Take-Two Interactive (TTWO) Valuation Check After a Strong 1-Year Run and Recent Share Price Pullback

Take-Two Interactive Software (TTWO) has quietly outperformed the broader market over the past year, and that kind of steady climb usually hints investors are looking past short term noise toward long term franchise strength.

See our latest analysis for Take-Two Interactive Software.

Recent wobbling in the share price, with a 7 day share price return of minus 1.75 percent, sits against a powerful 1 year total shareholder return of 33.3 percent. This suggests that momentum is still broadly building.

If Take Two’s run has you thinking about what else is quietly gaining traction, it might be worth exploring high growth tech and AI stocks for other potential growth stories in similar corners of the market.

With shares near 252 dollars, decent top line growth but a recent net loss, and only a modest gap to analyst targets, investors now face a key question: is this a fresh buying opportunity, or is future growth already priced in?

Most Popular Narrative Narrative: 9.3% Undervalued

With Take Two shares last closing at 251.60 dollars against a most popular narrative fair value of about 277.40 dollars, the valuation hinges on aggressive growth, margin recovery, and a rich future earnings multiple.

Strategic investments in technology, AI, and content pipeline efficiency, alongside a strong release slate with multiple high profile launches (including Borderlands 4, NBA 2K26, and Mafia: The Old Country), undergird management's outlook for record net bookings and enhanced profitability in the coming years.

Want to see why this story leans on a sharp swing from deep losses to strong profitability, plus a punchy future earnings multiple? The narrative spells out a steep revenue climb, a dramatic margin reset, and an eye catching valuation benchmark that assumes Take Two can behave more like a high growth platform than a traditional publisher.

Result: Fair Value of $277.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could fray if GTA 6 timing slips or mobile engagement softens, which could crimp the expected earnings ramp and test today’s premium multiple.

Find out about the key risks to this Take-Two Interactive Software narrative.

Another View: Rich Multiples Raise the Bar

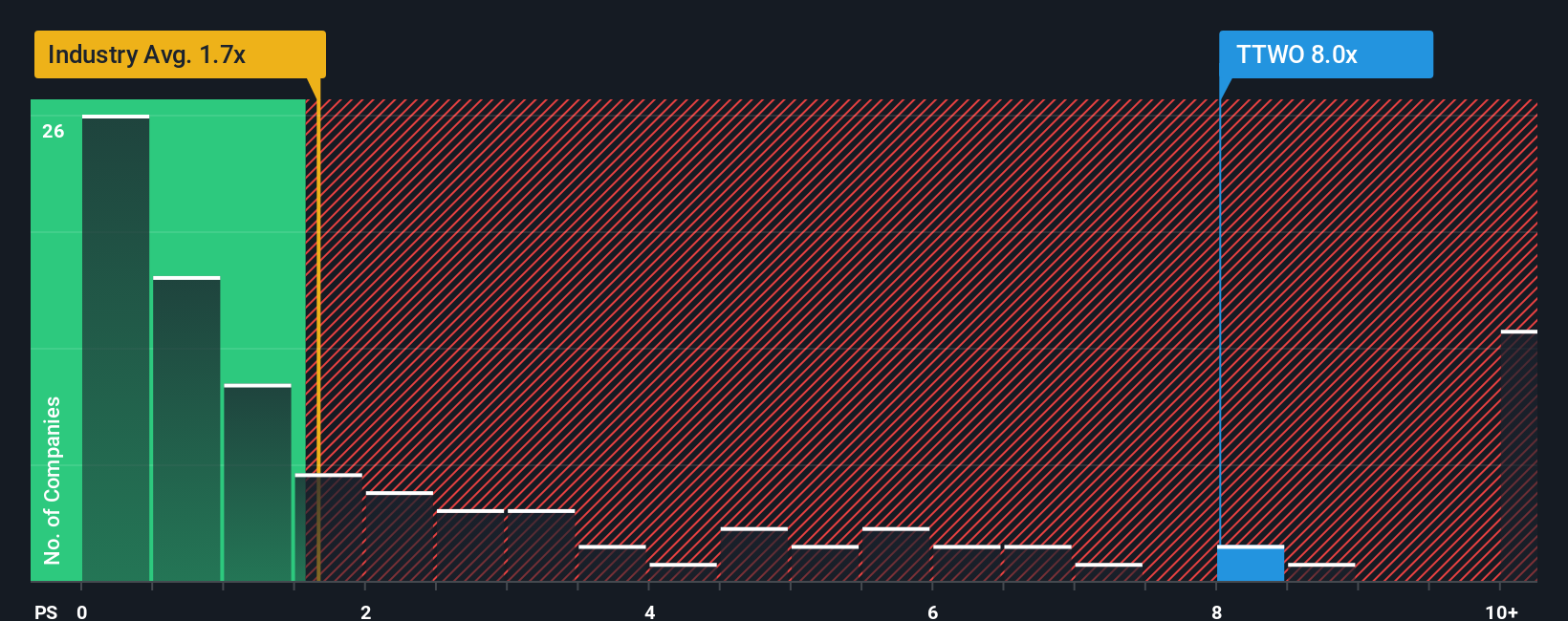

While the popular narrative points to about 9 percent upside, a simple price to sales check is far less forgiving. At roughly 7.5 times sales versus an industry 1.6 times and peer 5.5 times, and above a fair ratio of 4.6 times, investors are clearly paying up. This raises the question: how much perfection is already in the price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Take-Two Interactive Software Narrative

If you would rather stress test the assumptions yourself and build a view from the ground up, you can map out a bespoke narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Take-Two Interactive Software.

Ready for your next investing move?

Before the market’s next swing, put your watchlist to work by targeting fresh opportunities other investors are overlooking with the Simply Wall Street Screener.

- Capture potential mispricings early by scanning these 875 undervalued stocks based on cash flows that the market has yet to fully appreciate.

- Capitalize on structural trends by zeroing in on these 29 healthcare AI stocks transforming how medicine, diagnostics, and patient care evolve.

- Amplify your income strategy by filtering for these 14 dividend stocks with yields > 3% that can strengthen returns when growth alone is not enough.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报