Virgin Galactic Restructures Its Debt. How Bad Is This News, Exactly?

Key Points

Virgin Galactic has announced a plan to restructure its debt and sell more shares.

The goal is to push back the due date on debt until Virgin Galactic resumes space tourism flights.

The news struck like a thunderbolt, subtracting 16% from Virgin Galactic's (NYSE: SPCE) market capitalization in a matter of minutes.

On Dec. 9, space stock Virgin Galactic announced what it called a capital realignment, a plan to:

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

- Sell $46 million worth of new stock (that's about 12.1 million shares at the current share price), with attached warrants to buy stock.

- Place $203 million worth of "first lien notes" due in 2028 and paying 9.8% interest.

- Sweeten the deal on the debt placement by awarding lenders even more warrants to purchase stock "at an exercise price of 155% of the purchase price of the Shares."

Investors revolted, and a stock that had closed the previous day at $4.55 per share ended up trading closer to $3.81. Over the next three weeks, shares of the space stock continued to slide, closing last week at just $3.16 per share, more than 30% below its pre-"capital realignment" price.

But was the news really that bad?

Image source: Virgin Galactic.

Virgin Galactic's grand plan

As Virgin tells it, the goal of its capital realignment plan is to cut its debt load from $425 million to $273 million. With its current debt costing it about $13 million in annual interest expense, that might save the company some interest payments (or it may not; see below). Using new debt to roll over existing debt, Virgin should also be able to postpone the due date on most of its debt by about a year, to Dec. 31, 2028.

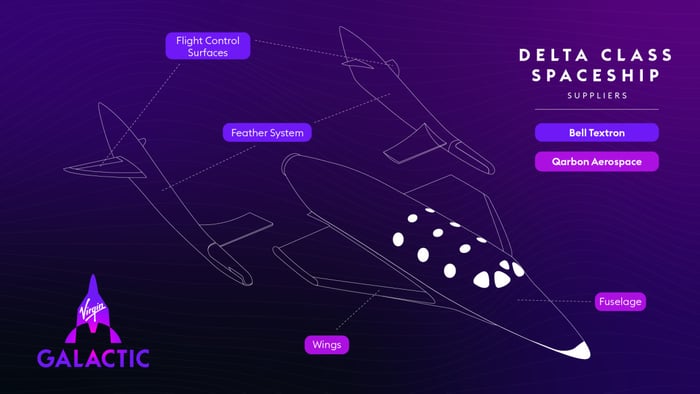

The hope is that, by that time, Virgin Galactic will have resumed commercial spaceflights with its new Delta-class spaceplane, carrying tourists to the edge of space and back. It will be generating revenue from the tourism flights, and will be able to use this revenue to pay the interest and pay down the principal on its loans.

As CEO Michael Colglazier explained in the company's third-quarter earnings report in November, Virgin hopes to begin flight testing its new spaceplane in Q3 2026, to resume commercial flights in fourth-quarter 2026, and to work through "most" of its backlog of space tourism tickets already sold by the end of 2027.

At last report, Virgin had sold approximately 800 tickets, mostly at prices in the $200,000 to $250,000 range, plus a few score more at prices closer to $450,000. Flying the customers who bought these tickets probably won't be enough to turn Virgin profitable in 2027. But by 2028, the plan is for Virgin Galactic to be selling new tickets for $600,000 apiece, flying about 750 passengers per year (aboard two Delta-class spaceplanes) -- and generating $450 million in revenue annually.

That might be enough to do the trick, allowing Virgin Galactic to earn a profit.

Profits -- versus profits per share

The big question for investors now is how big a share of that profit they can expect to enjoy. The fine print underlying the company's "capital realignment" plan is that it'll probably result in considerable share dilution for Virgin's current shareholders.

Speaking with the company's investor relations department last month, I was able to confirm that:

- Virgin Galactic had 63.2 million shares outstanding in November.

- It sold, or planned to sell, 10.6 million new shares at no less than $4.33 per share to raise the $45.6 million from share issuances.

- The warrants attached to the new debt it's issuing will be exercisable at $6.70, and will translate into at most 30.3 million new shares when exercised.

The upshot for investors

Add it all up, and we're looking at shares outstanding rising from 63.2 million today to 104.1 million when all's said and done. That works out to 65% dilution of the stake Virgin Galactic investors currently hold -- one big reason for investors to be upset by the news.

A second reason is that the new debt Virgin is issuing -- although it comes due a year later than the old debt it's replacing, which is a plus -- carries a 9.8% interest rate, which is significantly higher than the 2.5% interest rate paid on the convertible notes that Virgin will be retiring.

Thus, while the company's total debt load may decrease as a result of the debt rollover, it seems unlikely that interest payments will fall in tandem. On the contrary, interest costs will more likely rise after this "capital realignment." Indeed, if my math is right, they could as much as double.

Factor in the potential for plans to not unfold precisely as planned, for Delta-class spaceflights to be delayed, and for revenue to arrive later than expected, and I have to admit: I'm not at all optimistic about this capital realignment plan -- and I think investors are right to be selling Virgin Galactic stock.

Rich Smith has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Nasdaq

Nasdaq 华尔街日报

华尔街日报