3 Asian Dividend Stocks Offering Yields Up To 6.3%

As Asian markets navigate a complex landscape of economic shifts and geopolitical dynamics, investors are increasingly looking towards dividend stocks for stability and income. In this context, selecting stocks with strong fundamentals and consistent dividend payouts can be particularly appealing, offering potential resilience amid market fluctuations.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.74% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.42% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.15% | ★★★★★★ |

| NCD (TSE:4783) | 3.99% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.00% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.21% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.62% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.86% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.74% | ★★★★★★ |

Click here to see the full list of 1020 stocks from our Top Asian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

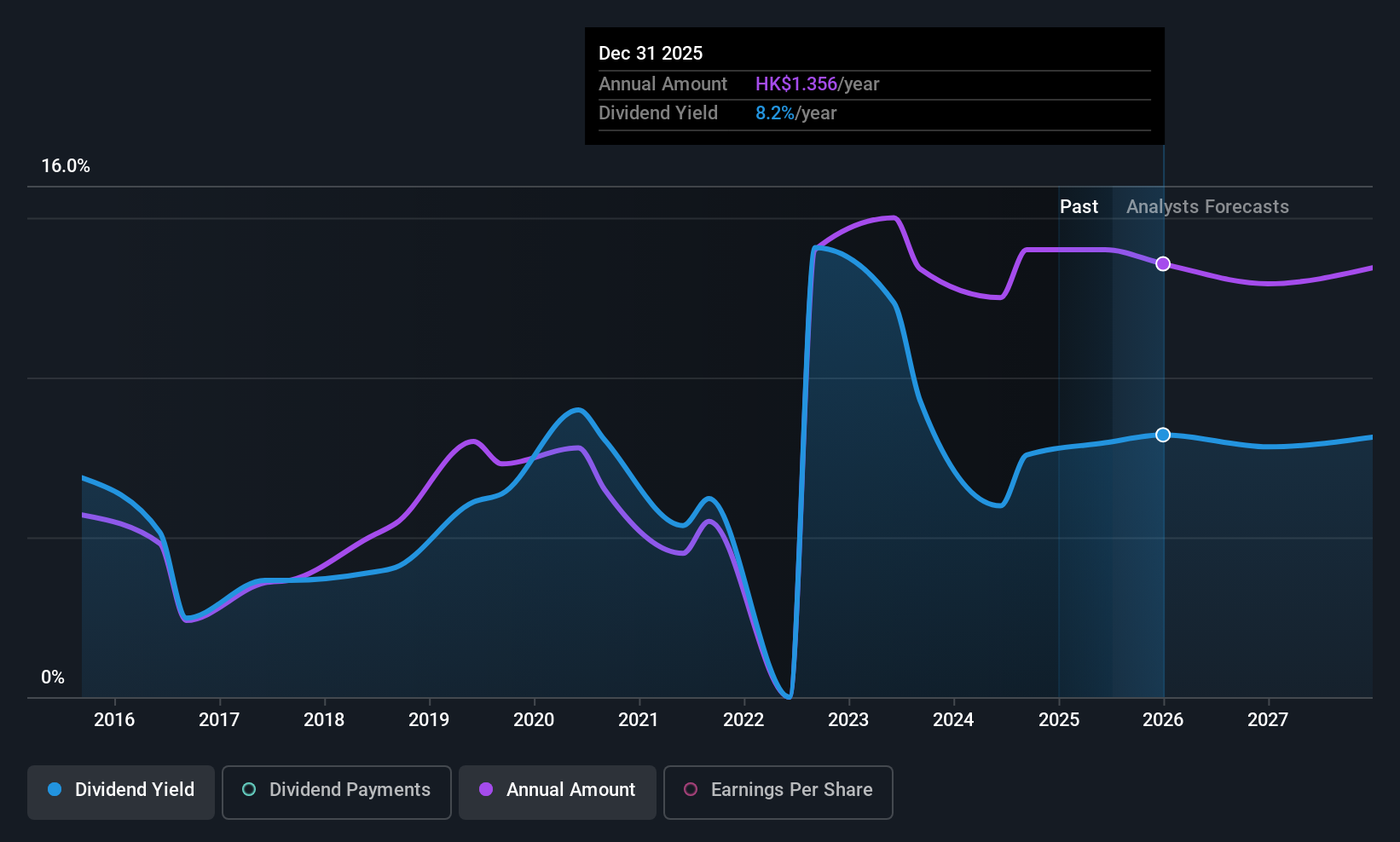

CNOOC (SEHK:883)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CNOOC Limited is an investment holding company involved in the global exploration, development, production, and sale of crude oil and natural gas, with a market cap of HK$1.07 trillion.

Operations: CNOOC Limited generates revenue through its global operations in the exploration, development, production, and sale of crude oil and natural gas.

Dividend Yield: 6.4%

CNOOC's dividend sustainability is supported by a payout ratio of 50.8% and cash payout ratio of 63.2%, indicating coverage by earnings and cash flows, though its dividend history has been volatile. Recent developments include the commencement of production at the Buzios6 Project, enhancing capacity to 1.15 million barrels per day, potentially strengthening future cash flows for dividends despite current yield being slightly below top-tier levels in Hong Kong.

- Get an in-depth perspective on CNOOC's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, CNOOC's share price might be too pessimistic.

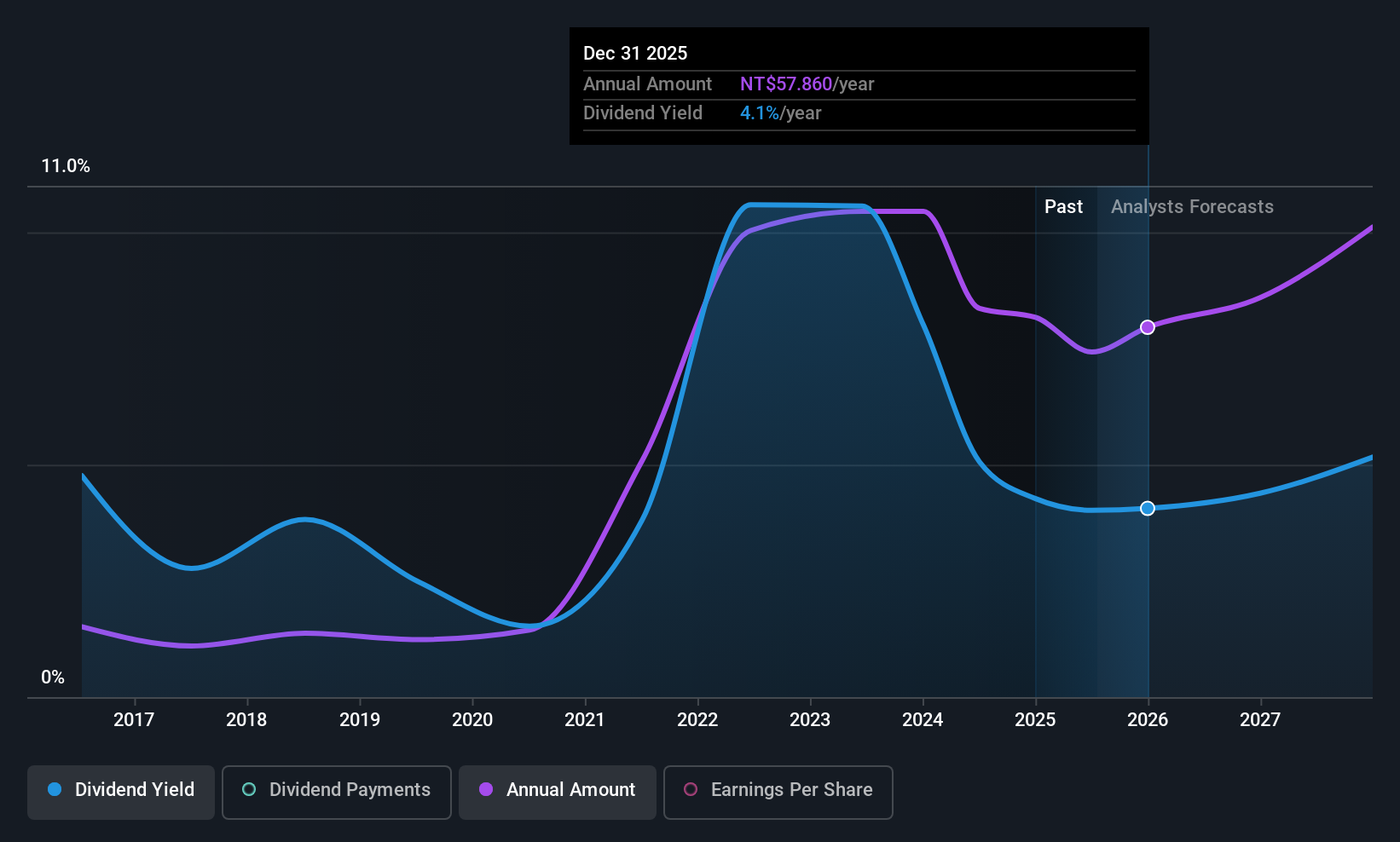

Quanta Computer (TWSE:2382)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Quanta Computer Inc. is a company that manufactures, processes, and sells laptop computers and telecommunication products across various international markets, with a market cap of approximately NT$1.07 trillion.

Operations: Quanta Computer Inc. generates revenue primarily from its Electronics Sector, amounting to NT$3.90 billion.

Dividend Yield: 4.7%

Quanta Computer offers a stable dividend profile with consistent growth over the past decade, supported by a payout ratio of 73% and cash flow coverage of 72.9%. While its dividend yield of 4.69% is below the top tier in Taiwan, it remains reliable. The company trades at a favorable price-to-earnings ratio compared to the market and peers. Recent earnings show robust sales growth, although net income slightly declined year-over-year for Q3 2025.

- Delve into the full analysis dividend report here for a deeper understanding of Quanta Computer.

- Our valuation report here indicates Quanta Computer may be undervalued.

MediaTek (TWSE:2454)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MediaTek Inc. is a company involved in the research, development, production, manufacture, and marketing of multimedia integrated circuits (ICs) across Taiwan and internationally, with a market cap of NT$2.35 trillion.

Operations: MediaTek Inc.'s revenue primarily comes from its Multimedia and Mobile Phone Chips and Other Integrated Circuit Design Products segment, which generated NT$583.82 billion.

Dividend Yield: 3.7%

MediaTek's dividend payments are covered by earnings and cash flows, with a payout ratio of 80.9% and cash payout ratio of 72.9%. However, its dividend yield is below the top tier in Taiwan. Despite a volatile dividend history, payments have grown over the past decade. The company trades at a favorable price-to-earnings ratio compared to industry peers. Recent strategic collaborations in automotive and AI sectors highlight MediaTek's growth potential but do not directly impact dividends.

- Unlock comprehensive insights into our analysis of MediaTek stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of MediaTek shares in the market.

Turning Ideas Into Actions

- Delve into our full catalog of 1020 Top Asian Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报