Amprius Technologies, Inc. (NYSE:AMPX) Stocks Pounded By 28% But Not Lagging Industry On Growth Or Pricing

Unfortunately for some shareholders, the Amprius Technologies, Inc. (NYSE:AMPX) share price has dived 28% in the last thirty days, prolonging recent pain. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 166% in the last twelve months.

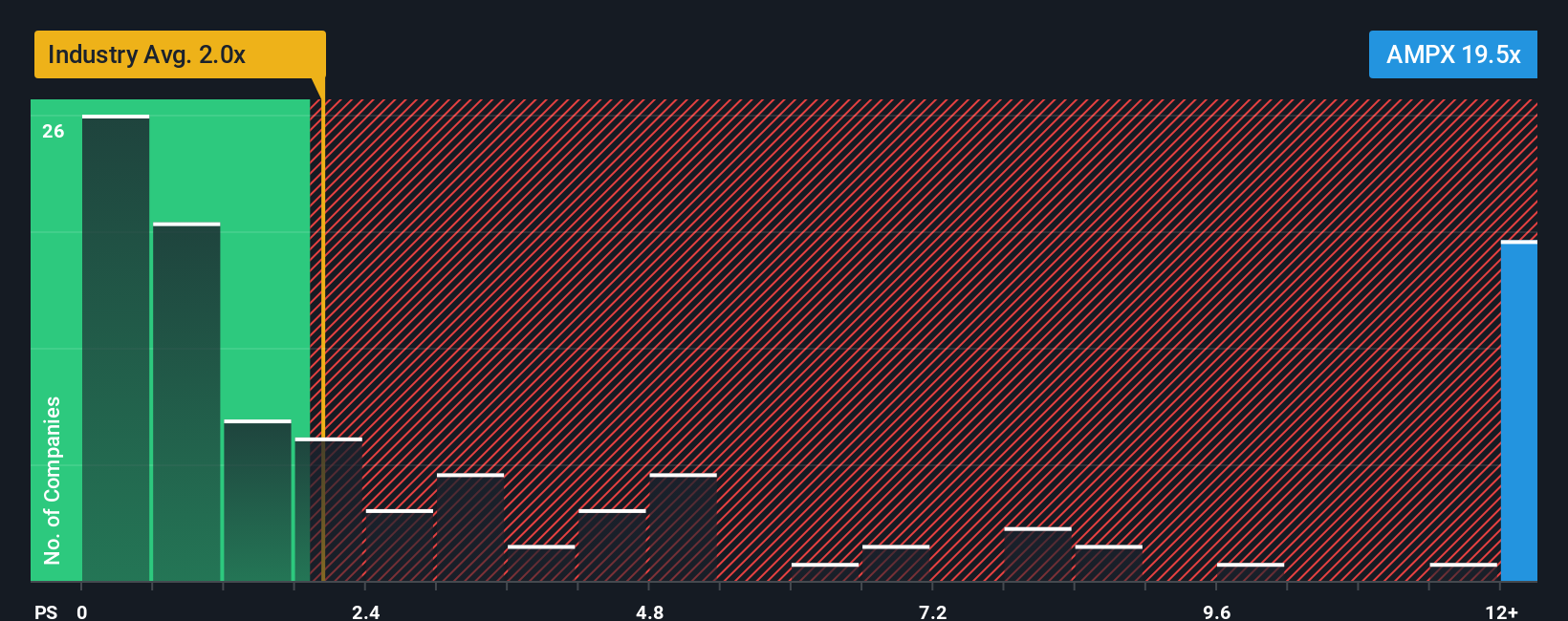

In spite of the heavy fall in price, when almost half of the companies in the United States' Electrical industry have price-to-sales ratios (or "P/S") below 2x, you may still consider Amprius Technologies as a stock not worth researching with its 19.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Amprius Technologies

What Does Amprius Technologies' P/S Mean For Shareholders?

Recent times have been advantageous for Amprius Technologies as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Amprius Technologies will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Amprius Technologies' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 234% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 83% each year during the coming three years according to the seven analysts following the company. With the industry only predicted to deliver 16% each year, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Amprius Technologies' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Even after such a strong price drop, Amprius Technologies' P/S still exceeds the industry median significantly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Amprius Technologies' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Amprius Technologies, and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报