Arrow Electronics (ARW): Reassessing Valuation After Flat Returns and Slightly Overvalued Fair Value Estimate

Arrow Electronics (ARW) has been quietly treading water, with the stock roughly flat over the past year even as revenue edges higher and net income slips. That mix creates an interesting value question.

See our latest analysis for Arrow Electronics.

At a share price of $113.04, Arrow’s 90 day share price return of negative 8.02 percent suggests momentum has cooled, even though the 5 year total shareholder return of 8.33 percent still reflects moderate long term value creation.

If Arrow’s steady but unspectacular trajectory has you rethinking your options, this may be a useful moment to explore high growth tech and AI stocks for other potentially more dynamic names in the broader electronics and tech ecosystem.

So with revenue still grinding higher but profits and the share price moving sideways, is Arrow quietly slipping into undervalued territory, or is the market already discounting all the future growth that lies ahead?

Most Popular Narrative: 4.4% Overvalued

With Arrow Electronics trading at $113.04 against a narrative fair value of $108.25, the story leans slightly cautious on upside from here.

The analysts have a consensus price target of $116.75 for Arrow Electronics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $135.0, and the most bearish reporting a price target of just $98.0.

Want to see what justifies a lower fair value than today’s price, even with revenue growth and margin expansion baked in? The narrative leans on specific growth, profitability, and valuation assumptions that could reshape how you see Arrow’s long term earnings power and multiple.

Result: Fair Value of $108.25 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, growing digitalization that lets customers bypass distributors and lingering inventory normalization could pressure Arrow’s revenue base and undermine those margin assumptions.

Find out about the key risks to this Arrow Electronics narrative.

Another Take on Value

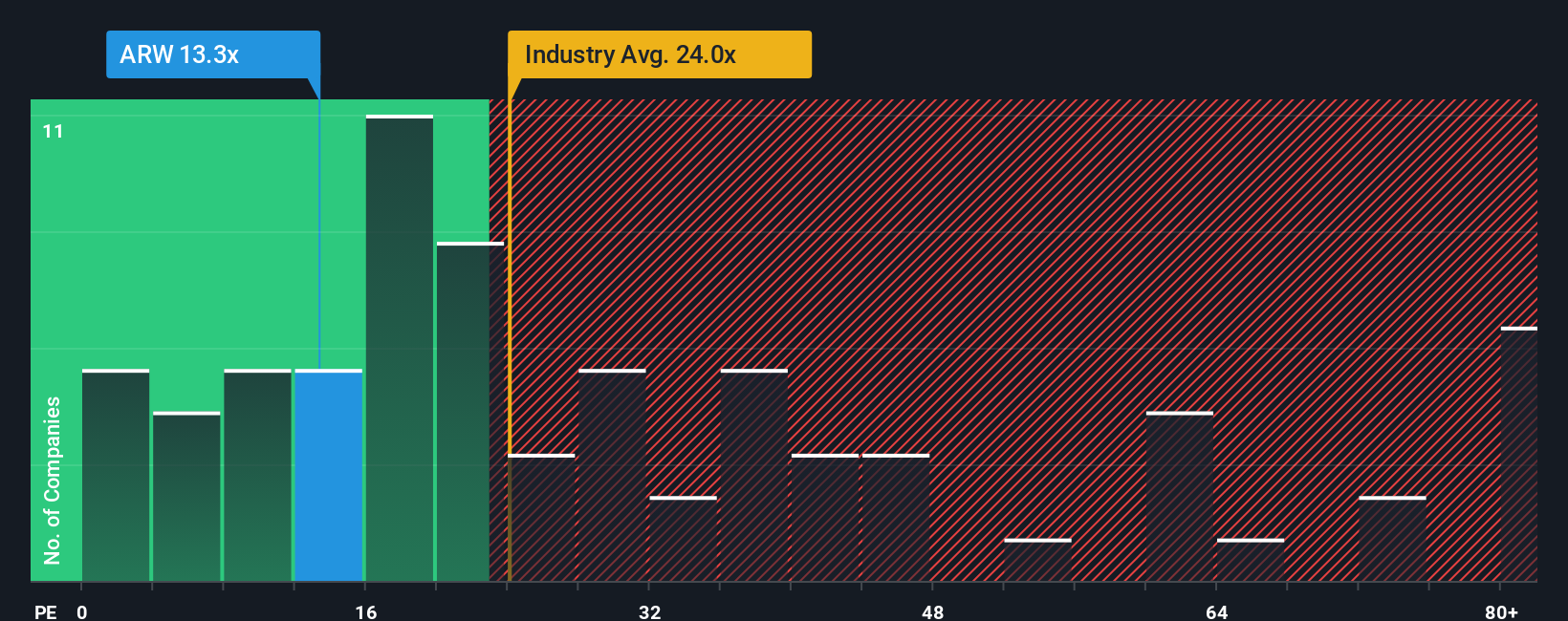

While the narrative fair value suggests Arrow is slightly overpriced, its 12.2x price to earnings ratio looks cheap compared to the US market at 19x, peers at 17.3x, and a fair ratio of 17.4x. Is the market underestimating Arrow or fairly discounting its growth risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arrow Electronics Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can build a tailored view of Arrow’s outlook in minutes, Do it your way.

A great starting point for your Arrow Electronics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next smart move?

Use the Simply Wall St screener now to uncover focused opportunities that match your strategy, before others spot them and reprice the upside away.

- Capture potential mispricing by targeting quality companies trading below their intrinsic value through these 875 undervalued stocks based on cash flows.

- Capitalize on innovation by zeroing in on early stage artificial intelligence opportunities with these 25 AI penny stocks that could shape the next growth cycle.

- Strengthen your income stream by pinpointing reliable payers using these 14 dividend stocks with yields > 3% to potentially lock in attractive yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报