Reassessing DexCom (DXCM): Is the Market Underestimating Its Valuation After a Year of Weaker Share Price Performance?

DexCom (DXCM) is back in focus as investors weigh solid double digit revenue and earnings growth against a weaker share price over the past year. That disconnect is creating fresh questions about valuation.

See our latest analysis for DexCom.

Over the past year, DexCom’s 1 year total shareholder return of around negative 18 percent contrasts with its recent steady operations. This suggests sentiment has cooled even as the growth story remains intact and valuation expectations reset.

If DexCom’s mixed momentum has you reassessing your watchlist, it could be a good moment to explore other innovative healthcare names using our healthcare stocks.

With shares lagging despite double digit growth and a sizable gap to analyst targets, investors now face a key question: is DexCom trading at a discount to its true potential, or is future growth already priced in?

Most Popular Narrative: 21.6% Undervalued

With DexCom’s fair value pegged near $84.85 against a $66.54 last close, the most followed narrative argues the market is underappreciating its long term earnings power.

The analysts have a consensus price target of $102.083 for DexCom based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $115.0, and the most bearish reporting a price target of $83.0.

Curious how steady double digit growth, rising margins, and a punchy future earnings multiple can still point to upside from here? The full narrative unpacks the aggressive revenue ramp, the profitability reset, and the valuation math that tries to justify it all. Want to see exactly how those moving parts combine into that higher fair value call?

Result: Fair Value of $84.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential Medicare pricing pressure and intensifying competition in CGM technology could compress margins and slow patient growth, challenging the undervalued thesis.

Find out about the key risks to this DexCom narrative.

Another View: Rich on Earnings

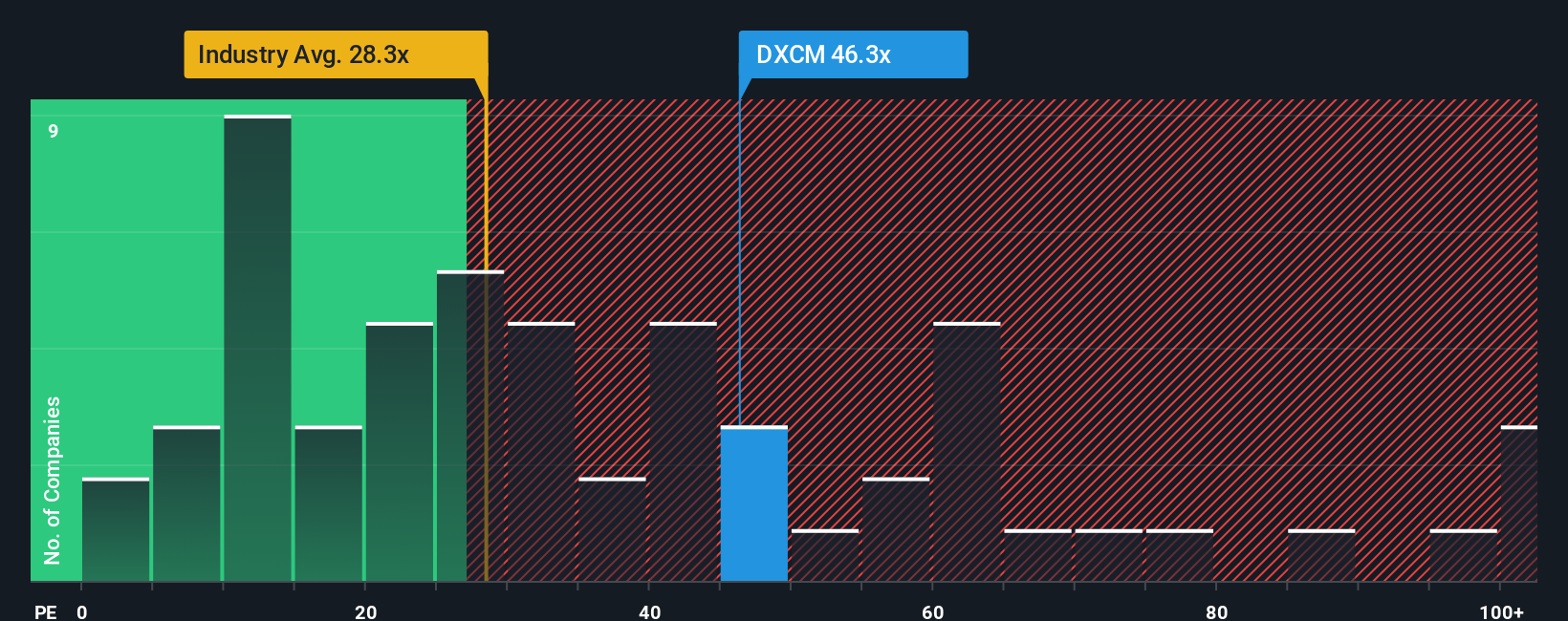

Our earnings based lens sends a different signal. At around 36 times earnings versus a fair ratio of 31.8 times, DexCom screens expensive, and it also trades richer than the US Medical Equipment industry at 29.5 times. Could today’s premium compress if growth or margins disappoint?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DexCom Narrative

If the current perspectives do not quite fit your view, dive into the numbers yourself and craft a personalized storyline in minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding DexCom.

Ready for more investing ideas?

Do not stop with one opportunity. Use the Simply Wall St Screener to uncover fresh, data driven stock ideas other investors could be missing.

- Capture potential mispricings by reviewing these 875 undervalued stocks based on cash flows that may offer upside as sentiment and fundamentals realign.

- Tap into powerful long term themes through these 25 AI penny stocks positioned at the front line of artificial intelligence adoption.

- Strengthen your income strategy with these 14 dividend stocks with yields > 3% that combine attractive yields with robust underlying businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报