Zarneni Hrani Bulgaria AD's (BUL:ZHBG) 48% Dip In Price Shows Sentiment Is Matching Earnings

Zarneni Hrani Bulgaria AD (BUL:ZHBG) shareholders that were waiting for something to happen have been dealt a blow with a 48% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 50% share price decline.

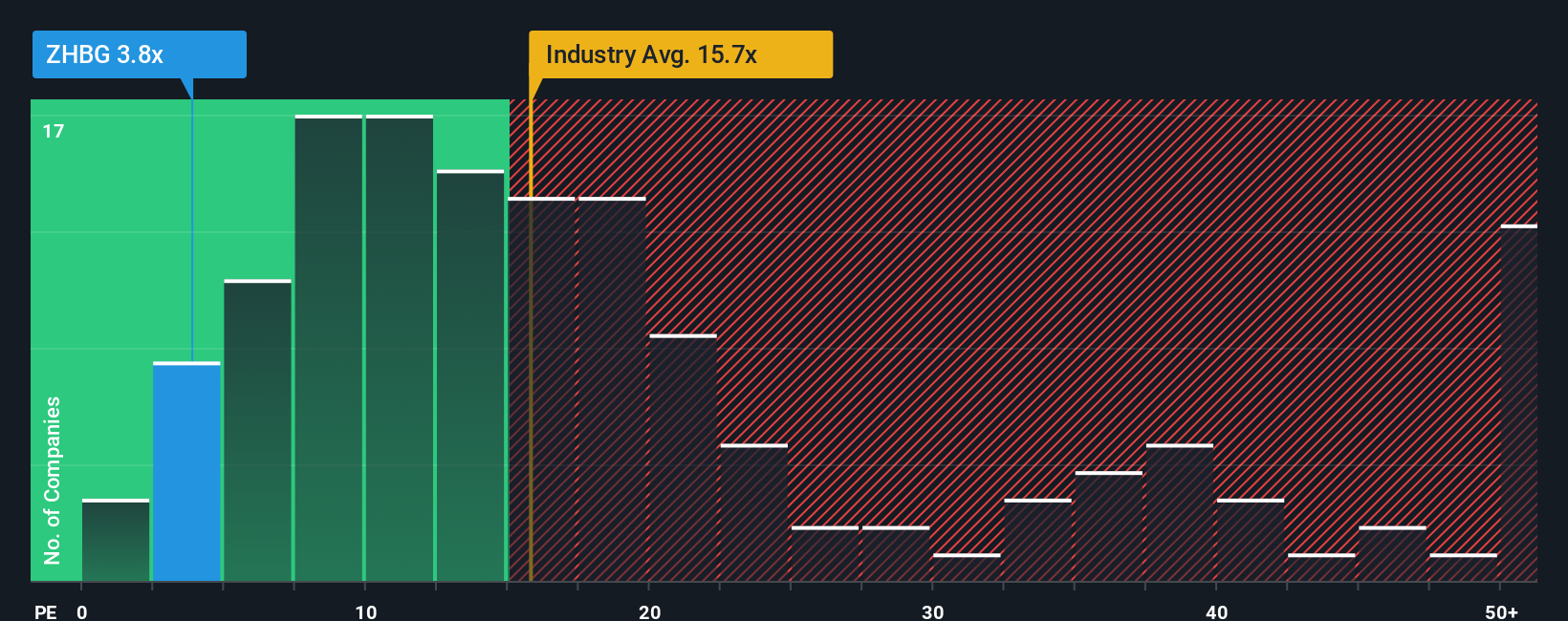

Following the heavy fall in price, Zarneni Hrani Bulgaria AD's price-to-earnings (or "P/E") ratio of 3.8x might make it look like a strong buy right now compared to the market in Bulgaria, where around half of the companies have P/E ratios above 12x and even P/E's above 28x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

For instance, Zarneni Hrani Bulgaria AD's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for Zarneni Hrani Bulgaria AD

How Is Zarneni Hrani Bulgaria AD's Growth Trending?

Zarneni Hrani Bulgaria AD's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Retrospectively, the last year delivered a frustrating 32% decrease to the company's bottom line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 13% overall rise in EPS. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the market, which is expected to grow by 21% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why Zarneni Hrani Bulgaria AD is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Shares in Zarneni Hrani Bulgaria AD have plummeted and its P/E is now low enough to touch the ground. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Zarneni Hrani Bulgaria AD revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Zarneni Hrani Bulgaria AD (1 shouldn't be ignored!) that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报