Dear Datavault Stock Fans, Mark Your Calendars for January 7

Datavault AI (DVLT) stock closed more than 20% higher on Dec. 31 after the artificial intelligence (AI) data science firm confirmed plans of issuing a special dividend in the form of warrants.

DVLT has announced Jan. 7 as the record date but is yet to reveal the distribution date. According to its press release, each of these warrants will carry a strike price of $5 and be exercisable for cash.

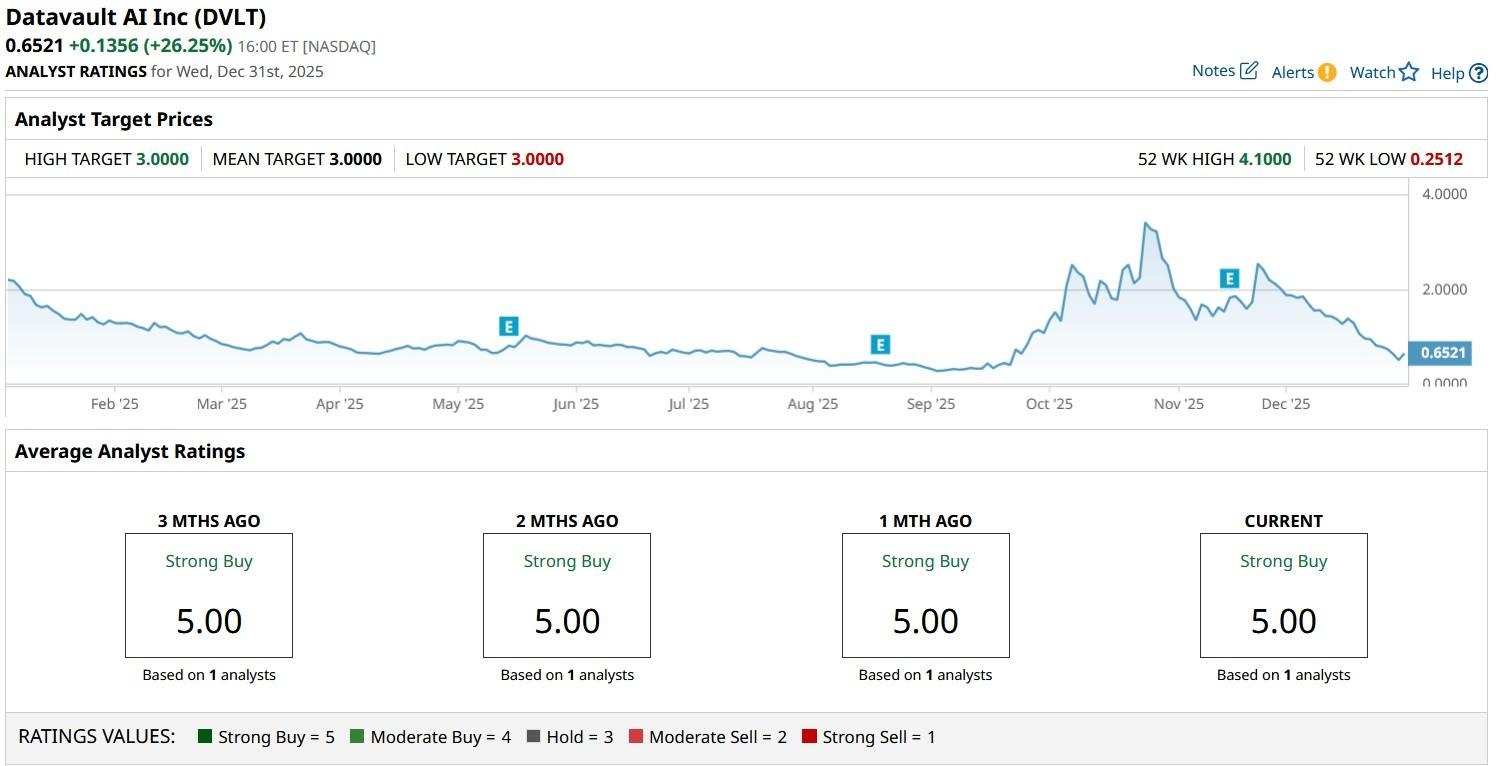

Despite today’s surge, Datavault stock is trading about 80% below its 52-week high set in October 2025.

Significance of Special Dividend for Datavault Stock

DVLT shares soared on the special dividend announcement as it signals management’s confidence in the company’s long-term prospects.

A strike price of $5 on the to-be issued warrants reassures investors that insiders see massive upside ahead. Plus, since these warrants are exercisable for cash only, Datavault AI doesn’t run a risk of dilution either.

All in all, the announcement may help stabilize sentiment after recent volatility – offering existing shareholders a tangible incentive to remain invested.

If DVLT paired it with significant updates at the CES, 2026 may just mark a turning point for its battered equity narrative.

Are DVLT Shares Worth Buying for 2026?

While Datavault AI remains in the penny stock territory, which makes it a high-risk bet, there’s reason to believe that it will prove a high-reward investment instead over time.

For starters, the Nasdaq-listed firm is growing at an exceptional pace. In the latest reported quarter, DVLT saw its revenue soar nearly 150% on a year-over-year basis to $1.17 million.

Moreover, the company’s forward-looking partnerships like the “Dream Bowl” broadcast deal signal significant monetization potential.

In terms of technicals, the AI stock has its near-term relative strength index (14-day) at roughly 38 currently, indicating bearish momentum is now coming to a halt.

Datavault AI Seen Rallying to $3 This Year

DVLT stock currently receives coverage from one Wall Street analyst only, which isn’t particularly a beacon of strong institutional confidence.

However, investors could take heart in the fact that that one analyst at least rates it at “Strong Buy” with a price target of $3, indicating potential upside of more than 250% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Nasdaq

Nasdaq 华尔街日报

华尔街日报