Galaxy Digital (TSX:GLXY): Reassessing Valuation After a Recent Pullback in the Share Price

Galaxy Digital (GLXY) has quietly turned in a mixed scorecard for investors, with the stock up about 21% over the past year but down roughly 36% in the past 3 months.

See our latest analysis for Galaxy Digital.

That mix of a strong 1 year total shareholder return and a steep 90 day share price decline suggests momentum has cooled for now. At the same time, the $24.75 share price reflects Galaxy Digital’s longer term growth story.

If Galaxy’s volatility has your attention, this could be a good moment to see what else is out there and explore high growth tech and AI stocks for more potential opportunities.

With revenue still growing, earnings swinging lower, and the share price sitting at a steep discount to analyst targets, is Galaxy Digital a mispriced play on digital assets and AI infrastructure, or is the market already discounting future growth?

Most Popular Narrative: 48.2% Undervalued

Compared with the last close at $24.75, the most followed narrative points to a fair value near $47.82, framing Galaxy Digital as materially mispriced.

The maturation of digital asset infrastructure, evidenced by large scale, long term data center developments and multi phase partnerships (e.g., CoreWeave), is poised to generate significant, high margin cash flows beginning in 2026, enhance earnings visibility, and improve the company's overall capitalization efficiency as these business lines scale. Advancements in real world asset tokenization and the convergence of onchain and offchain capital markets are creating new, durable revenue streams (e.g., staking, lending, tokenized asset management), which Galaxy is actively positioning for through innovation and platform development. This is expected to support long term growth in recurring revenue and operating income.

Want to see why this story leans so heavily on explosive revenue expansion, margin rebuild, and a punchy future earnings multiple, all working together? The full narrative reveals the bold growth curve, the expected turnaround in profitability, and the valuation math that connects those assumptions to that higher fair value figure.

Result: Fair Value of $47.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on CoreWeave and the capital intensity of scaling AI data centers could quickly undermine those ambitious growth and valuation assumptions.

Find out about the key risks to this Galaxy Digital narrative.

Another View: Rich on Traditional Metrics

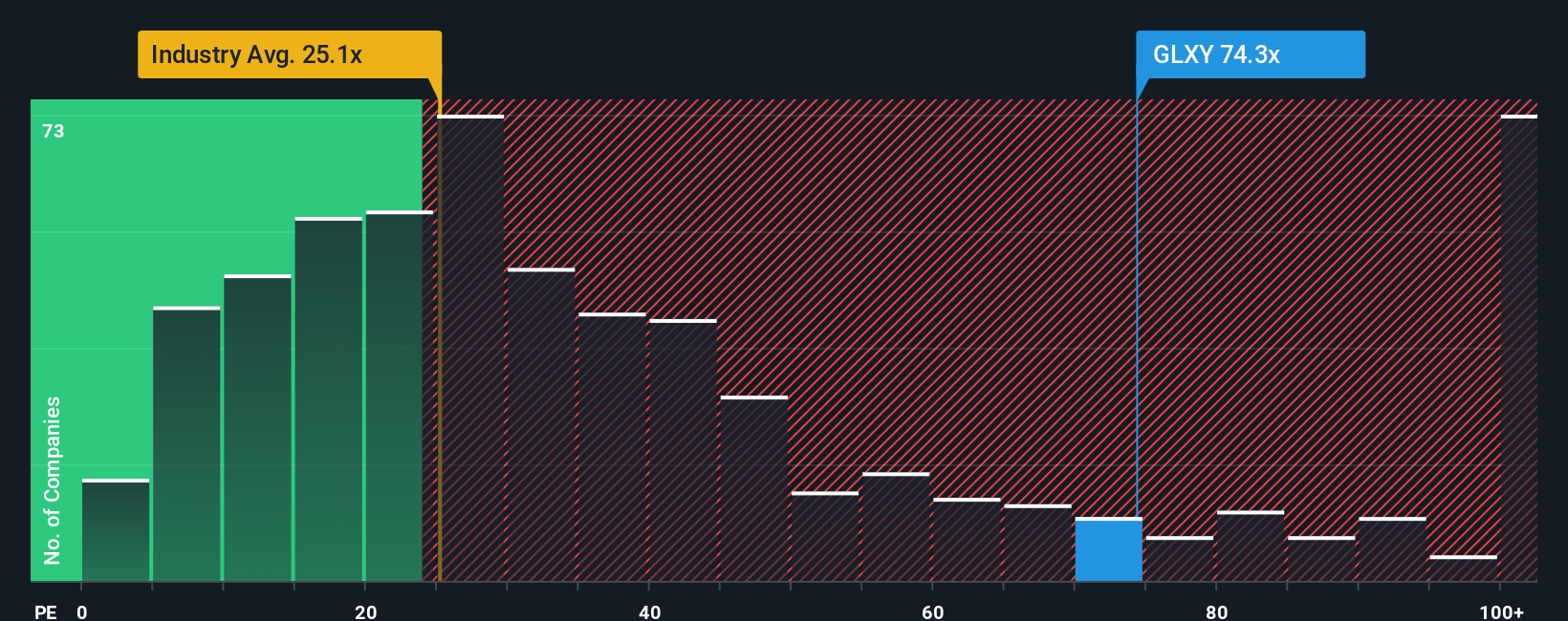

Those bullish narratives paint Galaxy Digital as nearly 50% undervalued, but a simple earnings lens tells a different story. At about 40 times earnings, versus a 25.6 times industry average and a fair ratio of 14.5 times, the stock looks stretched rather than cheap. If sentiment cools or growth underwhelms, that gap could unwind quickly.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Galaxy Digital Narrative

If this view does not quite fit your thesis, or you would rather dig into the numbers yourself, you can shape a fresh take in minutes, Do it your way.

A great starting point for your Galaxy Digital research is our analysis highlighting 1 key reward and 6 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before Galaxy Digital makes its next big move, consider lining up fresh stock ideas with solid fundamentals, growth momentum, and long-term staying power.

- Look for potential mispricings by targeting companies trading below their cash flow value using these 875 undervalued stocks based on cash flows, and position your portfolio for a potential re rating.

- Explore the AI theme by scanning these 25 AI penny stocks that combine strong growth characteristics with business models designed for scalable, data driven earnings.

- Enhance portfolio income by focusing on these 14 dividend stocks with yields > 3%, which can help provide stability while growth-oriented names like Galaxy Digital develop over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报