Oracle (ORCL): Rethinking Valuation After Bold AI, Cloud Expansion and Rising Investment Risks

Oracle (ORCL) is back in the spotlight after fresh commentary on its aggressive AI and cloud expansion, highlighting both the potential benefits of its OpenAI linked strategy and the growing worries around spending and debt.

See our latest analysis for Oracle.

After last year’s OpenAI fueled surge and sharp pullback, Oracle’s 1 month share price return of minus 10.05 percent and 3 month return of minus 32.88 percent suggest near term momentum is fading. At the same time, its 1 year total shareholder return of 18.84 percent and 3 year total shareholder return of 137.12 percent still point to a strong long term payoff for those backing its AI pivot.

If Oracle’s AI heavy strategy has your attention, this could be a good moment to scan other high growth tech and AI names using high growth tech and AI stocks for fresh ideas.

With Oracle now trading about 50 percent below the average analyst price target despite rich AI expectations, is this the moment to buy into discounted growth, or a sign the market already sees through the hype?

Most Popular Narrative Narrative: 49.8% Undervalued

Compared with Oracle’s last close at $195.71, the most followed narrative sees room for a dramatically higher long term value trajectory.

The dramatic RPO growth has led Oracle to accelerate its long term financial targets, repositioning the company as a "hypergrowth company". Long Term Growth Forecasts (Updated October 2025): Total Revenue Target: Projected to reach $225 billion by fiscal year 2030, representing a compound annual growth rate (CAGR) of over 31%. OCI Infrastructure Revenue: Projected to grow rapidly, reaching $166 billion by FY2030 (a 71% 5 year CAGR). EPS Target: Projected to reach $21 by fiscal year 2030 (a 28% 5 year CAGR).

Curious what kind of revenue surge, margin expansion, and future earnings multiple could justify nearly half upside from here? The narrative lays out a bold, numbers driven roadmap.

Result: Fair Value of $389.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained capacity bottlenecks or a sharp pullback in AI spending could quickly challenge the hypergrowth assumptions that are central to this bullish narrative.

Find out about the key risks to this Oracle narrative.

Another View: Market Signals Are More Cautious

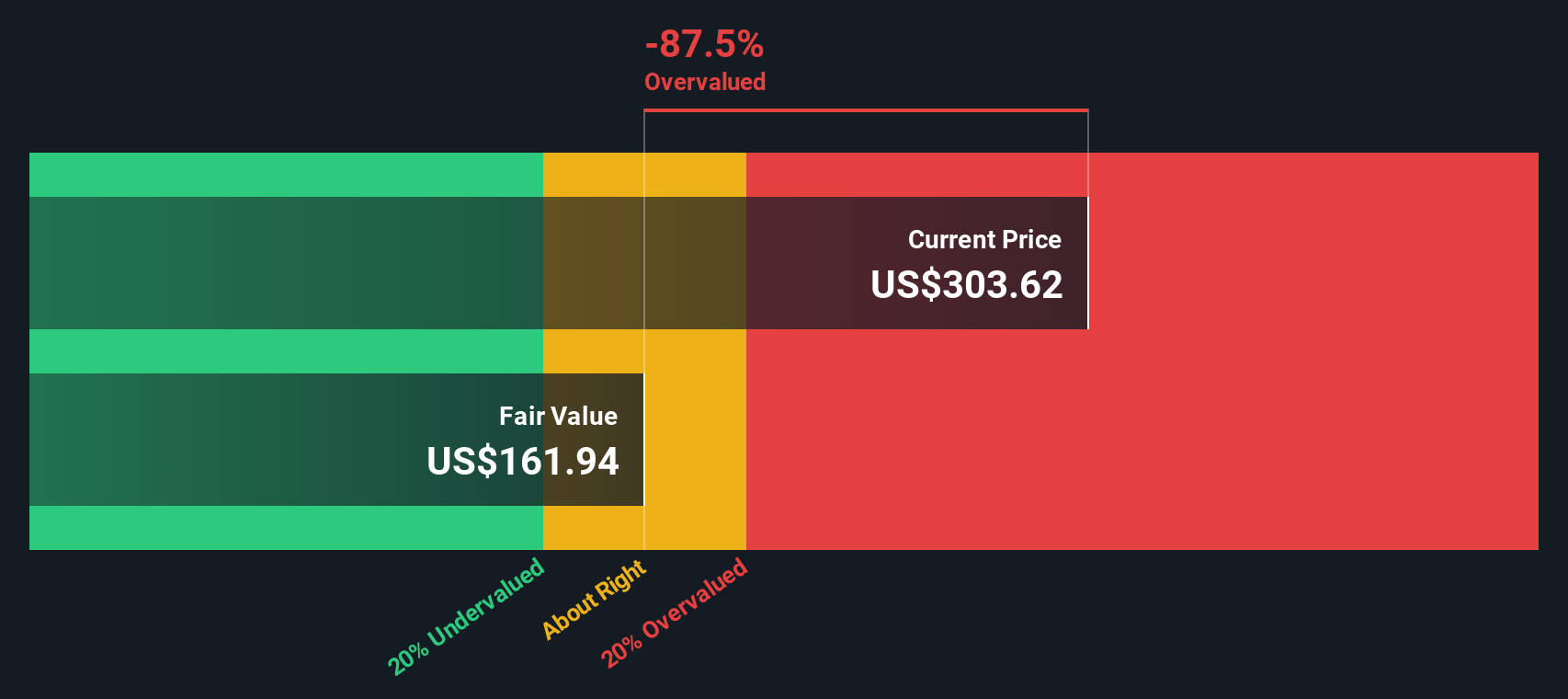

While the narrative pins Oracle’s fair value near $389.81, our DCF model points to a lower fair value of $166.31. This implies the stock at $195.71 is trading above intrinsic value, or overvalued. Is the market correctly pricing execution risk, or underestimating Oracle’s AI upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Oracle for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Oracle Narrative

If you are unconvinced by these views or simply prefer to dig into the numbers yourself, you can build a custom thesis in minutes: Do it your way.

A great starting point for your Oracle research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in a few next steps with targeted screeners so you are not relying on just one AI story to shape your portfolio.

- Boost your income potential by pinpointing steady payers using these 14 dividend stocks with yields > 3% to uncover companies rewarding shareholders with meaningful, sustainable yields.

- Target the next wave of innovation by focusing on these 29 quantum computing stocks that could benefit from breakthroughs in computing power and real world problem solving.

- Strengthen your margin of safety by scanning these 875 undervalued stocks based on cash flows that the market may be mispricing relative to their cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报