Undiscovered Gems in Global Markets to Watch January 2026

As global markets close out 2025, the U.S. economy is showcasing its strongest growth in two years, with major indices like the S&P 500 and Dow Jones Industrial Average reaching record highs, fueled by optimism around artificial intelligence and robust consumer spending. Despite this upbeat sentiment, small-cap stocks represented by the Russell 2000 Index have lagged slightly behind their larger counterparts, highlighting potential opportunities for investors to explore lesser-known companies that could benefit from economic tailwinds and emerging market trends. In such an environment, identifying undiscovered gems involves looking for stocks with strong fundamentals and growth potential that align well with these broader economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Shenzhen Coship Electronics | NA | 34.28% | 60.52% | ★★★★★★ |

| Hangzhou Hirisun Technology | NA | -9.43% | -21.49% | ★★★★★★ |

| YH Entertainment Group | 4.44% | -11.47% | -43.36% | ★★★★★★ |

| Yibin City Commercial Bank | 82.57% | -1.19% | 15.94% | ★★★★★★ |

| Daoming Optics&ChemicalLtd | 22.31% | 2.92% | 8.35% | ★★★★★☆ |

| Nanjing Well Pharmaceutical GroupLtd | 33.54% | 10.14% | 9.90% | ★★★★★☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

| Tibet TourismLtd | 21.50% | 10.05% | 27.69% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

HYUNDAI MOVEX (KOSDAQ:A319400)

Simply Wall St Value Rating: ★★★★★★

Overview: HYUNDAI MOVEX Co., Ltd. engages in IT and logistics system operations both domestically and internationally, with a market cap of ₩2.06 trillion.

Operations: HYUNDAI MOVEX generates revenue primarily from its logistics segment, contributing ₩406.19 billion, and the IT sector, which adds ₩25.34 billion. The company has a market cap of ₩2.06 trillion.

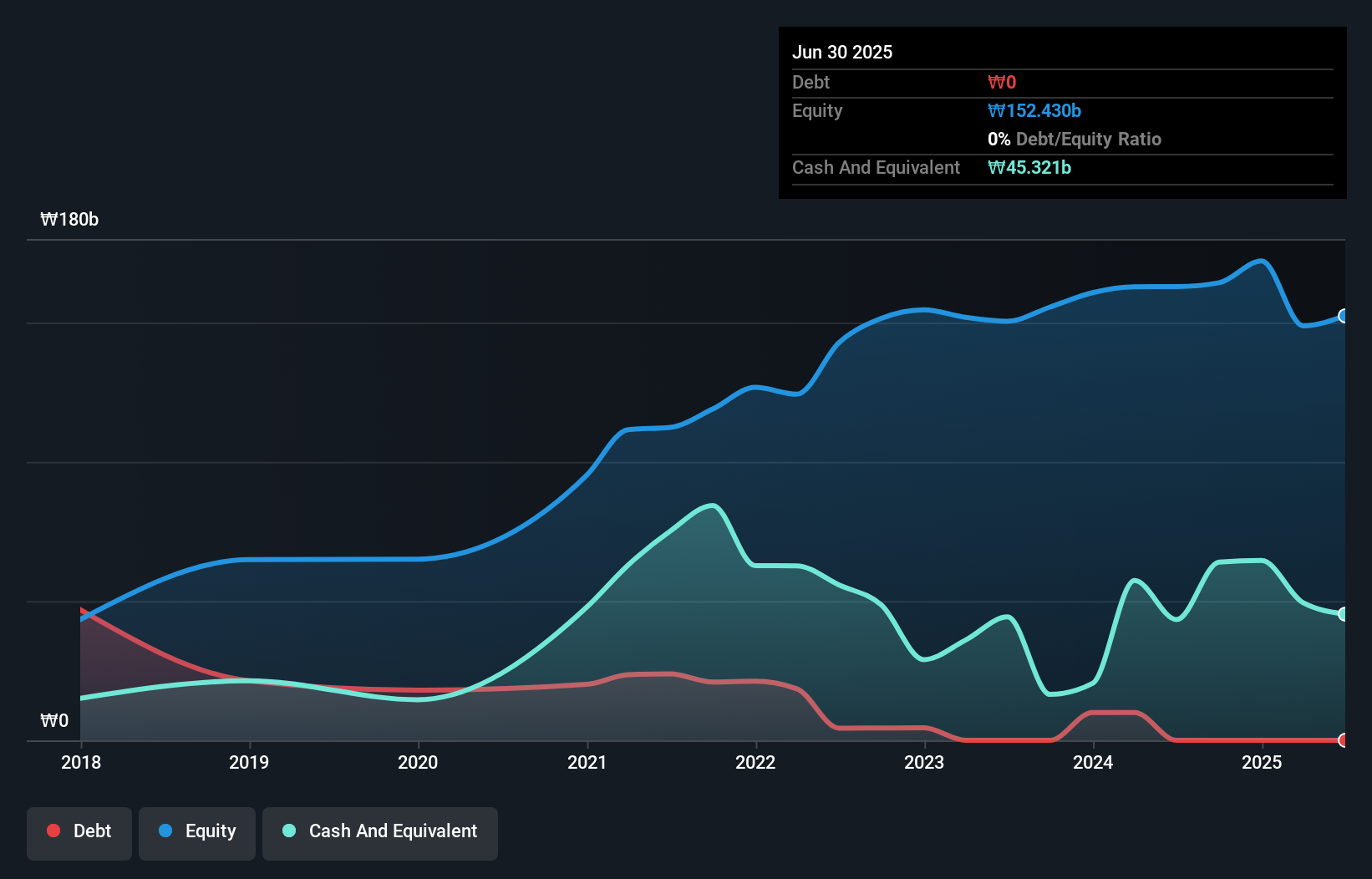

Hyundai Movex, a nimble player in its industry, showcases promising financial health with no debt as of now, compared to a 22.3% debt-to-equity ratio five years ago. The company reported sales of KRW 103.48 million for Q3 2025, up from KRW 83.96 million the previous year, while net income rose to KRW 5 million from KRW 4.58 million over the same period. Despite its volatile share price recently, Hyundai Movex's earnings have grown by an impressive 65.2% over the past year and are projected to continue growing at an annual rate of 18.58%.

- Click here and access our complete health analysis report to understand the dynamics of HYUNDAI MOVEX.

Assess HYUNDAI MOVEX's past performance with our detailed historical performance reports.

C Sun Mfg (TWSE:2467)

Simply Wall St Value Rating: ★★★★☆☆

Overview: C Sun Mfg Ltd., along with its subsidiaries, offers a range of processing equipment across Taiwan, China, and international markets, with a market capitalization of NT$37.77 billion.

Operations: C Sun Mfg Ltd. generates revenue primarily through its subsidiaries, with Suzhou Top Creation Machines Co Ltd. contributing NT$1.83 billion and C Sun Manufacturing LTD adding NT$1.03 billion to the total revenue stream.

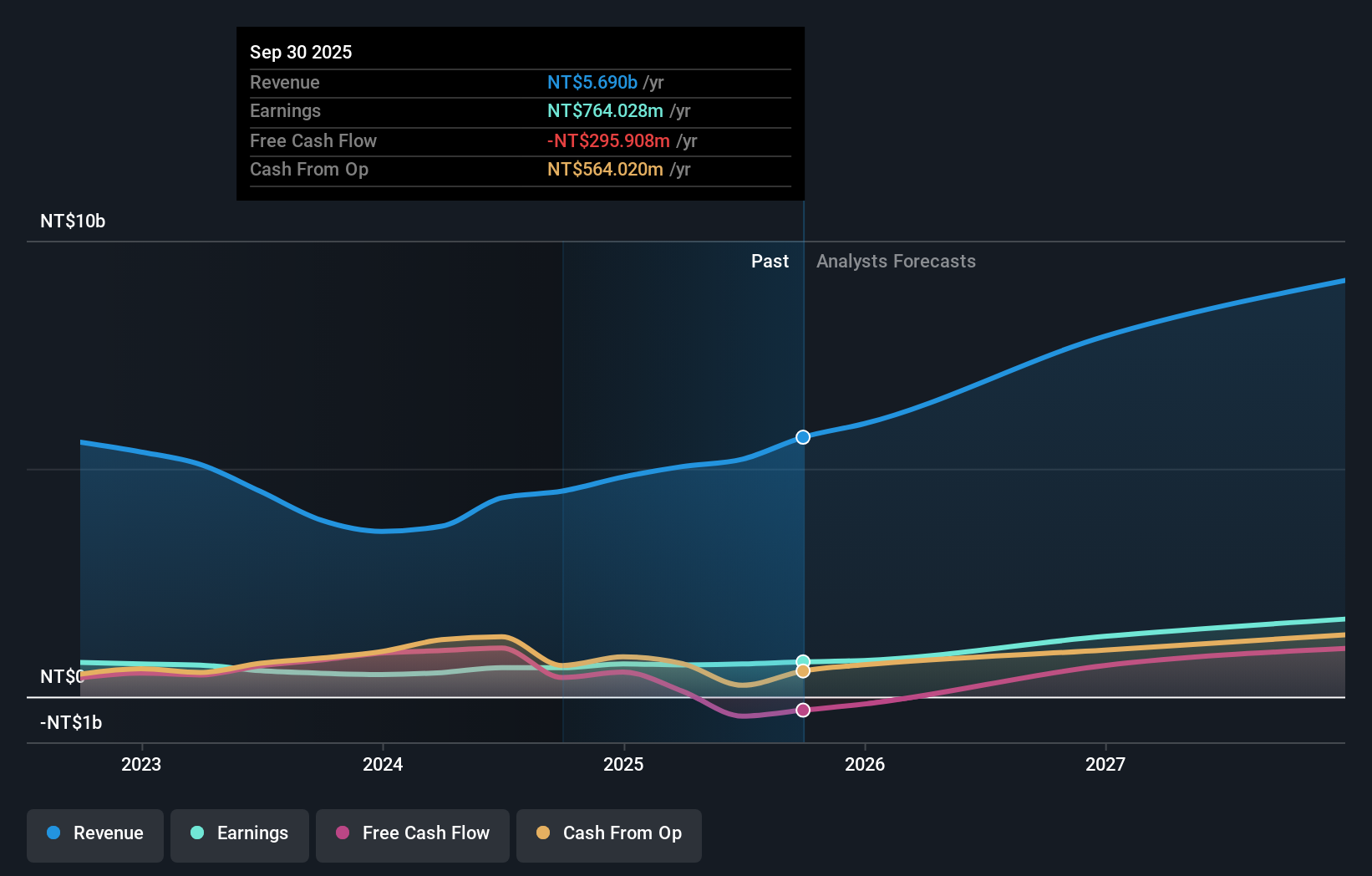

C Sun Mfg, a smaller player in the machinery sector, has shown impressive earnings growth of 20.5% over the past year, outpacing its industry. Despite this progress, the company doesn't generate positive free cash flow yet and has seen its debt-to-equity ratio increase from 51.5% to 61.8% over five years. Recent financials reflect a solid performance with Q3 sales reaching TWD 1,536 million compared to TWD 1,054 million last year and net income rising to TWD 212 million from TWD 165 million. Earnings per share improved as well, indicating robust operational efficiency amidst volatility in its share price recently.

Daxin Materials (TWSE:5234)

Simply Wall St Value Rating: ★★★★★☆

Overview: Daxin Materials Corporation focuses on the research, development, production, and sale of display and semiconductor specialty chemicals across Taiwan, China, Japan, and international markets with a market capitalization of approximately NT$35.64 billion.

Operations: The primary revenue stream for Daxin Materials comes from the manufacturing and sales of chemical materials for the optoelectronic industry, generating approximately NT$4.51 billion. The company has a market capitalization of about NT$35.64 billion.

Daxin Materials, a nimble player in the chemicals sector, showcased notable financial performance with third-quarter sales reaching TWD 1.19 billion, up from TWD 1.07 billion last year. Net income jumped to TWD 195.75 million from TWD 133.14 million, reflecting robust earnings growth of 45.6%, significantly outpacing the industry’s -1.6%. The company enjoys high-quality earnings and maintains more cash than its total debt, indicating sound financial health despite a rising debt-to-equity ratio from 7.6% to 8.5% over five years. With positive free cash flow and interest well-covered by profits, Daxin appears poised for continued stability and potential growth opportunities in its field.

- Dive into the specifics of Daxin Materials here with our thorough health report.

Evaluate Daxin Materials' historical performance by accessing our past performance report.

Summing It All Up

- Click here to access our complete index of 2995 Global Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报