3 Undervalued Small Caps In Global With Insider Buying

As global markets navigate a complex landscape marked by record highs in major indices and fluctuating consumer confidence, small-cap stocks have shown mixed performance with the Russell 2000 Index inching up slightly. In this environment, identifying promising small-cap opportunities often involves looking for companies with strong fundamentals and insider buying activity, which can signal potential confidence from those closest to the business.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| A.G. BARR | 14.2x | 1.6x | 48.96% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 41.52% | ★★★★★☆ |

| Eurocell | 17.0x | 0.3x | 38.26% | ★★★★☆☆ |

| BWP Trust | 10.6x | 13.8x | 14.34% | ★★★★☆☆ |

| Gooch & Housego | 46.2x | 1.1x | 23.11% | ★★★☆☆☆ |

| Dicker Data | 22.5x | 0.8x | -47.39% | ★★★☆☆☆ |

| Vita Life Sciences | 15.1x | 1.6x | 36.32% | ★★★☆☆☆ |

| Amaero | NA | 68.7x | 27.37% | ★★★☆☆☆ |

| Betr Entertainment | NA | 1.6x | 5.32% | ★★★☆☆☆ |

| CVS Group | 48.1x | 1.3x | 23.06% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

Marston's (LSE:MARS)

Simply Wall St Value Rating: ★★★★★★

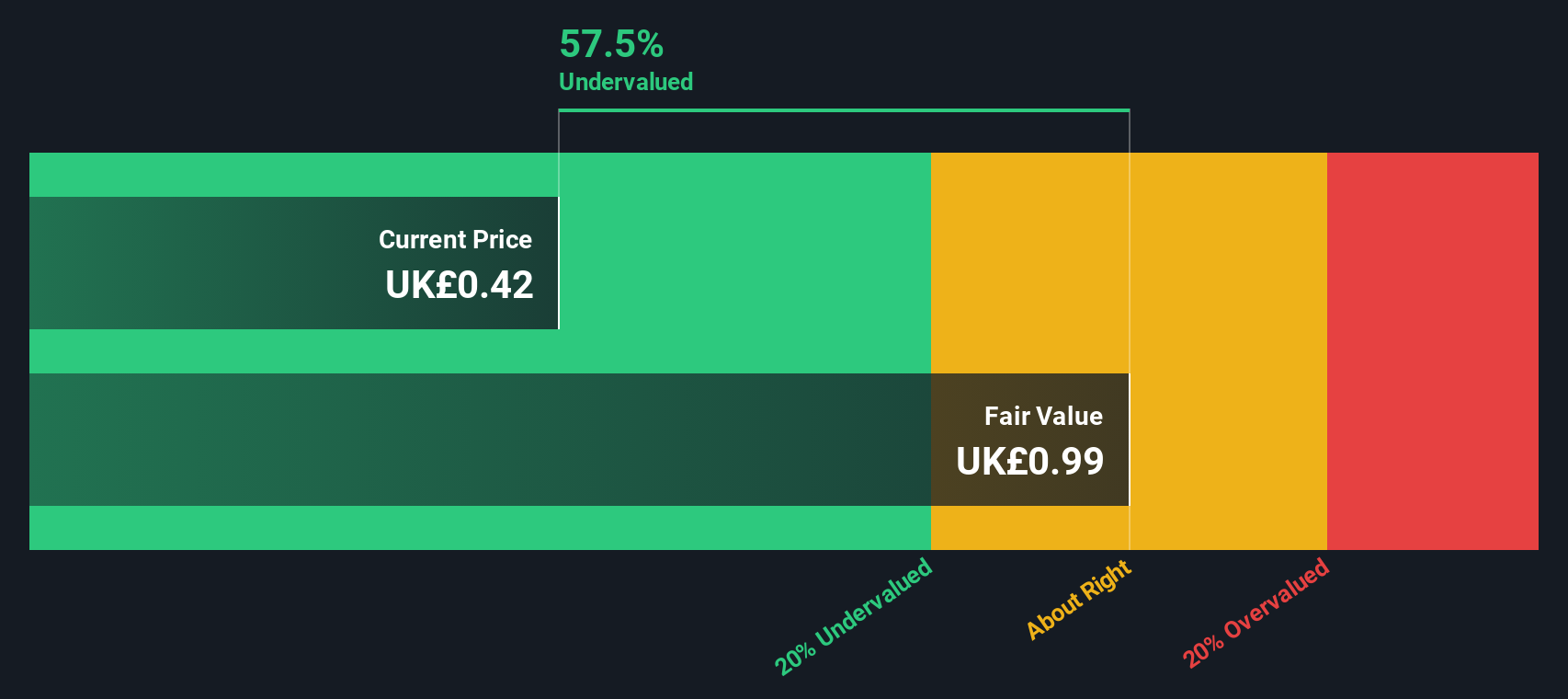

Overview: Marston's operates a chain of restaurants with a market capitalization of £0.42 billion.

Operations: The company generates revenue primarily from its restaurant operations, with a recent quarterly revenue of £897.9 million. The cost of goods sold (COGS) for the same period was £414.3 million, resulting in a gross profit margin of 53.86%. Operating expenses and non-operating expenses are significant components impacting net income, which recently stood at £71.6 million with a net income margin of 7.97%.

PE: 5.2x

Marston's, a smaller company in the hospitality sector, recently reported a turnaround with a net income of £71.6 million for the year ending September 27, 2025, compared to a net loss previously. This improvement is reflected in their earnings per share rising from losses to £0.113. Despite relying on external borrowing for funding, which carries higher risk without customer deposits as buffers, insider confidence was evident with share purchases made over the past year. These dynamics suggest potential growth opportunities amidst financial restructuring efforts.

- Get an in-depth perspective on Marston's performance by reading our valuation report here.

Assess Marston's past performance with our detailed historical performance reports.

Property For Industry (NZSE:PFI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Property For Industry is a company focused on property investment and management, with a market capitalization of NZ$1.88 billion.

Operations: PFI's revenue primarily stems from property investment and management, generating NZ$127.46 million. The company experienced fluctuations in its net income margin, with a recent figure of 0.83%. Operating expenses were recorded at NZ$11.16 million, while the gross profit margin stood at 82.82%.

PE: 11.3x

Property For Industry, a smaller company in the investment landscape, shows potential for growth with earnings forecasted to increase by 4.51% annually. However, its financial position is strained as interest payments aren't well covered by current earnings and funding relies entirely on external borrowing. Insider confidence is evident with Jeremy Simpson's recent purchase of 40,000 shares valued at NZ$99,400 in late 2025. Recent board changes include Angela Bull's appointment to the Audit and Risk Committee following Mr. Beverley's retirement.

Lassonde Industries (TSX:LAS.A)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Lassonde Industries is a Canadian company primarily engaged in the production and marketing of non-alcoholic beverages, with a market cap of CA$1.24 billion.

Operations: The company generates revenue primarily from non-alcoholic beverages, with the latest reported revenue at CA$2.90 billion. Over recent periods, the gross profit margin has shown fluctuations, reaching 26.50% in the most recent data point. Operating expenses have consistently been a significant cost component, contributing to overall financial performance dynamics.

PE: 12.2x

Lassonde Industries, a smaller player in its sector, recently reported third-quarter sales of C$723.85 million, up from C$668.27 million the previous year, with net income rising to C$36.84 million from C$29.65 million. Insider confidence is evident with recent stock purchases by key figures within the company this quarter, suggesting optimism about future prospects despite high debt levels and reliance on external borrowing. The firm anticipates over 10% sales growth for 2025 driven by strategic initiatives and market dynamics like the "Buy Canadian" sentiment and U.S. demand strategies.

Turning Ideas Into Actions

- Take a closer look at our Undervalued Global Small Caps With Insider Buying list of 147 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报