High Growth Tech Stocks In Asia To Watch January 2026

As the global market landscape continues to evolve, Asian tech stocks are capturing attention, particularly amidst a backdrop of optimism around artificial intelligence and steady economic growth in key regions like Japan and China. In this environment, identifying high-growth tech stocks involves looking for companies that are well-positioned to leverage technological advancements and robust economic indicators while navigating broader market sentiments.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 36.73% | 37.89% | ★★★★★★ |

| Zhongji Innolight | 35.08% | 35.94% | ★★★★★★ |

| Fositek | 37.11% | 51.61% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.94% | 32.84% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

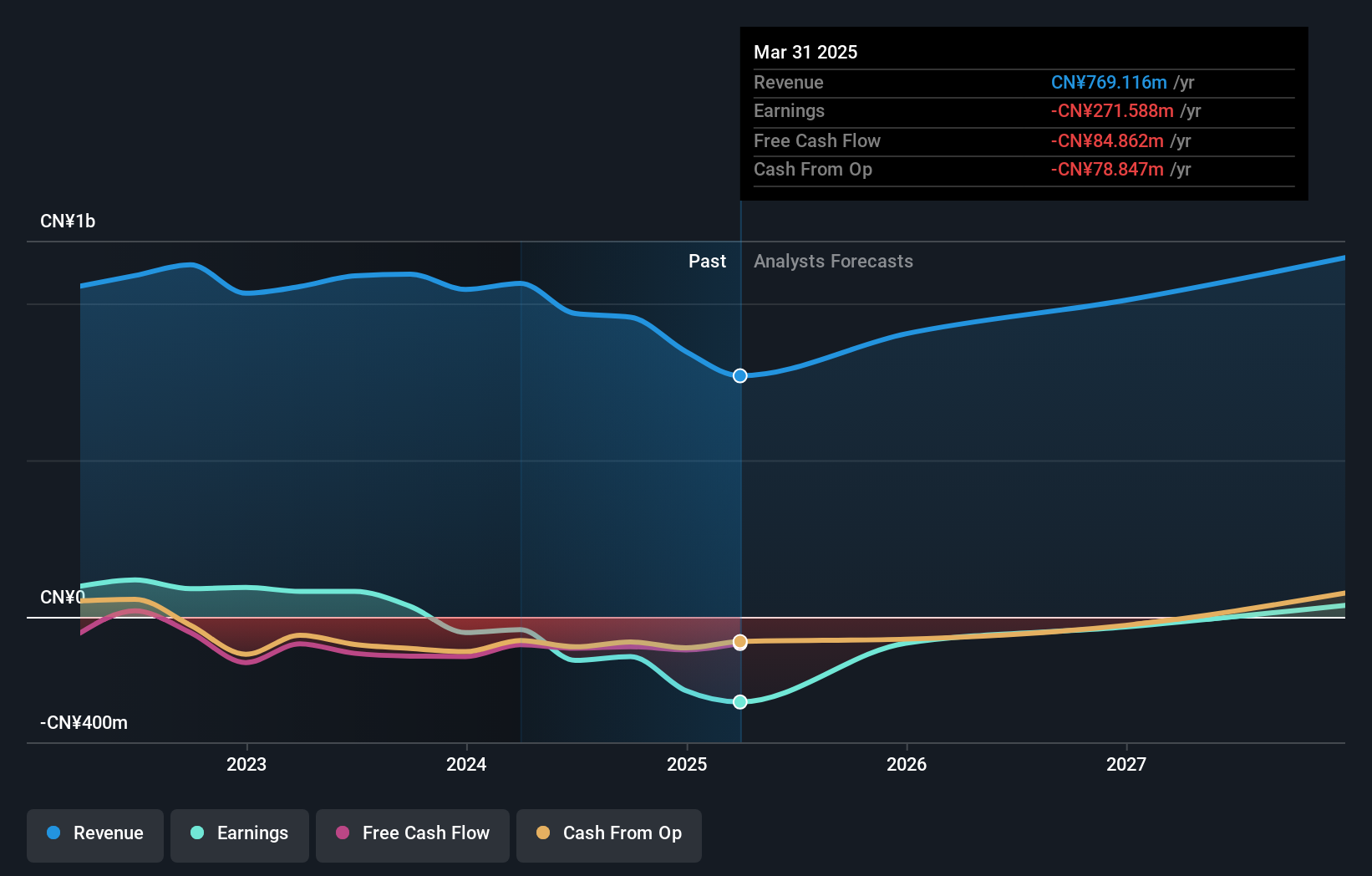

BeiJing Seeyon Internet Software (SHSE:688369)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BeiJing Seeyon Internet Software Corp. operates in the collaborative management software and services sector in China, with a market capitalization of CN¥2.83 billion.

Operations: Seeyon focuses on providing solutions, software products, and services within the collaborative management software industry in China.

BeiJing Seeyon Internet Software, navigating through a challenging fiscal period, reported a significant dip in sales to CNY 554.32 million from the previous year's CNY 616.88 million and doubled its net loss to CNY 219.04 million. Despite these setbacks, the company is poised for a robust recovery with earnings expected to surge by an impressive 111.73% annually. This anticipated turnaround is underpinned by strategic R&D investments aimed at innovation and market expansion, positioning it well above the average market growth forecast of 14.5%. Moreover, its commitment to evolving within the high-demand software sector in Asia suggests promising prospects for future profitability and growth.

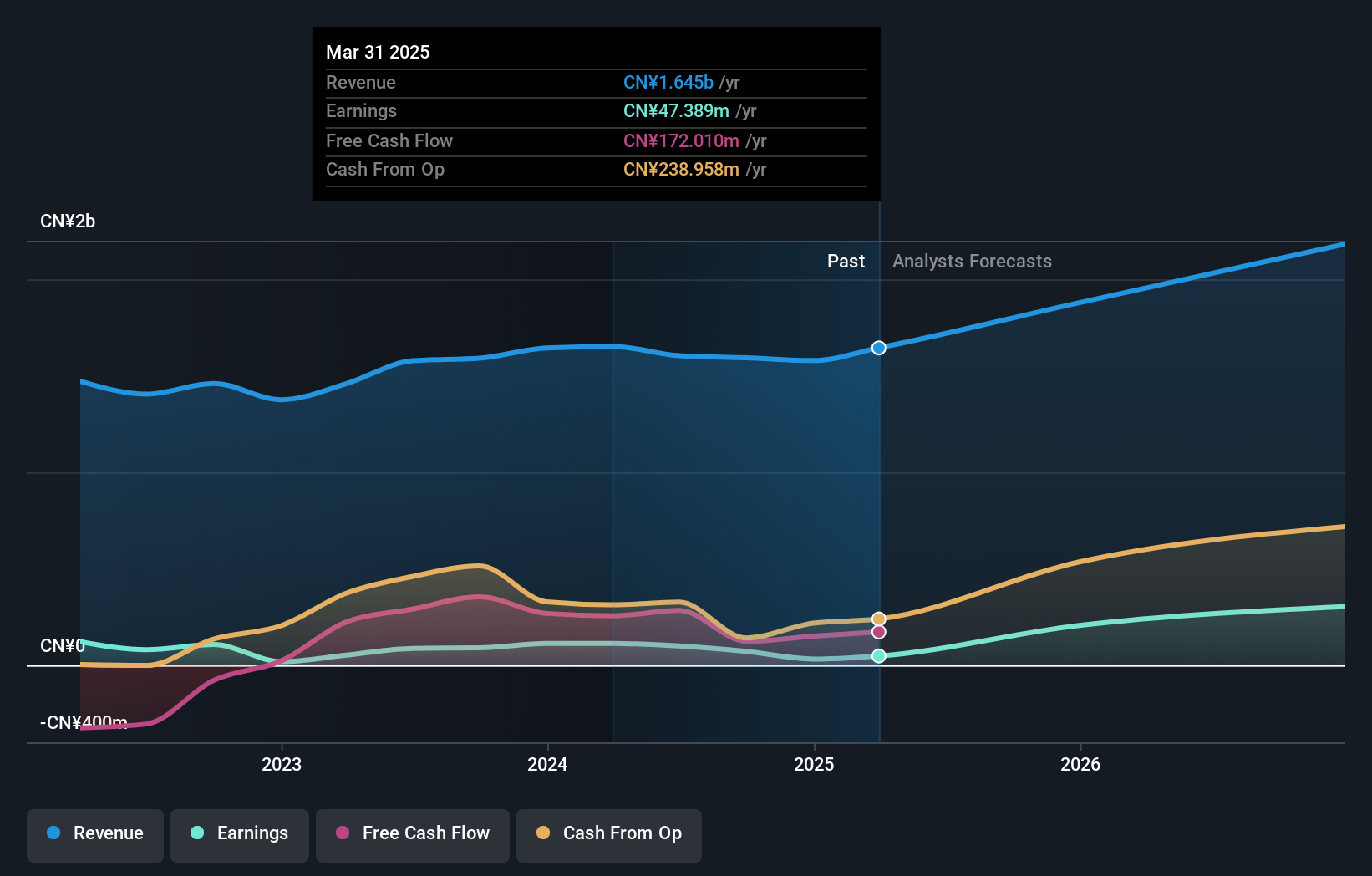

Shenzhen Jieshun Science and Technology IndustryLtd (SZSE:002609)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Jieshun Science and Technology Industry Co., Ltd. specializes in providing intelligent parking management solutions and related services, with a market capitalization of CN¥5.98 billion.

Operations: The company generates revenue primarily through its intelligent parking management solutions and related services. It has a market capitalization of approximately CN¥5.98 billion.

Shenzhen Jieshun Science and Technology Industry Co.,Ltd. has demonstrated robust financial performance, with revenue climbing to CNY 1.15 billion, a significant rise from the previous year's CNY 983.49 million. This growth is complemented by an increase in net income from CNY 43.01 million to CNY 71.59 million within the same period, reflecting an earnings surge of approximately 66%. The company's commitment to innovation is evident in its strategic R&D investments, which are essential for sustaining its competitive edge in the fast-evolving tech landscape of Asia. These financial metrics not only underscore Shenzhen Jieshun’s resilience but also hint at its potential trajectory amidst a dynamic market environment.

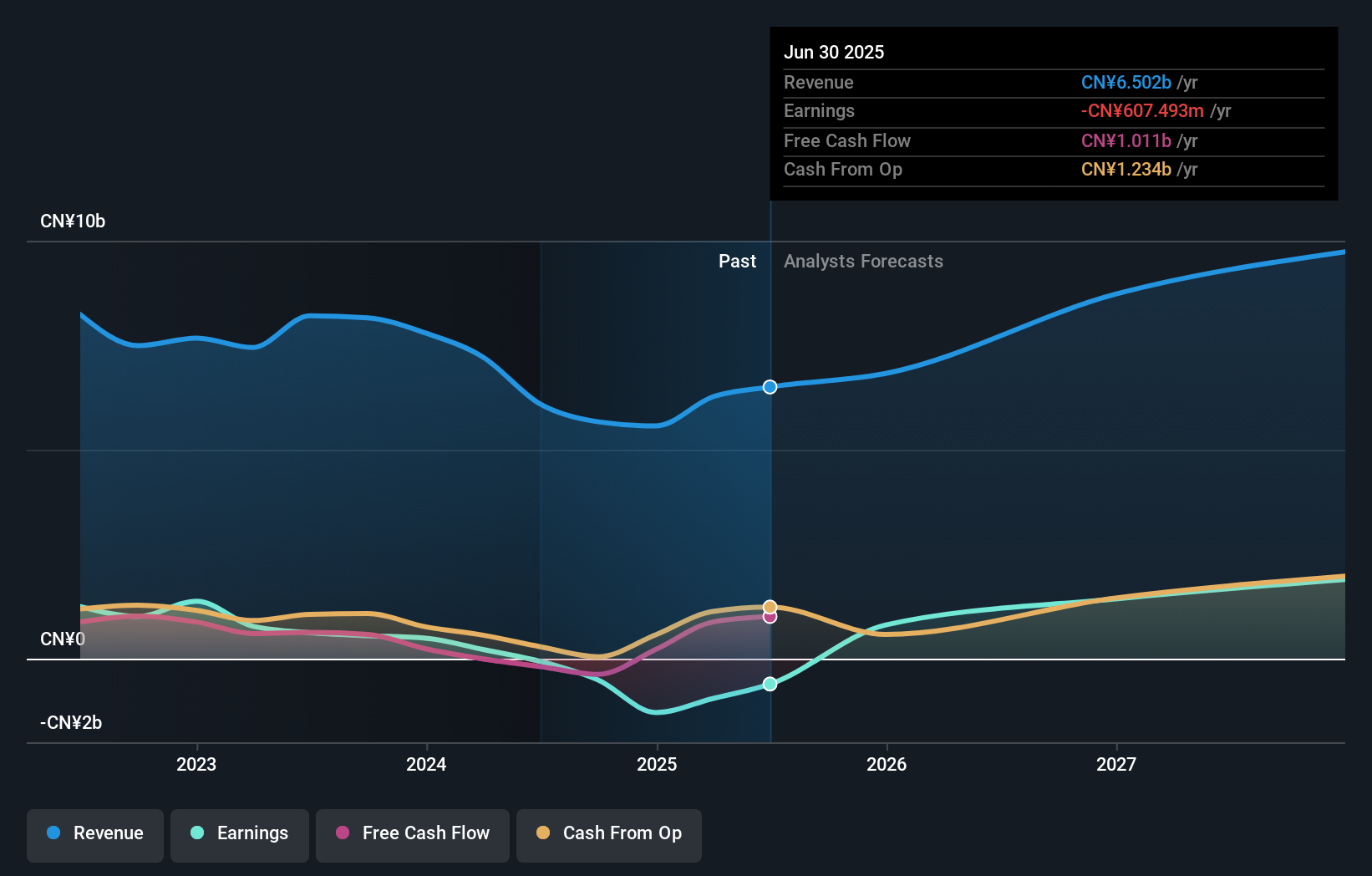

Perfect World (SZSE:002624)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Perfect World Co., Ltd. focuses on the research, development, distribution, and operation of online games both in China and internationally, with a market cap of CN¥32.50 billion.

Operations: The company generates revenue primarily from its online gaming segment, leveraging both domestic and international markets. Its financial performance is influenced by the costs associated with game development and distribution.

Perfect World Co., Ltd. has shown a remarkable turnaround, with its recent earnings report highlighting sales of CNY 5.42 billion, up from CNY 4.07 billion the previous year, and a swing to a net income of CNY 665.53 million from a prior loss. This performance is underpinned by an annualized revenue growth rate of 16.9% and projected earnings growth of 76.6%. The company's strategic focus on R&D is evident, as it aligns with broader industry trends where tech firms are increasingly leveraging advanced technologies to enhance competitive edges and market positions.

Key Takeaways

- Embark on your investment journey to our 187 Asian High Growth Tech and AI Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报