3 Asian Stocks Estimated To Be Trading At Discounts Of Up To 31.6%

As Asian markets navigate a landscape marked by cautious optimism, with indices like Japan's Nikkei 225 and China's CSI 300 showing gains amid global economic shifts, investors are increasingly on the lookout for opportunities that may be undervalued. In this context, identifying stocks that are trading at a discount can offer potential value plays, especially when broader market sentiment is buoyed by technological advancements and economic resilience in key regions.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Visional (TSE:4194) | ¥10010.00 | ¥19860.82 | 49.6% |

| Takara Bio (TSE:4974) | ¥795.00 | ¥1578.87 | 49.6% |

| Nan Juen International (TPEX:6584) | NT$347.00 | NT$687.14 | 49.5% |

| Kuraray (TSE:3405) | ¥1587.00 | ¥3166.05 | 49.9% |

| JINS HOLDINGS (TSE:3046) | ¥5530.00 | ¥11054.20 | 50% |

| Innovent Biologics (SEHK:1801) | HK$76.25 | HK$151.11 | 49.5% |

| Forth Corporation (SET:FORTH) | THB5.75 | THB11.22 | 48.7% |

| Daiichi Sankyo Company (TSE:4568) | ¥3348.00 | ¥6544.37 | 48.8% |

| CURVES HOLDINGS (TSE:7085) | ¥801.00 | ¥1583.80 | 49.4% |

| Aidma Holdings (TSE:7373) | ¥3160.00 | ¥6305.80 | 49.9% |

Underneath we present a selection of stocks filtered out by our screen.

WON TECHLtd (KOSDAQ:A336570)

Overview: WON TECH Co.,Ltd. produces and sells laser and energy-based equipment both in South Korea and internationally, with a market cap of approximately ₩697.23 billion.

Operations: The company's revenue primarily comes from its Surgical & Medical segment, generating approximately ₩147.26 billion.

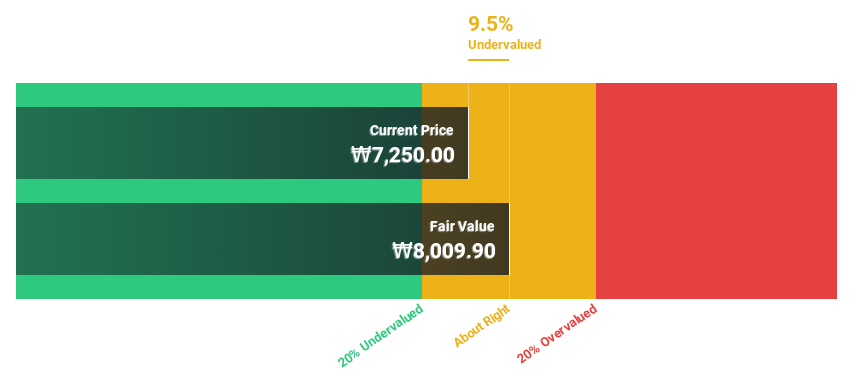

Estimated Discount To Fair Value: 31.6%

WON TECH Ltd. appears undervalued based on cash flow analysis, trading at ₩7,750, which is 31.6% below its estimated fair value of ₩11,330.73. The company has completed a share buyback worth KRW 5,999.82 million, potentially enhancing shareholder value. Revenue growth is expected to outpace the market at 17.9% annually, with earnings forecasted to grow significantly over the next three years despite being slower than overall market expectations in Korea.

- In light of our recent growth report, it seems possible that WON TECHLtd's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in WON TECHLtd's balance sheet health report.

HAESUNG DS (KOSE:A195870)

Overview: HAESUNG DS Co., Ltd. manufactures and sells semiconductor components in South Korea and internationally, with a market cap of ₩946.90 billion.

Operations: Revenue Segments (in millions of ₩):

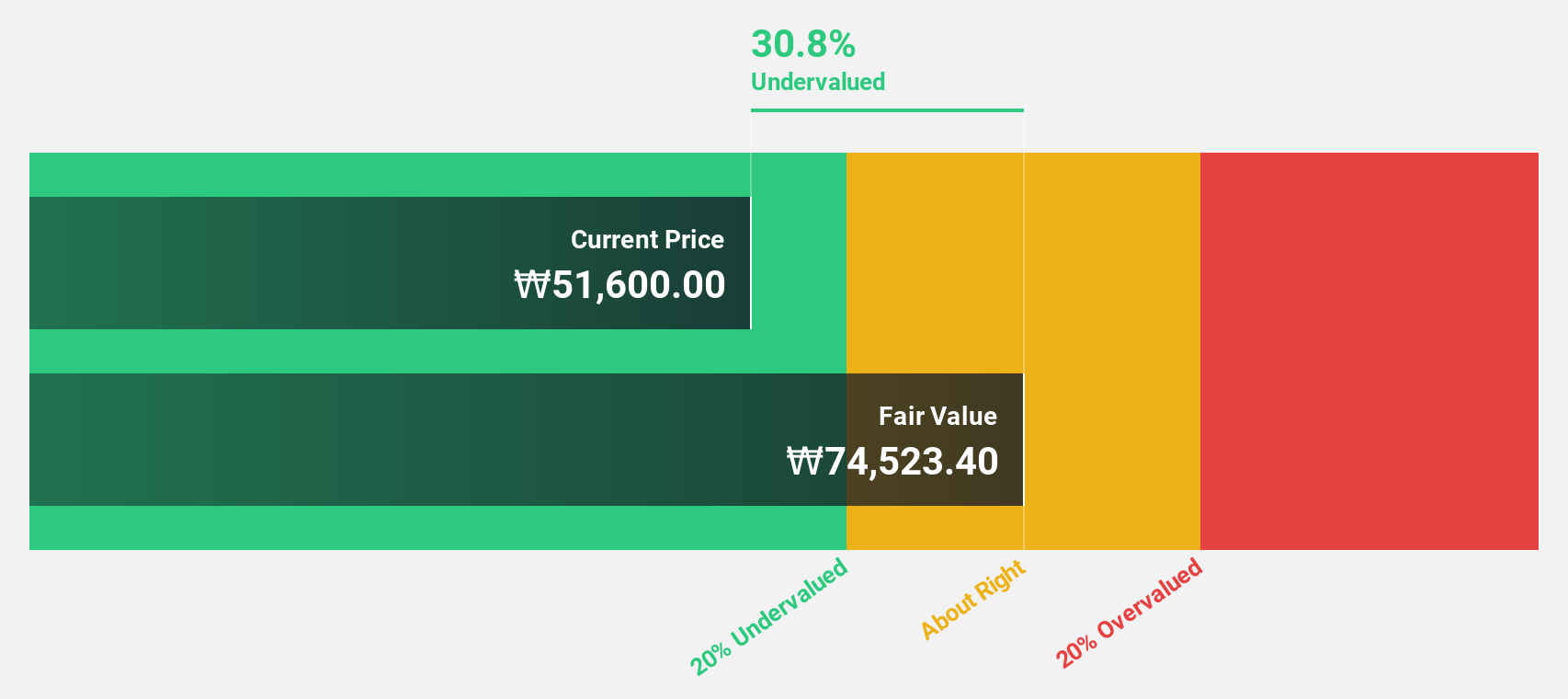

Estimated Discount To Fair Value: 20.2%

HAESUNG DS is trading at ₩55,700, more than 20% below its estimated fair value of ₩69,766.3. Despite a volatile share price recently and profit margins declining to 4.3% from last year's 9.5%, earnings are forecasted to grow significantly at 53.1% annually, outpacing the Korean market's growth rate of 30.9%. However, the dividend yield of 1.44% is not well covered by free cash flows and Return on Equity is expected to be low at 12.3%.

- According our earnings growth report, there's an indication that HAESUNG DS might be ready to expand.

- Click here to discover the nuances of HAESUNG DS with our detailed financial health report.

Zylox-Tonbridge Medical Technology (SEHK:2190)

Overview: Zylox-Tonbridge Medical Technology Co., Ltd. is a medical device company that offers neuro- and peripheral-vascular interventional devices in China and internationally, with a market cap of HK$7.79 billion.

Operations: The company generates revenue from the sale of neurovascular and peripheral-vascular interventional surgical devices, amounting to CN¥898.46 million.

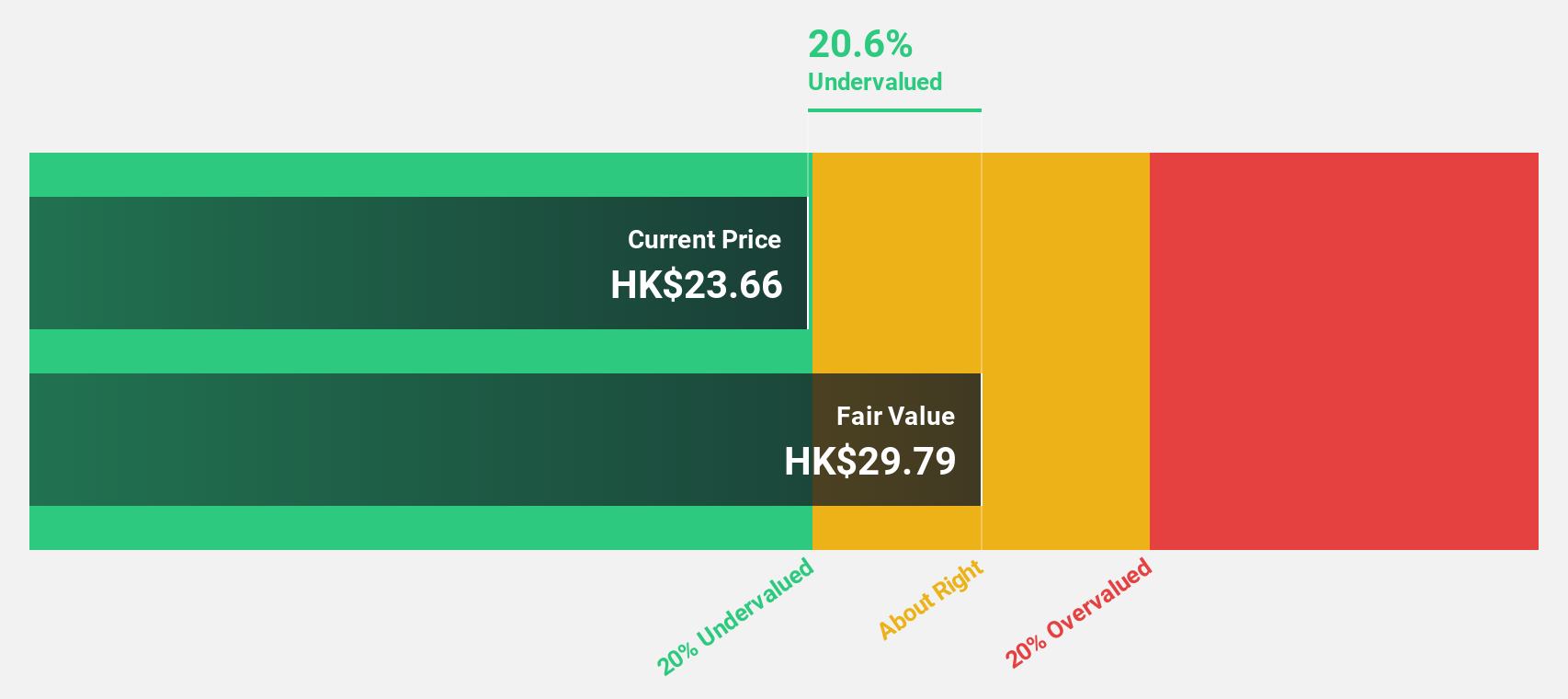

Estimated Discount To Fair Value: 26%

Zylox-Tonbridge Medical Technology is trading at HK$23.1, over 20% below its estimated fair value of HK$31.21, suggesting potential undervaluation based on cash flows. Despite significant insider selling recently, earnings are projected to grow at 36.3% annually, surpassing the Hong Kong market's growth rate of 11.8%. However, Return on Equity is forecasted to remain low at 9.6%. Recent amendments in share capital reflect strategic adjustments benefiting shareholders overall.

- The analysis detailed in our Zylox-Tonbridge Medical Technology growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Zylox-Tonbridge Medical Technology stock in this financial health report.

Key Takeaways

- Investigate our full lineup of 260 Undervalued Asian Stocks Based On Cash Flows right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报