ASX Penny Stocks To Watch In January 2026

As the Australian market winds down for the year, with a slight dip attributed to profit-taking and holiday closures, investors are keeping an eye on precious metals and commodities. In this context, penny stocks—often representing smaller or newer companies—remain a relevant investment area due to their potential for growth at lower price points. By focusing on those with strong financials and solid fundamentals, investors may uncover opportunities that offer both stability and potential upside in an ever-evolving market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.395 | A$120.37M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.41 | A$68.28M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.77 | A$51.68M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.01 | A$453.39M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.10 | A$231.93M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.073 | A$39.45M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.00 | A$3.51B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.24 | A$1.37B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.805 | A$118.02M | ✅ 4 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.24 | A$122.75M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 417 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

ASF Group (ASX:AFA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ASF Group Limited is an investment and trading house engaged in the real estate, resources, technology, and financial sectors across Australia, Asia, and Europe with a market capitalization of A$47.54 million.

Operations: The company generates A$32.99 million in revenue from its investment and trading house activities.

Market Cap: A$47.54M

ASF Group Limited, with a market capitalization of A$47.54 million, has recently become profitable, marking a significant turnaround from its previous financial state. The company is debt-free and boasts an outstanding Return on Equity of 1515.5%, indicating efficient use of equity capital to generate profits. Despite its low revenue of A$246K suggesting pre-revenue status in some sectors, ASF's profitability and lack of shareholder dilution are positive indicators for potential investors. However, the highly volatile share price over the past three months could pose risks for those considering this investment opportunity in the penny stock space.

- Unlock comprehensive insights into our analysis of ASF Group stock in this financial health report.

- Evaluate ASF Group's historical performance by accessing our past performance report.

HMC Capital (ASX:HMC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: HMC Capital Limited, along with its subsidiaries, owns and manages real estate-focused funds in Australia and has a market capitalization of A$1.66 billion.

Operations: HMC Capital generates revenue through its distinct segments: Digital (A$84.1 million), Real Estate (A$79.8 million), Private Credit (A$42 million), and Private Equity (A$28.3 million).

Market Cap: A$1.66B

HMC Capital, with a market capitalization of A$1.66 billion, has experienced substantial earnings growth of 123.2% over the past year, surpassing industry averages. Despite this growth, its dividend yield of 2.98% is not well covered by free cash flows, and a significant one-off loss of A$70.4 million impacted recent financial results. The company has reduced its debt to equity ratio from 50% to 6.9% over five years and maintains more cash than total debt, indicating strong financial management. However, HMC was recently dropped from the S&P/ASX 200 Index as of December 2025.

- Dive into the specifics of HMC Capital here with our thorough balance sheet health report.

- Evaluate HMC Capital's prospects by accessing our earnings growth report.

Michael Hill International (ASX:MHJ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Michael Hill International Limited is a retailer specializing in the sale of jewellery and related services across Australia, New Zealand, and Canada, with a market cap of A$146.24 million.

Operations: The company generates revenue primarily from its jewellery and related services operations, amounting to A$645.31 million.

Market Cap: A$146.24M

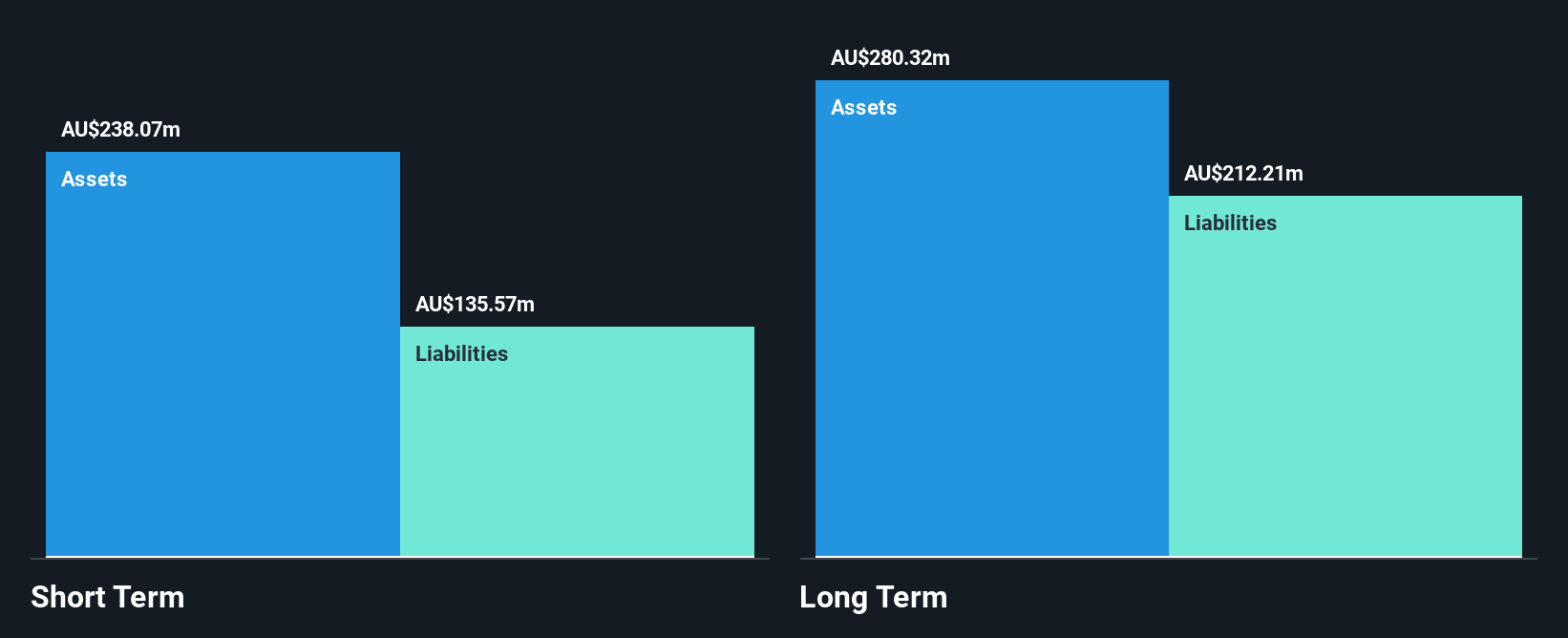

Michael Hill International, with a market cap of A$146.24 million, has recently transitioned to profitability, complicating comparisons with its historical earnings growth. The company’s short-term assets of A$238.1 million comfortably cover both short and long-term liabilities, though interest coverage remains below ideal levels at 2.7 times EBIT. Despite stable weekly volatility and satisfactory net debt to equity ratio (24.5%), the firm faces challenges such as a large one-off loss impacting recent results and low return on equity at 1.2%. Upcoming CFO Elodie Guillaumond's extensive experience may enhance financial strategy execution starting February 2026.

- Take a closer look at Michael Hill International's potential here in our financial health report.

- Explore Michael Hill International's analyst forecasts in our growth report.

Taking Advantage

- Click this link to deep-dive into the 417 companies within our ASX Penny Stocks screener.

- Curious About Other Options? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报