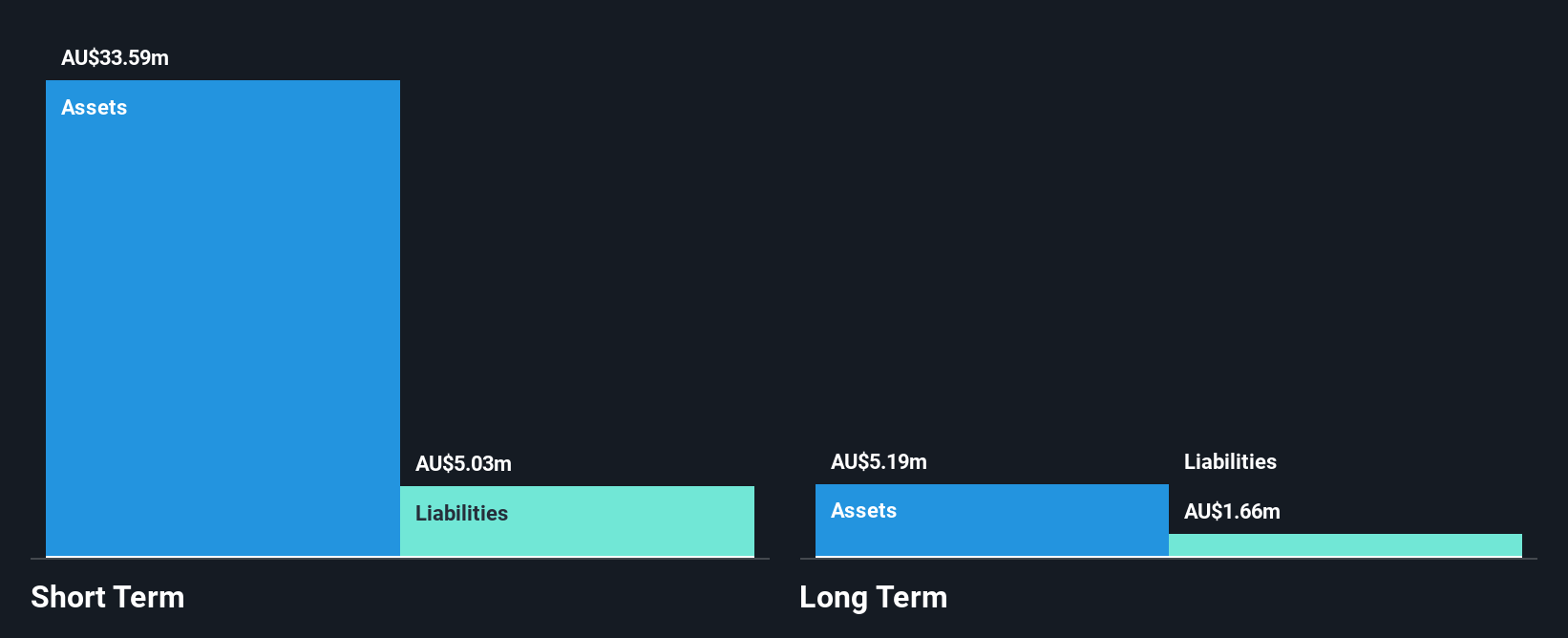

AML3D Limited, with a market cap of A$102.22 million, operates debt-free and remains unprofitable with losses increasing by 6.3% annually over the past five years. Despite this, the company has a solid cash runway exceeding three years based on current free cash flow and maintains short-term assets (A$33.6M) that cover both short and long-term liabilities. AML3D's board is experienced, averaging 4.8 years in tenure, and its management team has an average tenure of 2.9 years. While revenue from its 3D printing services is A$7 million, it lacks meaningful revenue generation currently but forecasts suggest significant earnings growth ahead at over 80% per year.

- Get an in-depth perspective on AML3D's performance by reading our balance sheet health report here.

- Learn about AML3D's future growth trajectory here.

NextEd Group (ASX:NXD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NextEd Group Limited offers educational services across Australia, Europe, and South America with a market cap of A$73.41 million.

Operations: The company's revenue is primarily driven by its International Vocational segment at A$70.97 million, followed by Technology & Design at A$9.60 million, Domestic Vocational at A$9.22 million, and Go Study Group at A$6.09 million.

Market Cap: A$73.41M

NextEd Group, with a market cap of A$73.41 million, is currently unprofitable but maintains a positive outlook with earnings forecasted to grow significantly at 106.08% per year. The company operates without debt and has a stable cash runway exceeding three years, supported by positive free cash flow growth at 13.5% annually. However, its short-term assets (A$45.3M) fall short of covering short-term liabilities (A$57.9M), indicating potential liquidity challenges in the near term. Despite increased losses over the past five years and high share price volatility, NextEd's experienced management and board provide some stability amidst these challenges.

- Jump into the full analysis health report here for a deeper understanding of NextEd Group.

- Examine NextEd Group's earnings growth report to understand how analysts expect it to perform.

Seize The Opportunity

- Reveal the 417 hidden gems among our ASX Penny Stocks screener with a single click here.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报