How Investors May Respond To Lundin Mining (TSX:LUN) Completing Its US$150 Million Share Buyback

- Lundin Mining reported that, as of December 31, 2025, its issued and outstanding shares fell to 854,347,591 after repurchasing 15,088,180 shares for about US$150,000,000 under its 2025 normal course issuer bid, while also accounting for employee stock option exercises and vesting.

- The company’s completion of its targeted annual buyback and reiteration of its ambition to become a top ten global copper producer highlight how capital returns and long-term growth plans are being pursued in tandem.

- We’ll now examine how the completed US$150,000,000 share buyback shapes Lundin Mining’s existing investment narrative around growth, risk, and returns.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Lundin Mining Investment Narrative Recap

To own Lundin Mining, you need to believe in its copper focused growth story and its ability to execute large South American projects without eroding returns. The completed 2025 US$150,000,000 buyback marginally tightens the share count but does not materially change the near term catalysts, which still hinge on advancing projects like Vicuña, or the main risks around copper price volatility and concentrated exposure to a few key Latin American assets.

The most relevant recent announcement here is the December 11, 2025 renewal of Lundin’s normal course issuer bid, which allows repurchases of up to 67,723,868 shares through December 2026. That program frames the latest US$150,000,000 buyback as part of an ongoing pattern of returning capital while Lundin pursues its ambition to become a top ten copper producer, keeping attention squarely on whether future cash flows from Vicuña and other projects can justify continued repurchases.

Yet, against this capital return story, investors should still be aware of how concentrated South American exposure could magnify any shift in...

Read the full narrative on Lundin Mining (it's free!)

Lundin Mining's narrative projects $3.6 billion revenue and $364.3 million earnings by 2028. This requires 0.0% yearly revenue decline and a $211.8 million earnings increase from $152.5 million today.

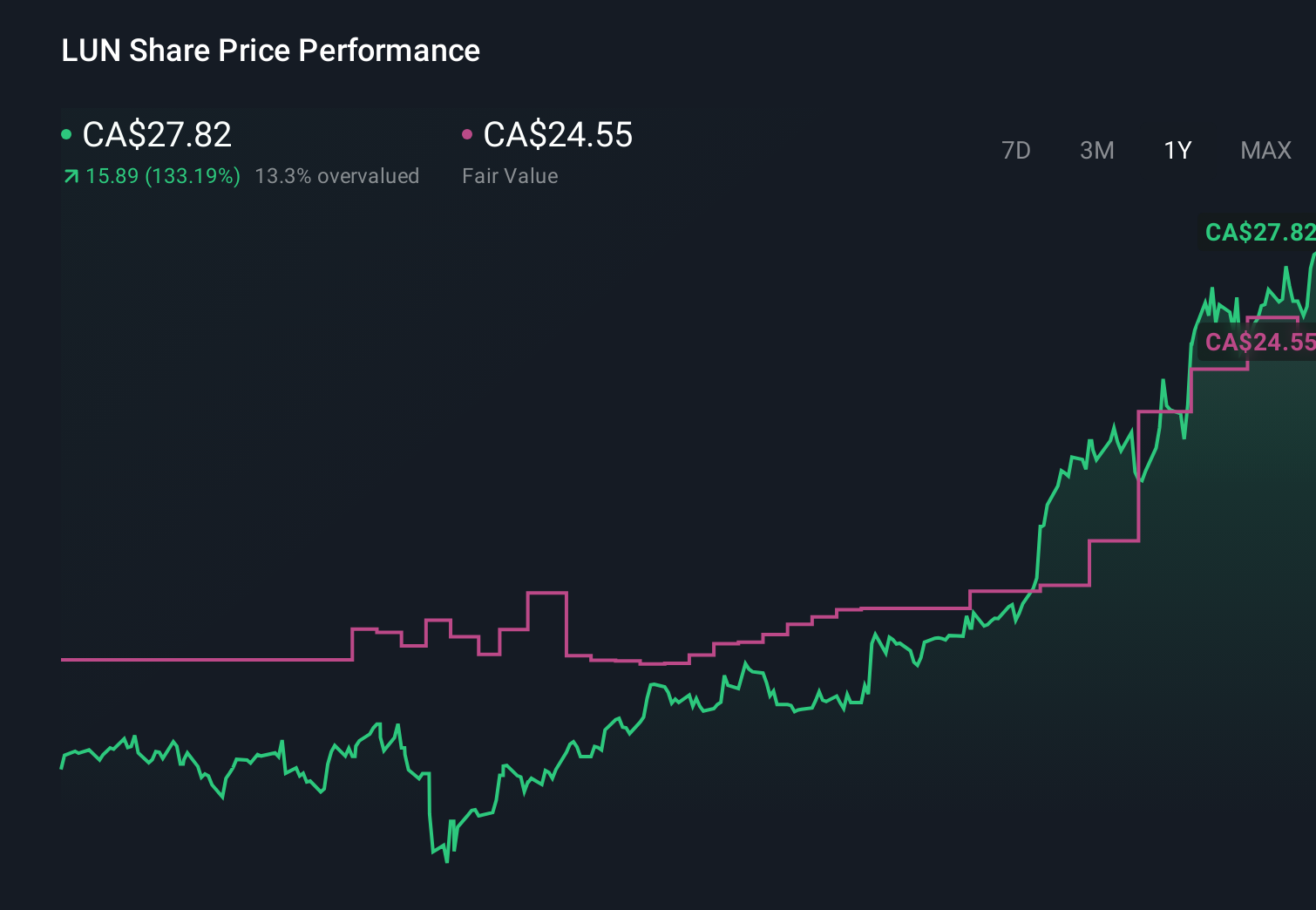

Uncover how Lundin Mining's forecasts yield a CA$27.52 fair value, a 7% downside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span roughly US$1.68 to US$28.03 per share, showing just how far opinions can diverge. When you set that dispersion against Lundin’s reliance on South American copper assets as a core risk, it underlines why many market participants look at several contrasting views before deciding how the growth, execution and political backdrop might affect the company’s performance over time.

Explore 6 other fair value estimates on Lundin Mining - why the stock might be worth less than half the current price!

Build Your Own Lundin Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lundin Mining research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Lundin Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lundin Mining's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报