Unilever (LSE:ULVR) Valuation Check After Recent Share Price Pullback

Unilever (LSE:ULVR) has been quietly treading water, with the share price slipping about 4% over the past month yet still delivering solid gains over the past 3 years, which raises an interesting valuation question.

See our latest analysis for Unilever.

Over the past year, Unilever’s modest 1 year total shareholder return of 2.31%, alongside a slightly negative 90 day share price return, suggests momentum has cooled a bit even as management pushes through gradual, margin focused changes.

If you are weighing Unilever against other defensive names, it can help to widen the lens and see what is happening across healthcare stocks as another pocket of resilient demand.

With earnings still growing and the shares trading at a discount to analyst targets and some intrinsic value estimates, the question now is whether Unilever is quietly undervalued or whether the market has already priced in its next leg of growth.

Most Popular Narrative: 9.6% Undervalued

With Unilever's shares last closing at £48.23 against a narrative fair value of about £53.37, the story hinges on steady earnings and margin upgrades rather than a dramatic rerating.

Portfolio transformation with a sharper focus on premium and science led Personal Care and Beauty & Wellbeing products, coupled with bolt on acquisitions of fast growing digitally native brands, is increasing exposure to higher margin categories and supporting long term margin and earnings expansion.

Want to see what kind of revenue runway and profit margins are embedded in this price tag, and how they stack up against today’s earnings base? The narrative breaks down a detailed path to higher profitability, a richer product mix, and a future valuation multiple that assumes investors will still pay up for this slow burn compounding story. Curious how those assumptions connect to that mid single digit upside from here, and what would need to go right to close the gap?

Result: Fair Value of £53.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying private label competition and weaker emerging market volumes could erode Unilever’s pricing power and undermine the margin and earnings trajectory in this narrative.

Find out about the key risks to this Unilever narrative.

Another View: Valuation Through Market Ratios

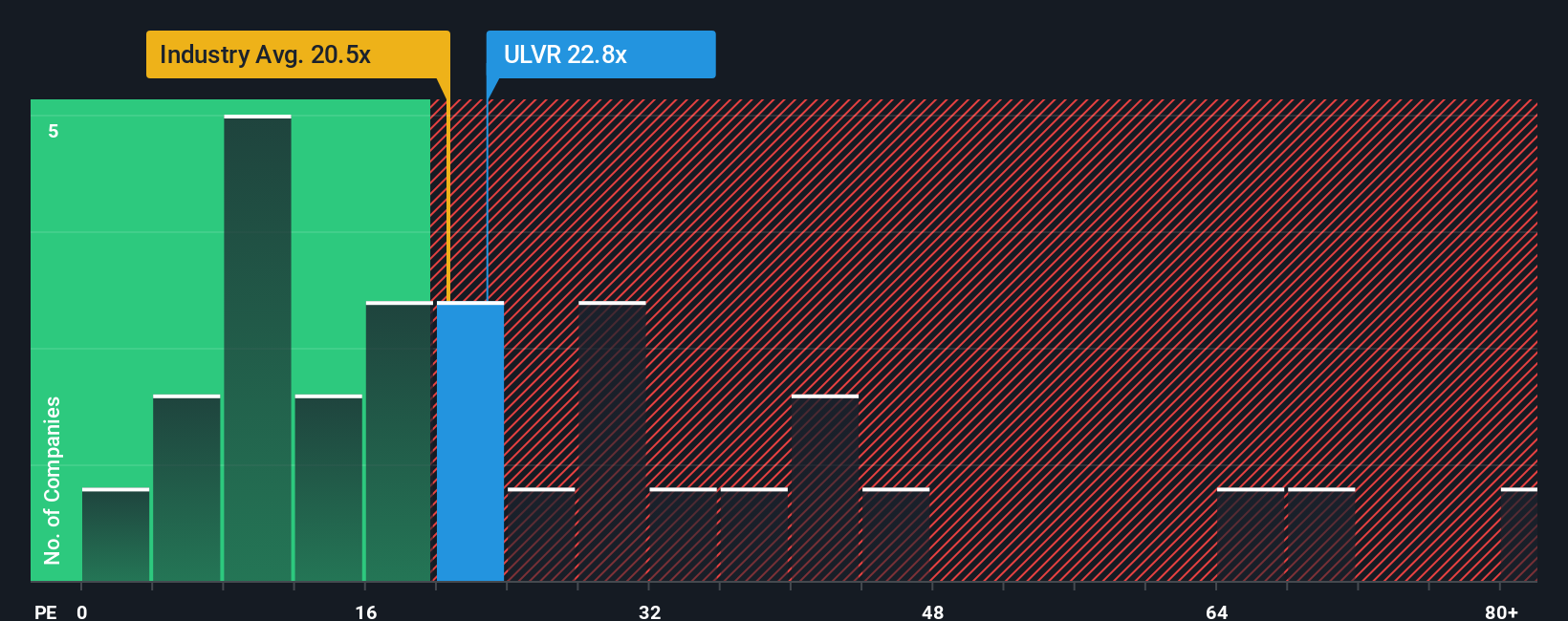

Looked at through its price to earnings ratio of 22.1x, Unilever is slightly expensive versus the European Personal Products industry at 21.1x, but screens cheaper than close peers at 37.5x and below a fair ratio of 23.8x. This hints at limited downside and selective upside. Could the market slowly re rate toward that fair ratio if execution holds?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Unilever Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalised Unilever view in just minutes: Do it your way.

A great starting point for your Unilever research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, use the Simply Wall Street Screener to uncover fresh opportunities that could complement or even outperform a position in Unilever.

- Capitalize on market mispricing by targeting companies trading below their intrinsic worth using these 875 undervalued stocks based on cash flows tailored to strong cash flow potential.

- Ride powerful thematic growth by focusing on these 25 AI penny stocks that sit at the intersection of innovation, automation, and long term earnings expansion.

- Strengthen your income stream by zeroing in on these 14 dividend stocks with yields > 3% that can help anchor your portfolio with reliable cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报