TSX Opportunities: AKITA Drilling And 2 Other Promising Penny Stocks

The Canadian market has been navigating a complex landscape, with investors encouraged to diversify across sectors like energy, industrials, and materials for potential success in 2026. Amid these broader economic trends, penny stocks remain an intriguing option for those seeking affordable entry points into potentially high-growth companies. While the term "penny stocks" might seem outdated, their appeal endures as they often represent smaller or newer firms that can offer unique value and growth opportunities when backed by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.15 | CA$54.35M | ✅ 3 ⚠️ 4 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.33 | CA$253.93M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.20 | CA$120.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.415 | CA$3.47M | ✅ 2 ⚠️ 3 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.36 | CA$53.98M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.27 | CA$844.93M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.20 | CA$23.78M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.29 | CA$166.88M | ✅ 2 ⚠️ 1 View Analysis > |

| Caldwell Partners International (TSX:CWL) | CA$1.02 | CA$30.04M | ✅ 1 ⚠️ 4 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.97 | CA$186.41M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 385 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

AKITA Drilling (TSX:AKT.A)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AKITA Drilling Ltd. is an oil and gas drilling contractor operating in Canada and the United States, with a market cap of CA$80.69 million.

Operations: The company generates revenue from its Contract Drilling Services segment, amounting to CA$222.12 million.

Market Cap: CA$80.69M

AKITA Drilling Ltd. demonstrates potential as a penny stock with notable financial resilience and growth. The company has shown significant earnings growth, achieving a 957.1% increase over the past year, surpassing both its historical average and industry performance. Its debt management is prudent, with a reduced net debt to equity ratio of 15.2%, and operating cash flow comfortably covering its debt obligations at 97.9%. Recent board changes include the addition of Mr. Rob Symonds, bringing extensive industry experience that could bolster strategic direction. Despite some revenue decline in Q3, profits have improved year-over-year, reflecting operational efficiency improvements.

- Click here to discover the nuances of AKITA Drilling with our detailed analytical financial health report.

- Gain insights into AKITA Drilling's outlook and expected performance with our report on the company's earnings estimates.

Panoro Minerals (TSXV:PML)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Panoro Minerals Ltd. is an exploration-stage company focused on the acquisition, exploration, and development of mineral properties in Peru, with a market cap of CA$108.30 million.

Operations: Panoro Minerals Ltd., an exploration-stage company, does not report any revenue segments as it focuses on developing mineral properties in Peru.

Market Cap: CA$108.3M

Panoro Minerals Ltd. is a pre-revenue exploration-stage company with a market cap of CA$108.30 million, focusing on mineral properties in Peru. Despite its unprofitable status, the company has managed to reduce its losses by 11.9% annually over five years and maintains a satisfactory net debt to equity ratio of 3.6%. Recent private placements raised CA$520,000, enhancing financial flexibility amid high share price volatility and inadequate short-term asset coverage for liabilities. The seasoned management team and board may provide strategic stability as Panoro navigates the challenges typical of penny stocks in the mining sector.

- Click here and access our complete financial health analysis report to understand the dynamics of Panoro Minerals.

- Assess Panoro Minerals' previous results with our detailed historical performance reports.

WonderFi Technologies (TSX:WNDR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: WonderFi Technologies Inc, with a market cap of CA$199.38 million, develops and acquires technology platforms to facilitate investments in the digital assets industry.

Operations: The company's revenue is primarily generated from its Trading segment, which accounts for CA$56.30 million.

Market Cap: CA$199.38M

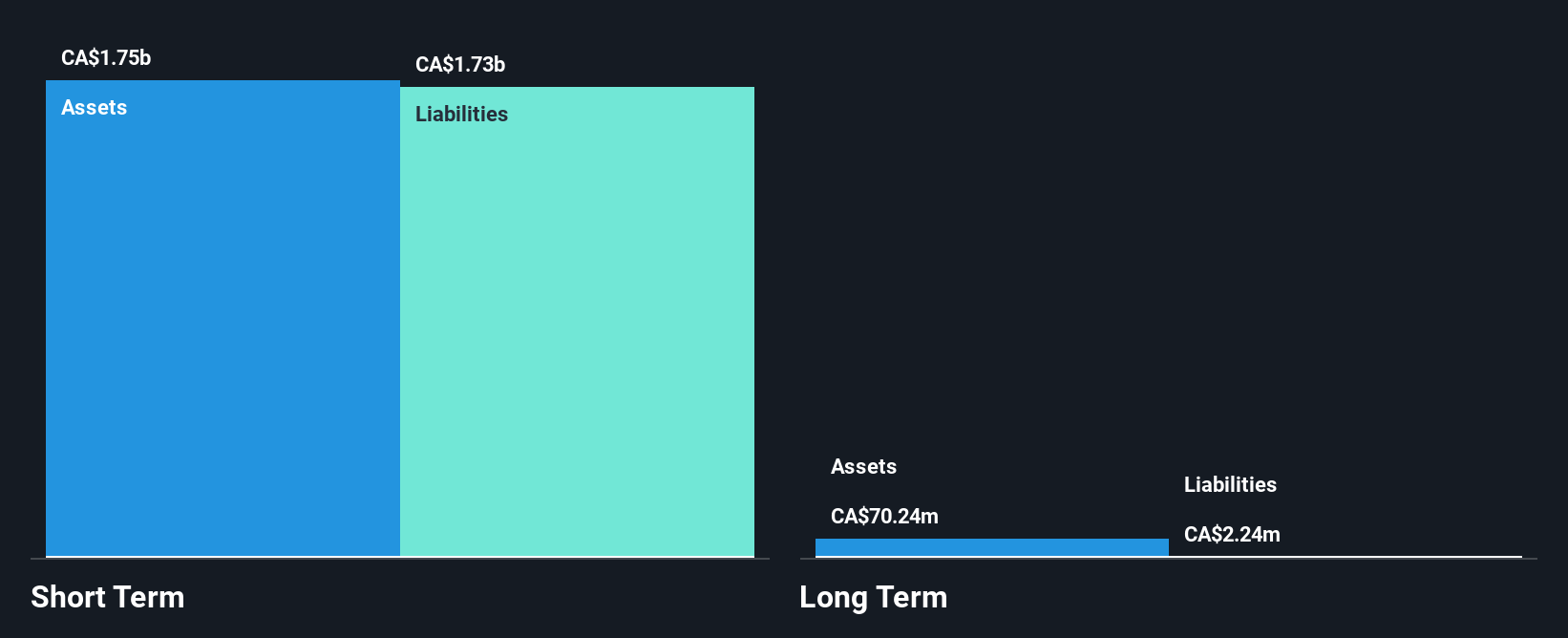

WonderFi Technologies Inc., with a market cap of CA$199.38 million, is navigating the volatile penny stock landscape with mixed financial indicators. The company reported third-quarter sales of CA$10.89 million, up from CA$6.9 million the previous year, yet it remains unprofitable with a net loss of CA$10.22 million for the quarter. Despite having more cash than total debt and short-term assets exceeding liabilities, WonderFi's negative return on equity and insufficient cash runway highlight financial challenges. Revenue growth is forecast at 5.88% annually; however, profitability remains elusive as losses have increased significantly over five years.

- Take a closer look at WonderFi Technologies' potential here in our financial health report.

- Evaluate WonderFi Technologies' prospects by accessing our earnings growth report.

Where To Now?

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 382 more companies for you to explore.Click here to unveil our expertly curated list of 385 TSX Penny Stocks.

- Want To Explore Some Alternatives? Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报