EP Manufacturing Bhd (KLSE:EPMB) Stock Rockets 25% But Many Are Still Ignoring The Company

EP Manufacturing Bhd (KLSE:EPMB) shares have continued their recent momentum with a 25% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 14% over that time.

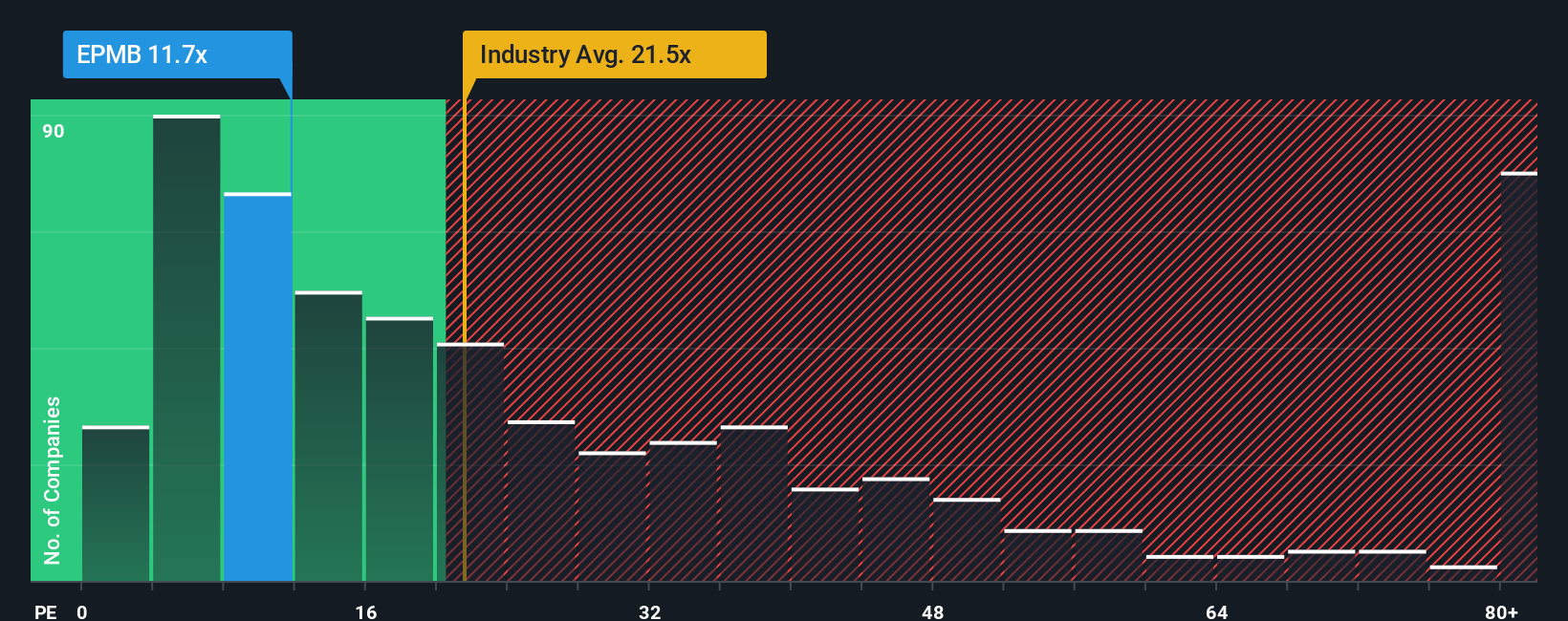

In spite of the firm bounce in price, given about half the companies in Malaysia have price-to-earnings ratios (or "P/E's") above 14x, you may still consider EP Manufacturing Bhd as an attractive investment with its 11.7x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

For example, consider that EP Manufacturing Bhd's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for EP Manufacturing Bhd

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, EP Manufacturing Bhd would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 22%. Still, the latest three year period has seen an excellent 885% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 15% shows it's noticeably more attractive on an annualised basis.

In light of this, it's peculiar that EP Manufacturing Bhd's P/E sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From EP Manufacturing Bhd's P/E?

The latest share price surge wasn't enough to lift EP Manufacturing Bhd's P/E close to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that EP Manufacturing Bhd currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with EP Manufacturing Bhd (at least 1 which is concerning), and understanding these should be part of your investment process.

If you're unsure about the strength of EP Manufacturing Bhd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报