What Ulta Beauty (ULTA)'s 'Ulta Beauty Unleashed' Store Revamp Means For Shareholders

- In late 2025, Ulta Beauty launched its “Ulta Beauty Unleashed” initiative to upgrade in-store shopping experiences and accelerate expansion into higher-growth international markets.

- This program signals a deeper push to turn stores into experiential destinations while using global expansion to diversify where future sales come from.

- We’ll now examine how Ulta Beauty Unleashed’s emphasis on elevated in-store experiences could reshape Ulta Beauty’s existing investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Ulta Beauty Investment Narrative Recap

To own Ulta Beauty, you need to believe that a large physical store base can still drive attractive returns by offering experiences, services, and product breadth that online-only rivals cannot easily match. The Ulta Beauty Unleashed initiative supports this thesis by doubling down on experiential stores, but it does not remove key near term questions around cost inflation and the eventual loss of the Target partnership.

One recent development that fits neatly alongside Ulta Beauty Unleashed is the launch of UB Marketplace, which brings 100 plus additional brands into Ulta’s digital ecosystem. By widening its online assortment while upgrading stores, Ulta is trying to keep both channels relevant for customers and reinforce the same catalysts investors are watching most closely: healthier margins and more diversified revenue growth.

Yet, while Ulta is leaning into these opportunities, investors should not overlook the rising structural cost pressures that could quietly weigh on margins over time...

Read the full narrative on Ulta Beauty (it's free!)

Ulta Beauty's narrative projects $13.8 billion revenue and $1.3 billion earnings by 2028. This requires 5.9% yearly revenue growth and an earnings increase of about $0.1 billion from $1.2 billion today.

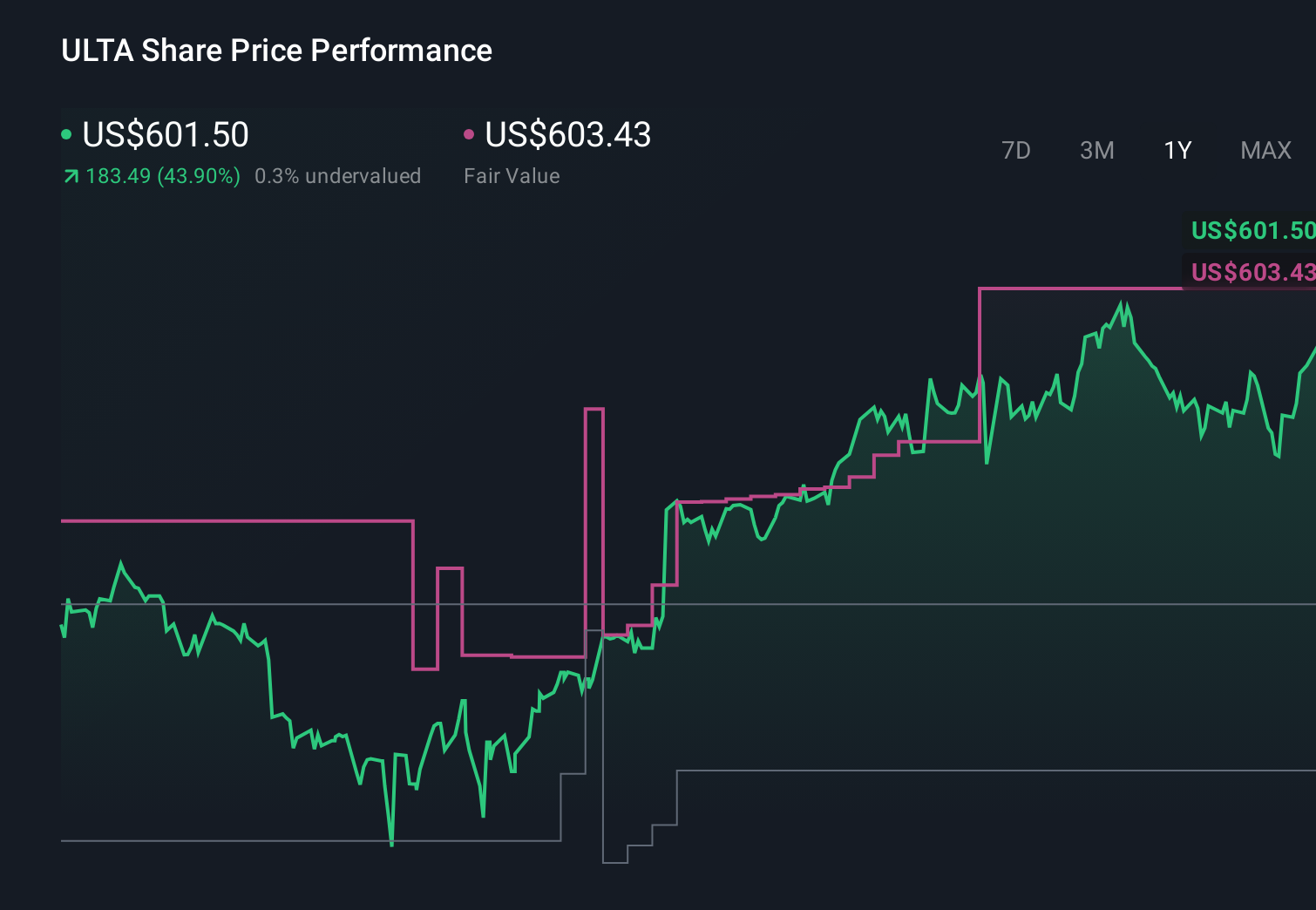

Uncover how Ulta Beauty's forecasts yield a $603.43 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Nine members of the Simply Wall St Community currently place Ulta’s fair value between US$384.20 and US$603.43, underscoring how far individual views can spread. Against this backdrop, the push toward more experiential stores under Ulta Beauty Unleashed sits squarely against concerns about higher store payroll, rent and other operating costs, so it is worth exploring several viewpoints before deciding how resilient you think those margins can be.

Explore 9 other fair value estimates on Ulta Beauty - why the stock might be worth as much as $603.43!

Build Your Own Ulta Beauty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ulta Beauty research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Ulta Beauty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ulta Beauty's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报